These 7 Altcoins Benefited from Ethereum’s Ecosystem Upgrade This October!

Jakarta, Pintu News – Ethereum has again caught the attention of the global crypto community with major upgrades rolling out in October 2025. Updates like EIP-4844 (proto-danksharding) and Layer 2 performance improvements promise lower transaction fees and much better scalability.

The impact of this upgrade not only strengthens Ethereum itself, but also spreads to various crypto projects that are part of the Ethereum ecosystem.

Why is this important? Because many of the most popular altcoins are built on Ethereum or depend on its infrastructure. When Ethereum’s core network is improved, Ethereum ecosystem altcoins are also boosted, both technically and in terms of market sentiment.

7 Altcoins that Benefit from the Ethereum Ecosystem Upgrade

1. Chainlink (LINK)

Chainlink is a decentralized oracle network that provides real-world data for smart contracts. Cheaper gas fees post Ethereum upgrade make Chainlink operations more efficient, especially in providing real-time data to various DeFi applications and institutions.

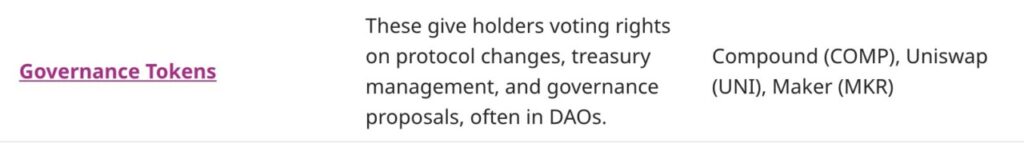

2. Uniswap (UNI)

As the largest DEX on Ethereum, Uniswap relies heavily on the performance of the Ethereum network. With increased transaction capacity and Layer 2 efficiency, users can now trade at lower fees and higher speeds – which can increase trading volume on the platform.

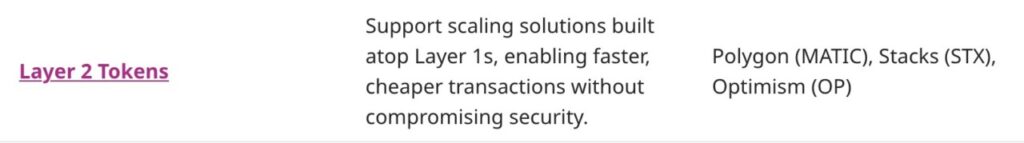

3. Polygon (POL)

Polygon, as a Layer 2 solution for Ethereum, gets a direct boost from this upgrade. EIP-4844 strengthens the rollup performance used by Polygon, reinforcing its position as the premier scalability solution for dApp developers.

4. Arbitrum (ARB)

Arbitrum is one of the most active Layer 2 rollups today. With Ethereum’s upgrade focus supporting Layer 2 efficiency, Arbitrum will see a decrease in on-chain data posting fees, making transactions cheaper and faster.

5. Optimism (OP)

Like Arbitrum, Optimism is also a Layer 2 direct beneficiary. Improved transaction efficiency will strengthen the OP-based dApp ecosystem, driving user adoption and new projects.

6. Aave (AAVE)

Aave, as the largest lending protocol on Ethereum, has greatly benefited from reduced fees and increased throughput. Users can now borrow assets with lower operational costs, which can lead to increased liquidity.

7. Balancer (BAL)

As an Ethereum-based DEX and automated portfolio manager, Balancer will directly benefit from increased throughput and lower fees, especially in complex smart pools and yield farming strategies.

Impact of Upgrade on Investors and Traders

This upgrade opens up new opportunities for investors and traders:

- Day traders can capitalize on the increased volume and volatility of positively driven altcoins.

- Long-term investors have stronger fundamental reasons to maintain or add to positions on Ethereum-related altcoins.

- DeFi and NFT projects that previously struggled with high costs are now more accessible, expanding market potential.

But as always, be mindful of the risks – too rapid a price surge can trigger a correction, and the effects of an upgrade are not always immediately apparent.

Conclusion

Ethereum’s ecosystem upgrade this month was a positive trigger that brought technical and sentiment benefits to many altcoins on its network. The seven projects that benefited the most – Chainlink , Uniswap , Polygon , Arbitrum (ARB), Optimism (OP), Aave , and Balancer – all showed short- and medium-term growth potential worthy of attention.

For investors and traders, this is a strategic moment to re-evaluate altcoins that are closely tied to Ethereum. With increased efficiency, institutional adoption, and an ever-evolving ecosystem, the future of Ethereum-based altcoins looks brighter than ever.

Also Read: John Bollinger’s Legendary Prediction: Ethereum & Solana Set to Surge in Late 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CryptoNews. Best Altcoins to Invest in October 2025. Accessed on October 22, 2025