Here’s the XRP “Rich List” – Whale Controls 42% of Supply!

Jakarta, Pintu News – The latest data from XRP Avenger and XRPSCAN paint a clear picture: XRP remains one of the most centralized yet transactionally active cryptocurrencies. With Ripple Labs holding a large supply control through escrow, as well as a growing community of investors, XRP shows a mix of institutional control and retail participation.

Concentration of ownership may remain a concern, but XRP’s role in the global financial system makes it a still-relevant asset in the blockchain utility era.

Latest Data: Average XRP Wallet Contains 12,350 Tokens

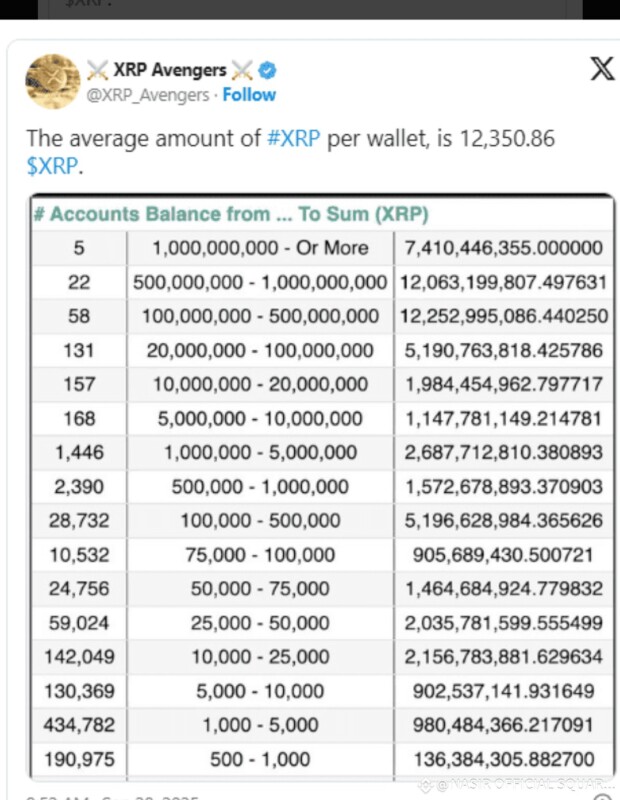

A data update from analyst account @XRP_Avengers (September 28, 2025) shows that the average amount of XRP per wallet now stands at 12,350.86 XRP, worth approximately $34,700 at $2.81 per XRP.

According to the data shared, the distribution of XRP assets is still very unequal, with a handful of whale wallets holding the bulk of the supply. Here’s the breakdown:

- The top 5 wallets control 7.4 billion XRP.

- 22 wallets hold between 500 million-1 billion XRP.

- 58 wallets controlling 100-500 million XRP.

- On the other hand, over 1.3 million wallets hold only ≤20 XRP, and around 2.3 million wallets hold 20-500 XRP only.

This concentration of ownership makes XRP one of the assets with the most centralized distribution among major cryptocurrencies, although the volume of on-chain transactions remains high.

Also Read: Shiba Inu Price Prediction: Will October Be a Month Full of Surprises?

Ripple Labs & Chris Larsen Dominate XRP Supply

According to XRPSCAN and CoinLore data, the largest holdings of XRP are still controlled by key entities within the Ripple ecosystem:

- Ripple Labs – the largest holder, controls around 42% of the total XRP supply, both directly and through escrow.

- Chris Larsen, co-founder of Ripple, is recorded as owning over 2.5 billion XRP, making him the individual with the world’s largest private holding of XRP.

In addition, some major exchanges such as Upbit and Binance also rank high on the list of major holders, as they manage XRP on behalf of millions of retail users.

Distribution & Escrow: XRP Supply Control Mechanism

Ripple Labs uses most of its holdings to support operations and market liquidity. However, to prevent supply spikes from depressing prices, the company is implementing a smart contract-based escrow system.

Every month, Ripple releases 1 billion XRP from escrow, but more than 60% is usually locked back after the current period. This system ensures the supply of XRP in the market remains under control and helps keep prices stable amid global crypto volatility.

According to Ripple’s Q3 2025 financial report, this escrow mechanism is also instrumental in supporting international partnerships forcross-border payments systems.

How to view the XRP “Rich List”

For investors who want to monitor the distribution of XRP assets in real-time, there are several reliable public data sources:

- XRPSCAN.com – Features a list of the 10,000 largest XRP addresses, complete with balances and transaction activity.

- CoinLore.com – Provides a list of top XRP wallets including addresses belonging to Ripple Labs, Upbit, and other major exchanges.

- XRP Rich List Tracker – A community platform featuring daily updates on the global distribution of XRP.

Through these sites, investors can monitor whale movements, which are often used as potential indicators for market direction predictions.

Whale Domination and Retail Investor Trends

The concentration of assets in the hands of whales remains a major issue in the XRP ecosystem. While the average wallet has 12,350 XRP, the reality is that more than 95% of wallets contain under 500 tokens.

Analysts from Nasir Official Square noted that the 1,000 XRP threshold is now considered the “serious investor level”, well below the overall average. Despite the uneven distribution, the increase in the number of new wallets and transaction volume shows the steady growth of the retail community.

Is XRP Still Worth a Look?

According to Binance data (October 7, 2025), the price of XRP is around $2.98 (IDR 49,476) with a positive trend of +0.14% in the last 24 hours.

With Ripple’s high dominance yet transparent escrow system, many analysts think XRP has strong fundamentals for institutional use, especially in the areas of remittances, CBDC interoperability, and cross-border payments.

However, investors are advised to remain cautious of the concentration of whale ownership and the ecosystem’s dependence on Ripple Labs’ policies.

Also Read: Dogecoin October 2025 Breakout Potential: Analyst Ali Martinez Points to Accumulation Phase!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- XRP Avengers. Average Amount of XRP per Wallet. Accessed on October 7, 2025.