Trump Speech: Is the Crypto Market Plummeting Due to Tariffs?

Jakarta, Pintu News – The crypto market took a dive today and hasn’t managed to recover after an announcement from the President of the United States, Donald Trump, which turned out to be unrelated to tariffs as previously feared by market participants.

Several other factors also contributed to this downward trend, including increased selling pressure from whales.

Why crypto markets are falling despite Trump not announcing new tariffs

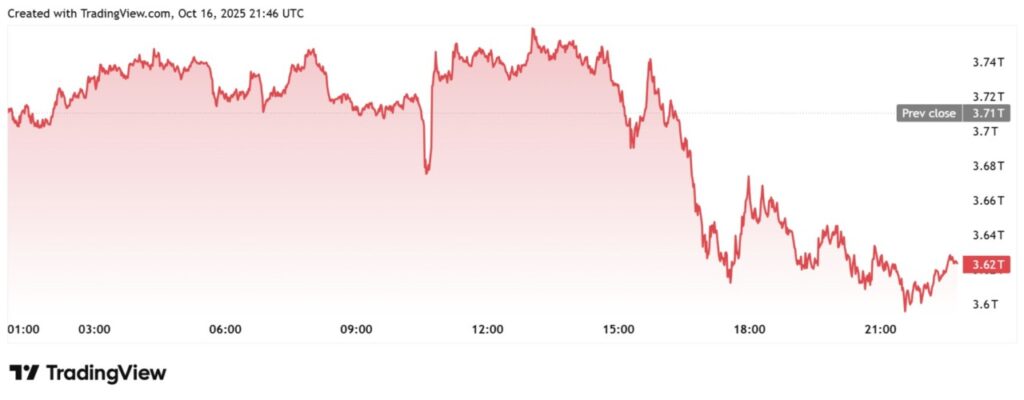

Data from TradingView shows that the crypto market is still on the decline today, despite President Donald Trump not mentioning tariffs in his latest announcement – an issue that was previously a source of concern and negative sentiment in the market.

Read also: Trump Tariffs: China Ready to Cooperate, Trade Tensions Trigger Crypto Market Crash!

Currently, the crypto market is down almost 3%, with the total market capitalization shrinking to $3.6 trillion.

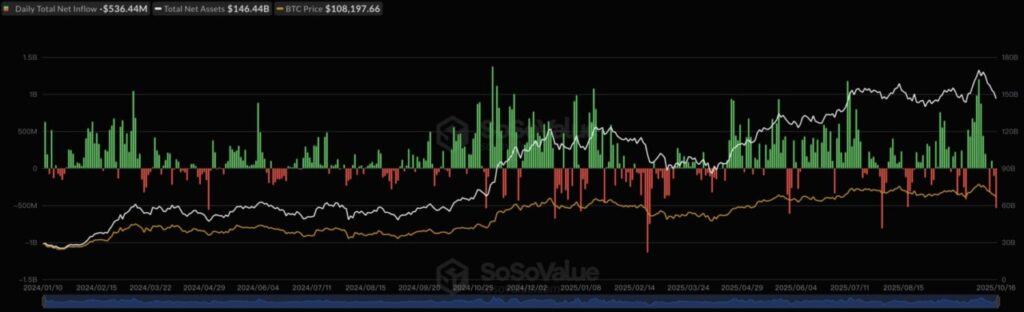

Additionally, on October 16, spot Bitcoin ETFs in the United States recorded net outflows of $536 million, according to data from SoSoValue. More strikingly, none of the twelve BTC ETFs recorded net inflows.

This suggests caution from investors amid heightened market volatility. The spot Ethereum ETF also saw a combined net outflow of $56.88 million on the same day.

Previously, CoinGape reported about a ‘Trump Insider Whale’-a big player in the market-who opened a $127 million Bitcoin short position just before Trump’s announcement. This action sparked fear among crypto market participants, and the price of BTC fell from a daily high of around $111,000.

Interestingly, the same whale is also known to have opened a Bitcoin short position worth up to $735 million before Trump announced 100% tariffs on China last week. Therefore, today’s short action has again led to speculation that Trump will announce new tariffs or at least make a statement regarding tariffs.

However, even though Trump did not mention tariffs in his announcement, the crypto market remained weak, led by Bitcoin which has shown a downward trend since hitting a new record high of $126,000 earlier this month. This bearish price action is believed to be caused by a number of other factors beyond the tariff issue.

