Citigroup Prediction: Bitcoin (BTC) Could Hit $231,000 in 12 Months

Jakarta, Pintu News – Citigroup recently issued a surprising prediction for the future of Bitcoin , with a potential price increase to $231,000 within the next 12 months. This analysis comes as there has been a significant increase in investor interest in the cryptocurrency.

In its latest report, Citigroup also gave a view on Ethereum , but with a more cautious sentiment compared to Bitcoin (BTC).

Citigroup’s Outlook for Bitcoin

As reported by Coingape, Citigroup estimates that in a bullish scenario, the price of Bitcoin (BTC) could reach up to $231,000. Meanwhile, the base and bearish scenarios are predicted to be at $181,000 and $82,000. The report also suggests that Bitcoin (BTC) could reach $132,000 towards the end of the year, which would mark a new record high.

The bank emphasized that growing investor demand will be a key driver of Bitcoin (BTC) price increases. Citigroup also expects wider adoption from institutional investors and financial advisors in incorporating crypto investments into their portfolios, which will support positive flows into Bitcoin (BTC).

Read also: Altcoin ETFs delayed due to US government shutdown, what will be the impact?

Comparison with Ethereum and Altcoin Market

Although Citigroup gave an optimistic prediction for Bitcoin (BTC), the bank has a more conservative view on Ethereum (ETH). In a bullish scenario, Ethereum (ETH) is expected to only reach $7,300 in the next 12 months, with a bearish scenario at $2,000.

Citigroup stated that it is more positive towards Bitcoin (BTC) compared to Ethereum (ETH) because Bitcoin (BTC) is getting a larger portion of new fund flows into the crypto market. Uncertainty surrounding investor demand and user activity on the Ethereum (ETH) network is the main reason for Citigroup’s cautious stance on the altcoin.

Read also: Pi Network (PI) in October 2025: Will it Rise from the Brink?

Funds Inflow and Impact of Employment Report

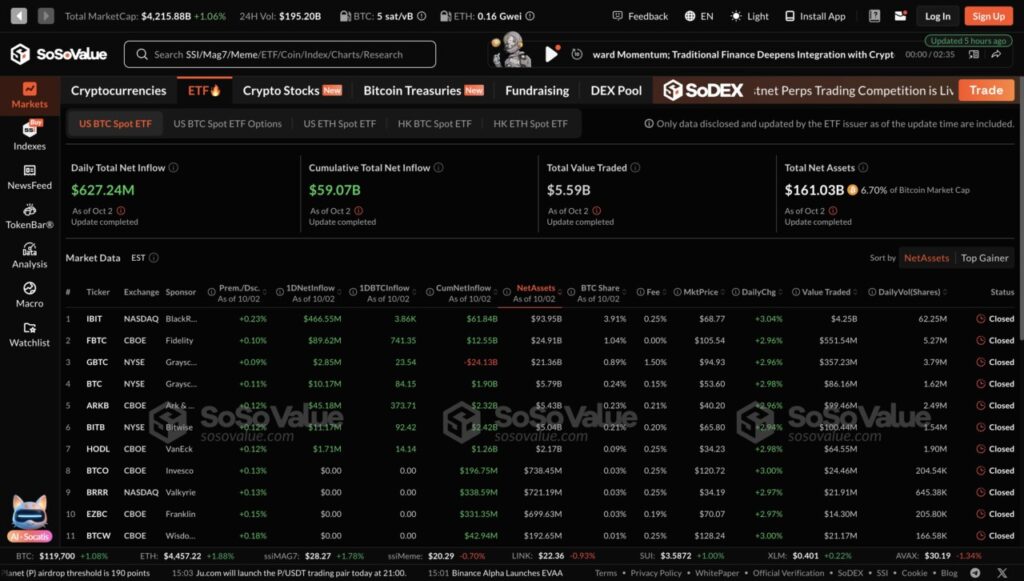

Citigroup’s new Bitcoin (BTC) prediction comes at a time when fund inflows into Bitcoin (BTC) ETFs are on the rise again. Data from SoSoValue shows that these funds have recorded more than $1.6 billion in inflows over the past three days. On October 1, the Bitcoin (BTC) ETF recorded net inflows of $675.81 million, which was the largest amount since September 10.

The rise in Bitcoin (BTC) price that began yesterday, with a rise from around $114,000 to above $119,000, was also supported by the ADP jobs report that showed a weakening labor market. This increased the chances of an interest rate cut by the Federal Reserve, which also contributed to the price rally earlier this month.

Conclusion

With a very bullish prediction from Citigroup and massive fund flows into the Bitcoin (BTC) ETF, the future of Bitcoin (BTC) looks very bright. Investors and market analysts will continue to watch closely for further developments, especially in relation to the Federal Reserve’s interest rate policy and further adoption by institutional investors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Citigroup Predicts Bitcoin Could Climb to $231,000 in 12 Months. Accessed on October 5, 2025

- Featured Image: Generated by AI