Ethereum Holds Steady at $4,000 Today — Is a Breakout Coming for ETH?

Jakarta, Pintu News – Citing a report by CoinSpeaker, the price of Ethereum is expected to experience a major surge, along with a sharp decline in the supply available in the market and increased accumulation by financial institutions.

Then, how is Ethereum’s current price movement?

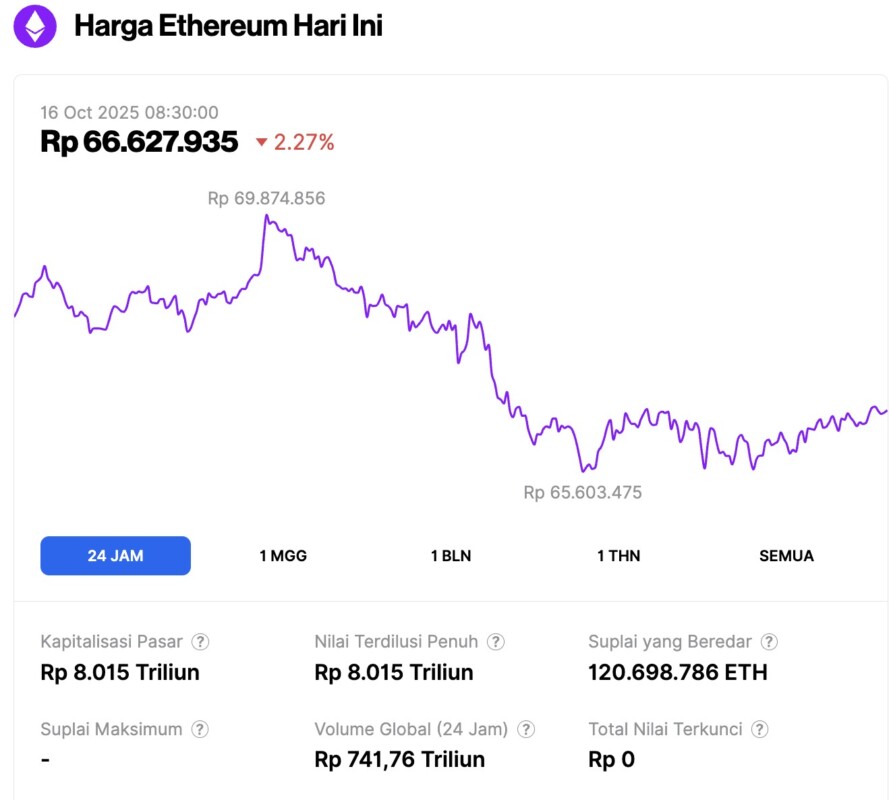

Ethereum Price Drops 2.27% in 24 Hours

On October 16, 2025, Ethereum was trading at approximately $4,001, or around IDR 66,627,935 — marking a 2.27% drop over the past 24 hours. During this period, ETH hit a low of IDR 65,603,475 and a high of IDR 69,874,856.

At the time of writing, Ethereum’s market capitalization is around IDR 8,015 trillion, while its 24-hour trading volume has declined by 27%, falling to IDR 741.76 trillion.

Read also: Bitcoin Drops to $110,000 Today — Could It Fall to $50,000? Peter Brandt Thinks So

ETH Poised for a Big Spike Amid Declining Supply & Institutional Accumulation

According to a crypto analyst named “Crypto Gucci,” Ethereum has never experienced a market cycle with so much of a “supply vacuum” happening simultaneously as it is right now.

Some digital assettreasuries ( DATs) such as Bitmine and Bit Digital have amassed nearly 5.9 million ETH, worth around $24 billion. This amounts to about 4.9% of the total circulating ETH supply.

At the same time, spot Ethereum ETFs in the United States have absorbed $28 billion worth of ETH since their launch in July last year. Experts predict these inflows could be even greater if staking activities get regulatory approval.

Ethereum staking activity has also reached a record high. Currently, around 35.7 million ETH or nearly 30% of the total supply is locked in staking contracts, with most of it unable to be cashed out due to withdrawal queues that take up to 40 days.

“When demand meets shrinking supply like this, prices don’t just rise – they can explode,” the analyst wrote.

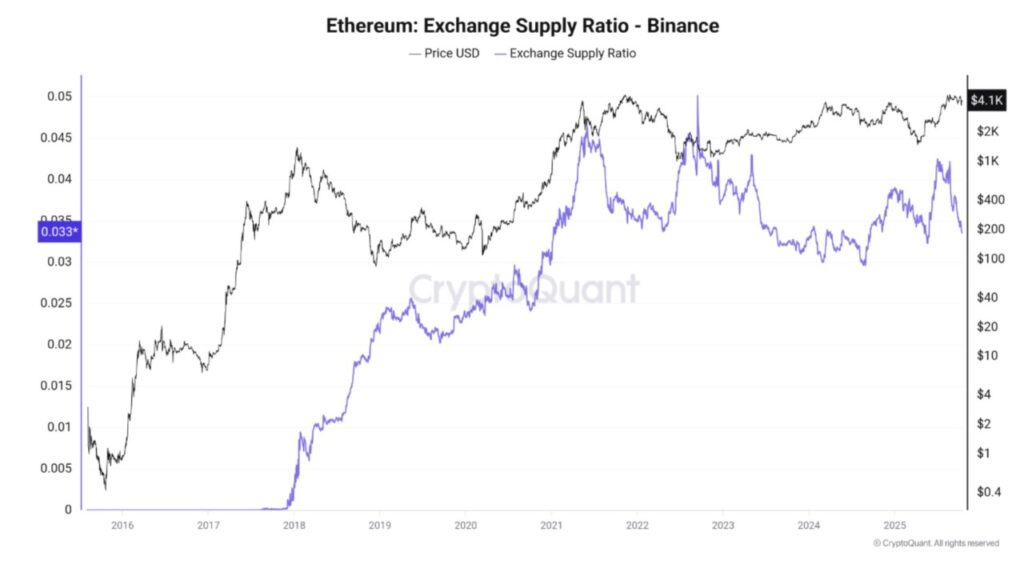

ETH Balances on Exchanges Shrink to Lowest Level in Months

The latest data from CryptoQuant shows that the Ethereum supply ratio on Binance has dropped sharply to 0.33 – the lowest level since May last year.

This drop indicates that many investors are moving their ETH to self-custody, which usually signals long-term confidence and decreasing selling pressure.

Read also: XRP in Freefall: Is the $2 Level the Final Line of Defense?

As of October 15, Ethereum’s price was hovering around $4,150, after dropping to $3,900, with ETH trading volume jumping 13%, reaching $63 billion.

Crypto Ceaser analysts note that ETH is currently trading at a strong support zone of around $4,000, which could be an interesting buying opportunity for traders looking for a crypto asset with the potential for the next big surge.

He also added that “the real moment will begin” once Ethereum convincingly breaks the weekly resistance level of $4,874.

Meanwhile, BitMine Chairman Tom Lee reiterated his year-end price target for ETH at $10,000. This optimism is also supported by historical data from CoinGlass, which shows that the fourth quarter since 2016 has averaged a 21.36% return for Ether.

If this trend repeats, ETH could approach the $5,000 mark by the end of this year.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Ethereum Could Surge to New Highs as Supply Hits Multi-Month Low. Accessed on October 16, 2025