Solana (SOL) Investment Can Double Profits? Here’s SOL Price Analysis (10/20/25)

Jakarta, Pintu News – While Bitcoin is often in the center of institutional attention as the primary digital asset, recent research shows that moderate exposure to Solana can significantly improve portfolio efficiency. The analysis reveals that adding even a small amount of Solana can have a profound impact on investment returns.

How Solana Allocation Generates High Profits

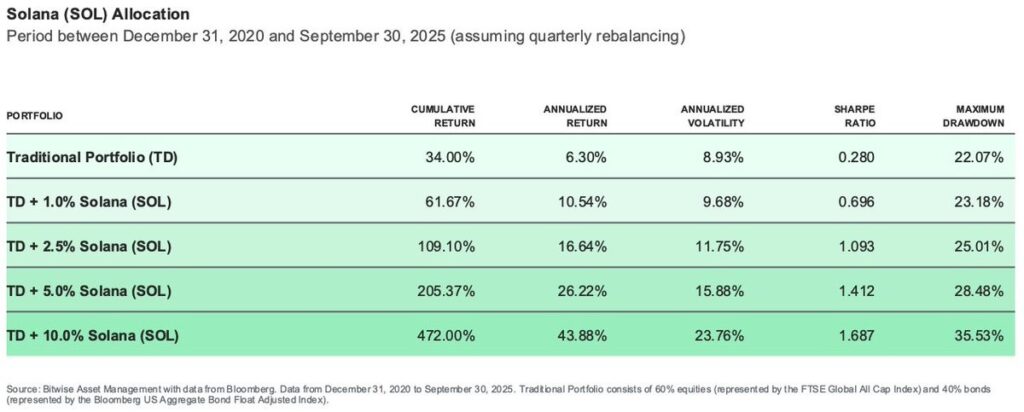

Research shows that by adding just 1% exposure to Solana (SOL), annualized returns can increase to 10.54% with a Sharpe ratio of 0.696. When the allocation was increased to 2.5%, returns jumped to 16.64% with the Sharpe ratio reaching 1.093.

Furthermore, a 5% allocation to Solana (SOL) managed to generate a return of 26.22% with a Sharpe ratio of 1.412. According to Capital Markets, a riskier allocation of 10% to Solana (SOL) could boost the portfolio’s annualized return to 43.88% with a Sharpe ratio of 1.687. These results suggest that measured exposure to Solana (SOL) can strengthen long-term portfolio performance, although diversification alters the results.

Also Read: 5 Reasons Why Avalanche (AVAX) Price Exploded in Q4 & is in the Crypto Whale Spotlight!

Impact of Diversification on Crypto Allocation

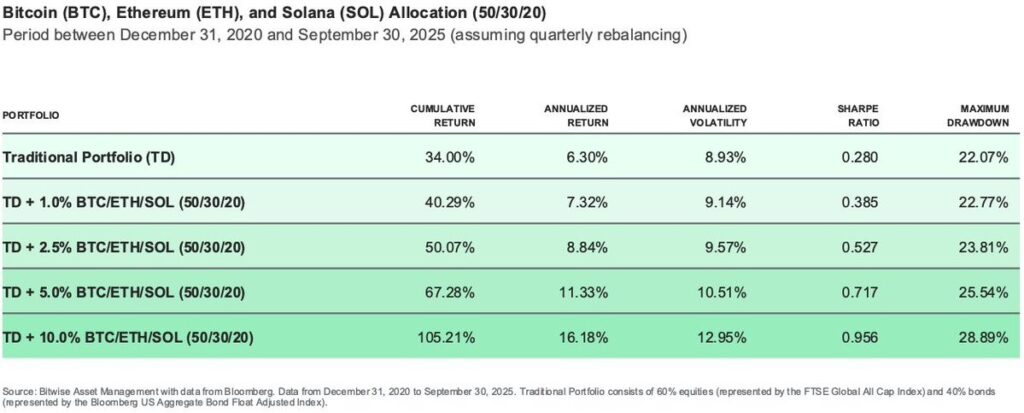

When the 10% crypto allocation is split equally between Bitcoin (BTC), Ethereum , and Solana (SOL), the annualized return drops to 19.87%. This is significantly lower compared to Solana’s (SOL) solo performance. Meanwhile, a 50:30:20 allocation split between Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) yielded a return of 16.18%.

Smaller allocations of 5% and 2.5% towards crypto resulted in a steady but moderate increase with returns of 11.33% and 8.84% respectively. Capital Markets emphasized that despite the sharp increase in returns, the maximum decline remained manageable across all allocations.

Solana’s On-Chain Fundamentals and Future Prospects

Solana (SOL) is known for its low transaction fees and high throughput, processing approximately 96 million daily transactions in the first quarter of 2025. The network has recorded significant institutional adoption and user growth across a wide range of applications from payments to gaming and consumer applications.

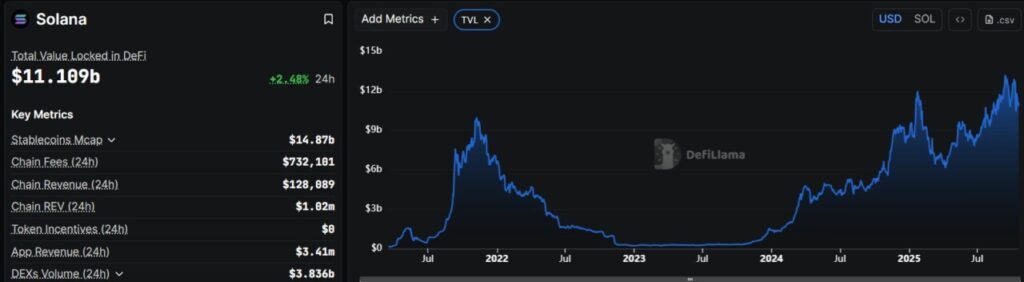

With over $11 billion in locked value, Solana (SOL) is the second largest decentralized finance ecosystem. Its efficiency and scalability position it as a credible next-generation blockchain for decentralized applications. Speculation regarding a potential Solana (SOL) ETF in the US also raises discussion about the role of crypto in modern portfolio theory.

Conclusion

Taking all factors into consideration, Solana (SOL) offers an attractive investment opportunity with high potential returns. While diversification can offer more consistent growth, a focused exposure to Solana (SOL) shows higher returns, making it an attractive option for investors seeking efficiency and returns in their portfolio.

Also Read: ChatGPT Prediction: XRP, DOGE & PEPE could hit an all-time high by the end of 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Solana Investment Profits Report. Accessed on October 20, 2025