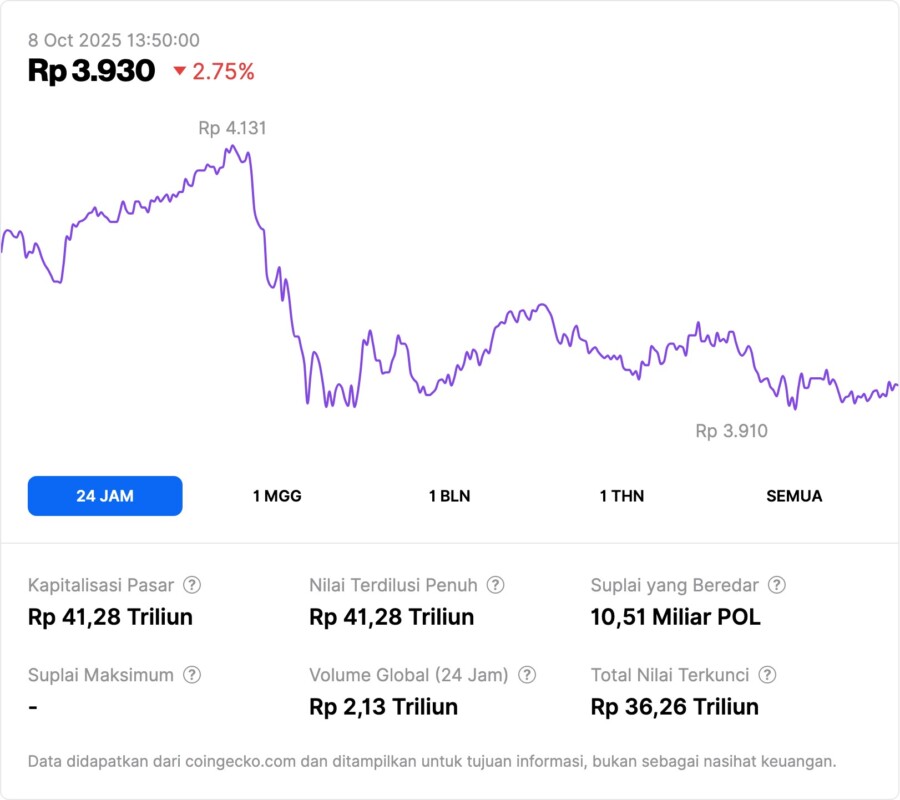

5 Polygon Reforms: End POL Inflation, POL Prices Potentially Rise in October 202?

Jakarta, Pintu News – Polygon is once again a hot topic among investors and the global crypto community. A bold proposal from an activist investor is pushing for the total removal of 2% annual inflation on POL tokens, as well as initiating a buyback and token burn program to stabilize the market value. This move is a major effort to restore confidence and value in POL, which has dropped 46% in the past year.

According to a report from Cryptopolitan, the proposal received widespread attention from investors, project leaders, and Polygon users.

1. 2% Inflation Makes POL Bought or Left Behind?

Polygon investors consider that the annual inflation of 2% is one of the causes of the constant selling pressure on POL tokens. According to Venturefounder, the proposer of the proposal, this inflation generates around 200 million new POL tokens every year, thus increasing the number of sellers and reducing buying pressure.

He believes that the current token system does not reflect the performance of Polygon ‘s technologically evolving project. Despite the solidification of the infrastructure and ecosystem, the token price continues to plummet, drawing the attention of the crypto community for immediate reform.

Also Read: 5 Ways to Check Crypto Wallet: Monitor Assets & On-Chain Activity in Real-Time

2. Token Burn & Buyback Proposal Make POL More Scarce?

The reform proposal includes a grand plan: phasing out inflation (0.5% per quarter to zero), accompanied by using 20% of Polygon’s quarterly revenue to buy back POL from the market and burn those tokens to reduce the total amount in circulation.

This strategy is similar to the deflationary method applied to resilient altcoins such as Binance Coin , which has successfully raised the value of tokens through the burn mechanism. With reduced supply, the price of POL has the potential to jump significantly if demand stabilizes or increases.

3. Community urges real action, not tech promises

While Polygon continues to develop technologies like AggLayer and other Layer-2 solutions, the community is disappointed that the rollout has been slow. Some investors have cited this as one of the reasons why the POL token has not gained much traction in the market.

In the forum discussion, Venturefounder stated that it was time for Polygon to “catch up” on price performance to match its technological capabilities. He also urged the development of a transparent on-chain dashboard that displays the number of tokens in circulation in real-time.

4. Validator Challenge & Polygon Team Response

Although many investors welcomed this proposal, some validators rejected the removal of inflation. This is because they receive incentives from newly minted tokens. Without inflation, they are worried that node operations will become unprofitable.

As a solution, the community proposed that validator rewards be taken from revenue or transaction fees, rather than from the minting of new tokens. Polygon Labs CEO, Marc Boiron, and co-founder Brendan Farmer, have acknowledged this proposal and are looking into it seriously.

5. Market Impact: POL Can Enter Crypto’s Top 10 Again?

With pressure from competitors such as Arbitrum, Optimism, and Base that are trending due to fast and cheap transactions, Polygon needs to make strategic moves to return to being a Layer-2 leader. This reform proposal has the potential to bring POL back to the top crypto list by market cap.

According to market analysts, if this plan is approved and executed properly, POL could ease selling pressure and attract whale interest back into the token. In the medium term, this could serve as an example of reform for other projects facing similar token inflation issues.

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Nellius Irene / Cryptopolitan. Investors rally behind Polygon revamp to kill POL inflation. Accessed on October 8, 2025