Bitcoin Drops to $108,000 Today — Is the Decline Set to Continue?

Jakarta, Pintu News – The price of Bitcoin is undergoing a market correction. On Tuesday, its value dropped to $107,000 after breaking the $111,000 mark the previous day.

On-chain data analysts now consider the current price range as a crucial point. This point will determine whether the asset will continue its uptrend or experience a moderate correction in the medium term.

Then, how will the Bitcoin price move today?

Bitcoin Price Drops 1.02% in 24 Hours

On October 22, 2025, Bitcoin was priced at $108,557, equivalent to IDR 1,807,197,943, reflecting a 1.02% decline over the past 24 hours. During this period, BTC hit a low of IDR 1,792,908,660 and reached a high of IDR 1,894,046,920.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 35,824 trillion, while its 24-hour trading volume has surged by 73% to IDR 1,797 trillion.

Read also: Data Shows Bitcoin Short Squeeze, Backed by “Bullish” US CPI Speculation

Critical Point for Bullish Momentum

On-chain data analytics platform Glassnode highlighted this situation by sharing its Cost Basis Distribution Quantile Model chart on X.

The model analyzes the distribution of Bitcoin investors’ acquisition costs to assess the likelihood ofprofit-taking at current price levels. Unlike traditional technical analysis, this tool uses live data from the blockchain to identify accumulation patterns, providing a more accurate picture of institutional support and resistance zones.

The chart displays several quantile lines, one of which is the 0.95 line (Red). This line represents the average price paid by the top 5% of Bitcoin holders – those with the highest cost basis.

When the price of Bitcoin moves above the 0.95 line, it indicates an overheated market and entry into a high-risk zone, where the likelihood of selling to realize profits increases.

Read also: Solana Co-Founder Launches New Perpetual DEX to Rival Aster and Hyperliquid

Conversely, when the price drops below the 0.95 line, the market goes into a trend transition phase or equilibrium state. This is what happened to Bitcoin after the flash crash that occurred on October 10.

Pivot Point: Quantile 0.85

Bitcoin price is currently near the 0.85 quantile boundary, which is considered a key support area. If the price breaks this line on a sustained basis, it is usually interpreted as an increased risk of a medium-term correction.

Glassnode issued a warning:

“If buyers are able to hold this zone, momentum could be re-established from here. But if it loses this level again, the market is likely to drop further. This is a crucial area to watch.”

Derivatives Traders Brace for Continued Decline

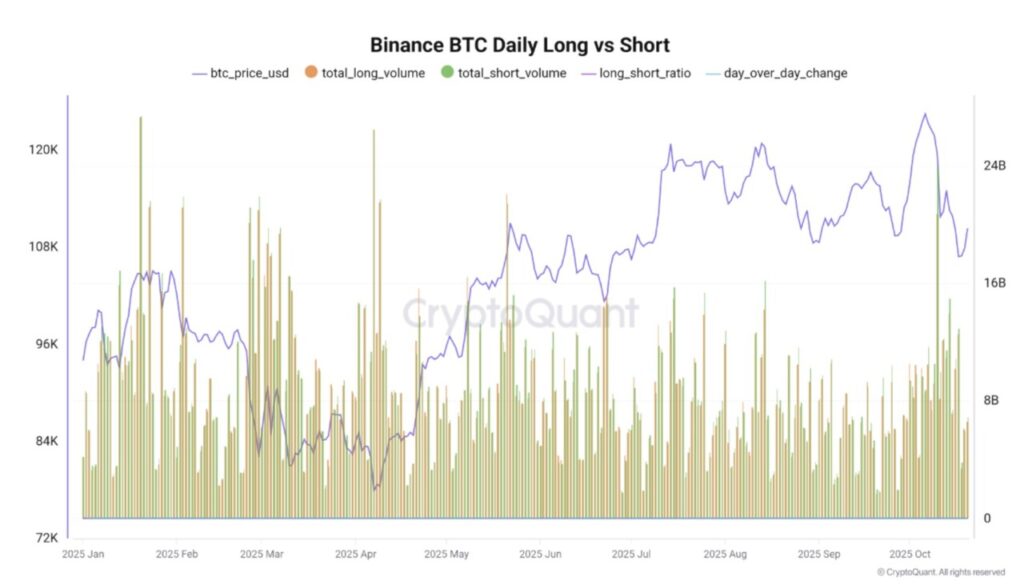

Investor sentiment on Binance – the largest crypto derivatives platform by volume – also suggests expectations of further price adjustments.

Arab Chain, an analyst at CryptoQuant, noted:

“During October, there was an increase in Bitcoin futures trading volume on Binance, with sellers dominating almost every day until yesterday.”

Bitcoin futures positioning on Binance is currently slightly skewed to the sell side, shifting from an almost 50:50 balance. The long/short ratio currently stands at 0.955, and the daily change (DOC) of -0.063 indicates a slowdown in positive momentum.

Arab Chain concludes:

“Overall, the current data reflects a fragile balance between buyers and sellers, with a slight edge on the side of selling pressure. If this trend continues, it could pave the way for further corrections – unless the market shows signs of renewed buying or stronger institutional support in the next few days.”

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Hits Key Support; Analysts Warn of Deeper Correction. Accessed on October 22, 2025