Massive Selling Pressure from the Whales

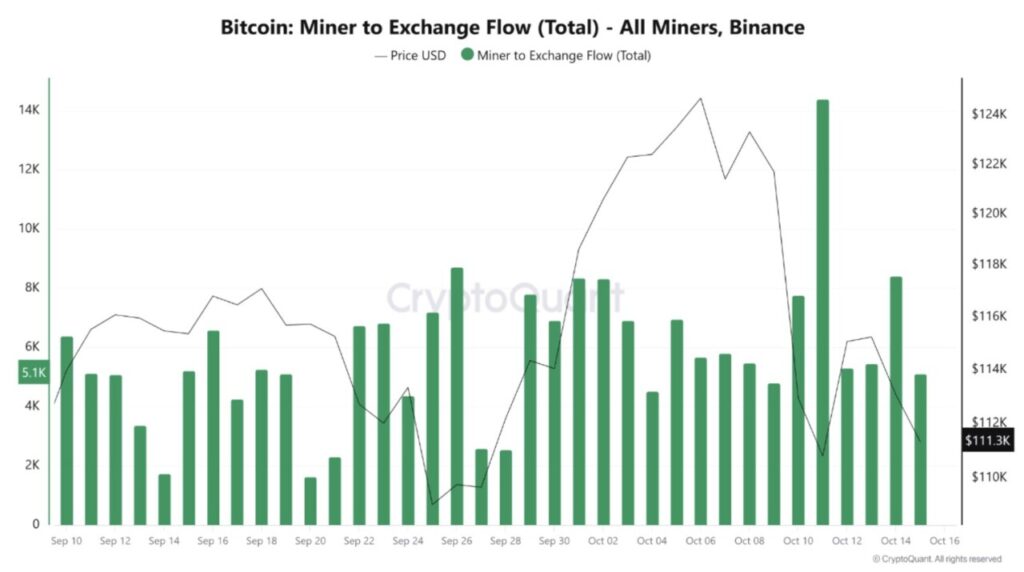

Analysis from CryptoQuant revealed that Bitcoin miners have deposited around 51,000 BTC into exchanges since October 9, indicating that they have most likely started selling their assets.

Inflows from these miners increased sharply on October 11, reaching 14,000 BTC-the highest figure since last July, when the Bitcoin price dropped to $110,000.

CryptoQuant noted that the deposit of 51,000 BTC in the last seven days indicates a significant change in behavior from miners, from holding to selling. This change is considered a bearish signal, not only for Bitcoin, but also for the crypto market as a whole.

Miners have historically been one of the largest holders of Bitcoin. Therefore, a large-scale sell-off from this group could put huge selling pressure on the price of BTC. However, it’s not just miners who are selling.

Read also: Analysts Predict XRP Price to Fall to $2: Open Interest Down, Death Cross Nearing

As reported by the CoinGape page, the old whales or Bitcoin OG also sell whenever BTC reaches a new high. They sold again after Bitcoin touched the price of $126,000.

One such whale is the ‘Trump Insider Whale’, also known as Bitcoin OG. This whale is known to have contributed to the downward trend of the crypto market. On-chain analytics platform Arkham revealed that the whale has deposited $222 million worth of BTC into Coinbase today, indicating a possible large sell-off.

Gold Starts to Steal Attention from Bitcoin

So far, Wall Street analysts have argued that investors are investing in gold and Bitcoin as part of a “debasement trade” strategy – a hedge against falling fiat currency values.

However, crypto watcher Plur states that this strategy may now only apply to gold, especially when looking at BTC’s price movements amid the current downward trend of the crypto market.

Plur said that “gold has stolen some of Bitcoin’s spotlight” this year, and considered that Bitcoin as the main momentum asset failed to show a strong performance. He even said BTC “choked” when performing on the big stage, or failed to meet market expectations.

Read also: Whale Crypto Siphons $30 Million Worth of XAUt Digital Gold Amid New Record Highs!

According to Plur, this is due to a sell-off from Bitcoin OGs, where BTC holdings are still highly concentrated in a handful of parties. He also highlighted market concerns over Bitcoin’s 4-year cycle, which indicates that the crypto market may be at its peak.

Nevertheless, Plur believes that most of these whales have already sold their BTC, and the remaining selling pressure will gradually subside until the end of this year.

On the other hand, Plur notes that there is strong evidence that Bitcoin price tends to follow gold price movements with a time lag of 60 to 90 days. With gold prices setting new records almost every day, this could be a signal that BTC will soon enter an uptrend.

Plur also predicts that the crypto market will remain choppy until there is more clarity regarding the trade conflict between the US and China. However, he remains optimistic that the “real show” is still to come, signaling that the bull market cycle is not really over.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Why Is Crypto Market Down Despite Trump’s Non-Tariff Announcement. Accessed on October 17, 2025