Dogecoin Drops 3% Today, but MVRV Z-Score Signals Room for Growth

Jakarta, Pintu News – The price of Dogecoin has almost doubled since plummeting two weeks ago when the crypto market was in turmoil. Based on one of the key technical indicators, the top meme coin is expected to continue rising in the coming weeks.

So, how is the Dogecoin price moving today?

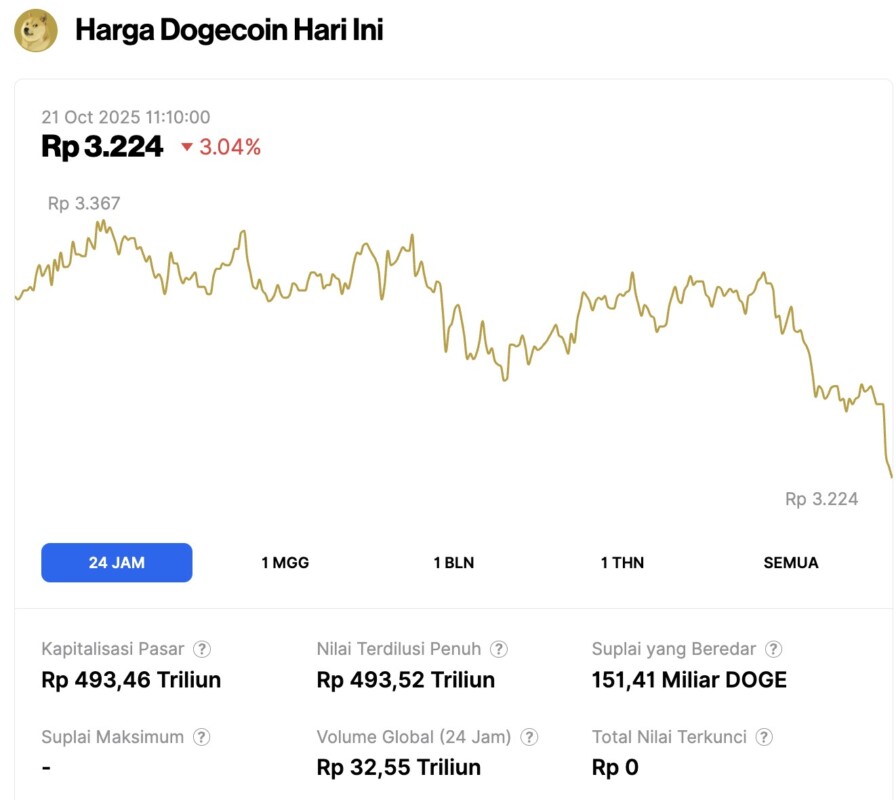

Dogecoin Price Drops 3.04% in 24 Hours

On October 21, 2025, the price of Dogecoin recorded a decrease of 3.04% in 24 hours, trading at $0.1944, equivalent to Rp3,224. In the last 24-hour period, the DOGE price moved in the range of Rp3,367 to Rp3,224.

As of writing, Dogecoin’s market cap stands at around IDR 493.46 trillion, with a trading volume of around IDR 32.55 trillion in a 24-hour period.

Read also: Dogecoin Price Prediction: Elon Musk’s New Marketplace Likely to Push DOGE to $1?

DOGE Tests Support with 100-400% Rally History

After a sharp recovery, Dogecoin managed to break back through the medium-term uptrend line as a support level – a technical structure that, since October 2023, has historically preceded price rallies of 100 to 400%.

This trendline, formed from DOGE’s 2023 low around $0.055, has been the backbone of every major uptrend in the past two years.

As of October 20, DOGE is trading at around $0.20, comfortably above its 200-week exponential moving average (200-week EMA; blue line) at $0.156, and is testing its 20-week EMA (green line) and 50-week EMA (red line) as short-term resistance levels.

If the price of DOGE is able to hold and close above both EMAs, it could open up opportunities for a further rise towards $0.25 – which coincides with the 0.382 Fibonacci retracement level of the 2021-2022 downtrend.

If the positive momentum continues, DOGE could potentially target a price of $0.31 (0.5 Fibonacci line) in November-December, and even reach $0.37 in January 2026 – which is the intersection of the 0.618 Fibonacci retracement and the upper limit of its ascending channel.

