Bitcoin rises 46% after Trump goes soft on China – here are 3 impacts on the crypto market

Jakarta, Pintu News – Bitcoin price has risen sharply by 46% from its lowest point after US President Donald Trump softened his statement on China. This statement sparked renewed optimism in global financial markets, including crypto.

Here are three key impacts of Trump’s statement on Bitcoin price and the crypto market as a whole.

1. Bitcoin Price Rebounds from $109,000 to $115,000 in 48 Hours

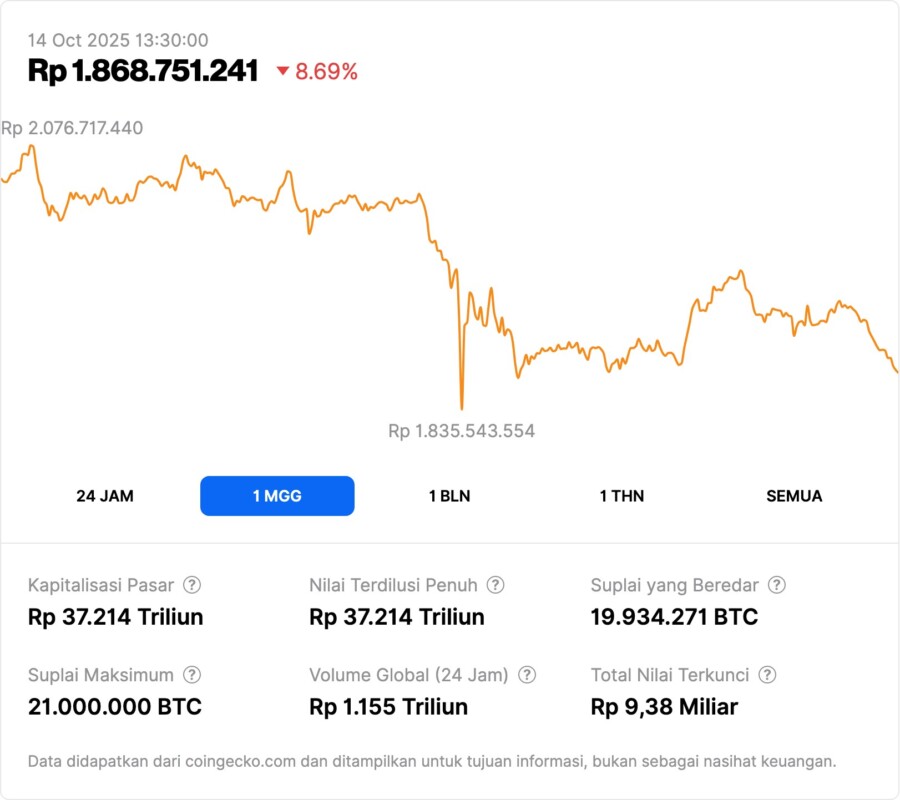

According to a report from Bitcoin.com, the price of Bitcoin had dropped to $109,000 (Rp1,804,277,000) on Friday due to market concerns over the trade war. However, after Trump made a peaceful statement regarding China, the price of BTC jumped back to $115,000 (Rp1,902,595,000) on Monday afternoon.

Trump wrote, “Don’t worry about China, it will all be fine!” on his media account. This positive sentiment was enough to erase almost half of Bitcoin’s losses over the weekend, showing how sensitive markets are to global political statements.

Also Read: Memecoin Market Adds $10 Billion Post-Crisis: What’s Next for Traders?

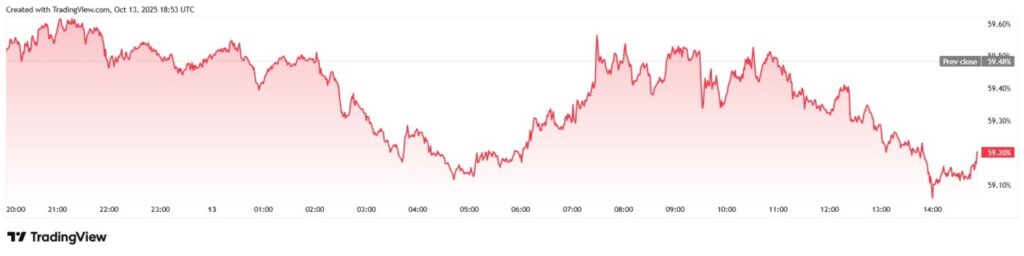

2. Bitcoin’s dominance falls as altcoins begin to be monitored

Despite the price increase, Bitcoin’s dominance in the market actually fell 0.54% to 59.20%, according to TradingView data. This means that investors are starting to monitor other resilient altcoins that may be snapped up as BTC stabilizes.

Altcoins like Ethereum , Solana , and Ripple are also starting to show signs of recovery. In previous cycles, BTC’s decline in dominance often triggered altseason-a phase where many altcoins surged higher than Bitcoin.

3. Trading Volume and Liquidation Decline, Stable Market?

Bitcoin trading volume fell 7.95% to $82.13 billion (Rp1,359 trillion) in the last 24 hours. Usually, the volume increases on Mondays, but this time it fell, indicating that investors are cautious.

Liquidations also showed a decline. Data from Coinglass recorded total liquidations of just $78.94 million (Rp1.3 trillion) on Monday. Of that figure, $45 million came from short positions, signaling many bearish traders were “swept away” during the sudden price rise.

Conclusion: Global Politics Still a Major Factor in Crypto Prices

Bitcoin’s 46% price increase in just two days shows that the crypto market is still highly responsive to geopolitical news, especially from the US and China. Although the market is starting to stabilize, market participants should still monitor important metrics such as BTC dominance, volume, and volatility.

Investors also need to be wary of follow-up statements from Trump or President Xi Jinping that could again abruptly change the direction of the market.

Also Read: BTC & ETH Rise After the “Biggest One-Day Wipeout in Crypto History”: Here’s Why!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Frederick Munawa / Bitcoin.com. Bitcoin Claws Back 46% of Losses After Trump Softens Stance on China. Accessed on October 14, 2025