Crypto Market Crashes on Weekend, Liquidating Over $20 Billion!

Jakarta, Pintu News – The cryptocurrency market is in turmoil again after a massive sell-off rocked the prices of Bitcoin , Ethereum and hundreds of other altcoins last Friday. In a single day, more than $20 billion (Rp331 trillion) of leveraged positions were liquidated across multiple exchanges, making it one of the most dramatic crashes since the FTX era.

The main cause? President Donald Trump’s tweet about 100% tariffs on Chinese imports that triggered a sudden panic across the global crypto market.

Massive Sell-Off: Mass Liquidation Hits Crypto Market

According to CoinGlass data, Friday’s (October 10) sell-off triggered the liquidation of more than $20 billion worth of positions on centralized exchanges, while the DeFi sector took a hit with hundreds of millions of dollars worth of positions forced to auto-close. Bitcoin (BTC) fell sharply to below $110,000 (Rp1.82 billion), while Ethereum (ETH) weakened to around $4,169 (Rp69 million), and Solana fell to $196.56 (Rp3.25 million).

The turmoil began just two hours before the US stock market closed on Friday afternoon local time, when Trump announced the new tariffs via the Truth Social platform. The impact was swift – liquidity in the crypto market thinned dramatically as traders scrambled to close positions. Trading volumes on exchanges dropped sharply over the weekend, magnifying the selling pressure into Saturday morning Asian time.

Analysts believe that the lack of market activity over the weekend made matters worse as there were not enough buy orders to absorb the selling pressure. This led prices on some crypto exchanges to experience extreme movements similar to a flash crash.

Read also: Crypto market recovery, why did the market rise today (10/13/25)?

Data Shows Bitcoin Liquidation Zones at Critical Levels

According to Ray Salmond, Head of Markets at Cointelegraph, liquidation heatmap data from Hyblock Capital shows that long-term leveraged positions are heavily accumulated in the $120,000-$113,000 zone (Rp1.99-Rp1.87 billion). When the price breaks the lower limit of this zone, a series of automatic liquidations occur and accelerate the Bitcoin price crash.

“If we look at the liquidation map, the area between $120,000 and $113,000 is the ‘liquidity pocket’ where long positions are opened. When the price drops below that, the system automatically starts closing those positions one by one,” Salmond explained in an interview with Schwab Network.

Salmond added, statistically the Bitcoin price has now moved two standard deviations below the average price (mean) in the range of $120,000. “This means that Bitcoin is now trading at a considerable discount, and there are quite a few buy orders in the $110,000-$115,000 area (Rp1.82-Rp1.91 billion),” he said.

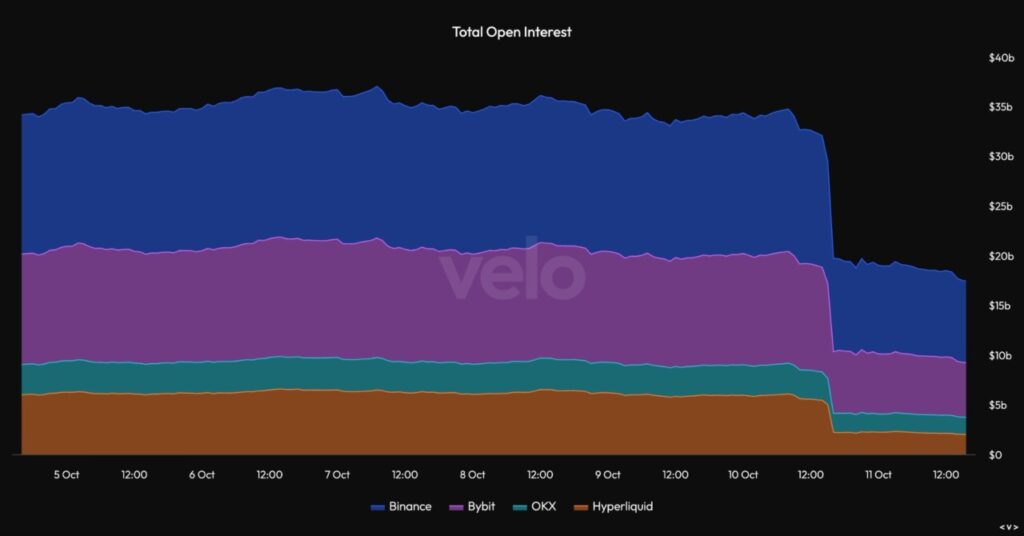

However, open interest (OI) data – the total active contracts in the futures market – showed a sharp decline of almost 45% across all major crypto exchanges. This shows that traders’ interest in opening new positions is still very low, signaling that the market is not ready for a short-term recovery.

Also read: Peter Brandt is now optimistic about BTC, ETH, XRP, and XLM? Here’s why!

Trump triggers global turmoil, CME futures to determine next direction

President Trump’s tweet on China’s tariff policy released at a vulnerable time was the main trigger for the sudden sell-off. As it was done towards the end of the trading session, market participants did not have time to respond strategically. As a result, many leveraged positions were trapped and eventually hit margin calls simultaneously.

Analysts predict that crypto market weakness is likely to continue until the opening of the CME futures market and the US stock market on Sunday evening (US time). The initial reaction from traditional markets will provide an important signal as to whether institutional players are ready to buy again or will wait for additional pressure.

Meanwhile, popular macro analyst account EndGame Macro thinks that the macroeconomic backdrop – including US inflation concerns and geopolitical tensions – exacerbated the effect of Trump’s tweet. He called the market conditions before the crash already “fragile,” so just a little trigger was enough to bring down the entire crypto price structure.

Conclusion

This massive sell-off shows how sensitive the crypto market is to external factors such as political policies and global liquidity. With more than IDR331 trillion vanished in a day, investors are now waiting for recovery signals from the futures market and Bitcoin’s next move. One thing’s for sure – volatility remains a key feature of the cryptocurrency world, and next week will be a big test of market confidence.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin, altcoin market sell-off continues: What was the cause and when will it end?. Accessed October 13, 2025.

- Featured Image: Generated by Ai