Capital Rotation Could Drive DOGE’s Rise

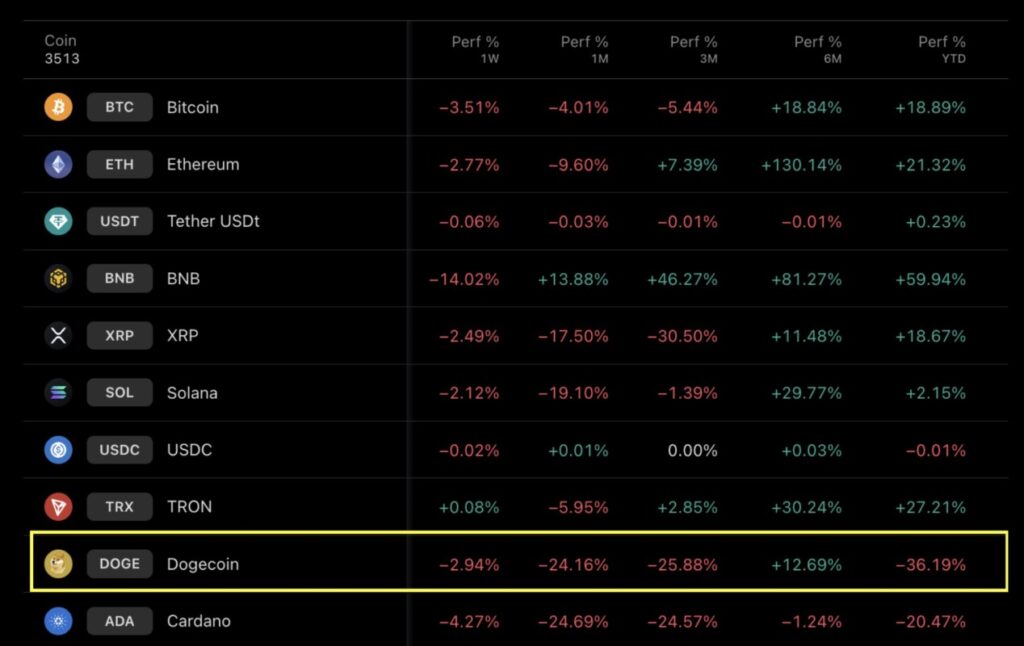

Despite its recent recovery, Dogecoin is still among the underperforming cryptocurrencies so far in 2025. DOGE is still down more than 35% year-to-date, while Bitcoin has recorded a 70% gain and Ethereum is up 45%.

This lagging performance makes DOGE a potential candidate for capital flow from the capital rotation process – a phenomenon where traders shift profits from large, overheated assets to lagging assets that have high volatility appeal.

The DOGE/BTC pair also supports this bullish sentiment, with prices continuing to move within a long-termdescending triangle pattern, while bouncing off horizontal support levels around 0.0000017 BTC.

Read also: Ethereum Price Drops 2% Today — Are Investors Buying the Dip?

A short-term recovery towards the upper trendline of the triangle at around 0.0000022 BTC – or about 35% higher – seems likely come December.

Dogecoin’s MVRV Z-Score Hints at Further Upside Potential

The MVRV Z-Score chart for Dogecoin shows that the asset is still undervalued when compared to its historical cycle, reinforcing the possibility of a further rally.

Historically, big DOGE rallies – such as in early 2021 – often occur when the MVRV Z-Score spikes from neutral or negative levels (below the green area on the chart).

As of mid-October, DOGE’s Z-Score value stood at around 0.2, slightly below the previous overheating threshold. This suggests that most market participants have not recorded excessive unrealized gains – a condition common in the early phase of a bull market.

This pattern indicates that there is still room for improvement before entering anoverbought condition.

If market sentiment and liquidity improve, DOGE could potentially retest resistance levels in the $0.25-$0.30 range in the next few months – in line with Fibonacci targets and possible capital flows from large-cap crypto assets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Empire. Dogecoin Price Forecast: Key On-Chain and Technical Signals Point to $0.30 Target. Accessed on October 21, 2025