Ethereum Holds Steady at $3,800 Today as Holders Begin to Sell — What Comes Next?

Jakarta, Pintu News – Ethereum is still facing resistance at the $4,000 level after several failed recovery attempts. Despite generally stable market conditions, the second-largest cryptocurrency is still struggling to turn the psychologically important level into a support level.

Selling pressure from long-term holders (LTH) has been one of the main obstacles, limiting Ethereum’s ability to regain upward momentum. So, how will Ethereum price move today?

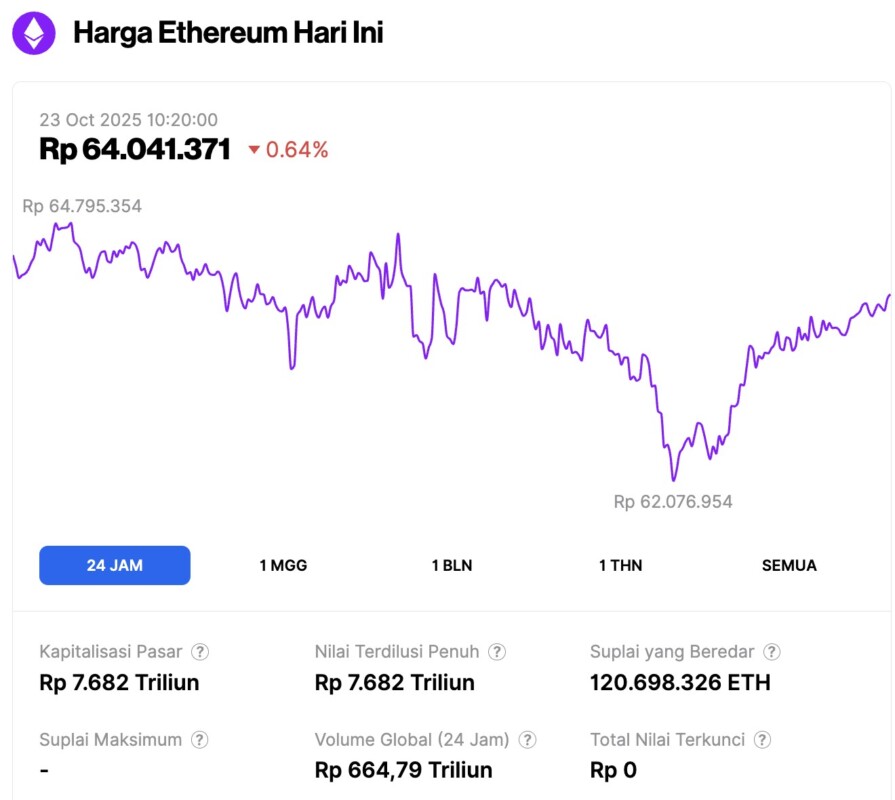

Ethereum Price Drops 0.64% in 24 Hours

As of October 23, 2025, Ethereum was trading at approximately $3,835, or around IDR 64,041,371, marking a 0.64% decline over the past 24 hours. During that time, ETH dipped to a low of IDR 62,076,954 and peaked at IDR 64,795,354.

At the time of writing, Ethereum’s market capitalization sits at roughly IDR 7,682 trillion, while its daily trading volume has dropped by 15% over the past day to IDR 664.79 trillion.

Read also: Bitcoin Stalls at $108,000 Today — Is BTC Gearing Up for a Breakout?

Ethereum Holders Start Selling

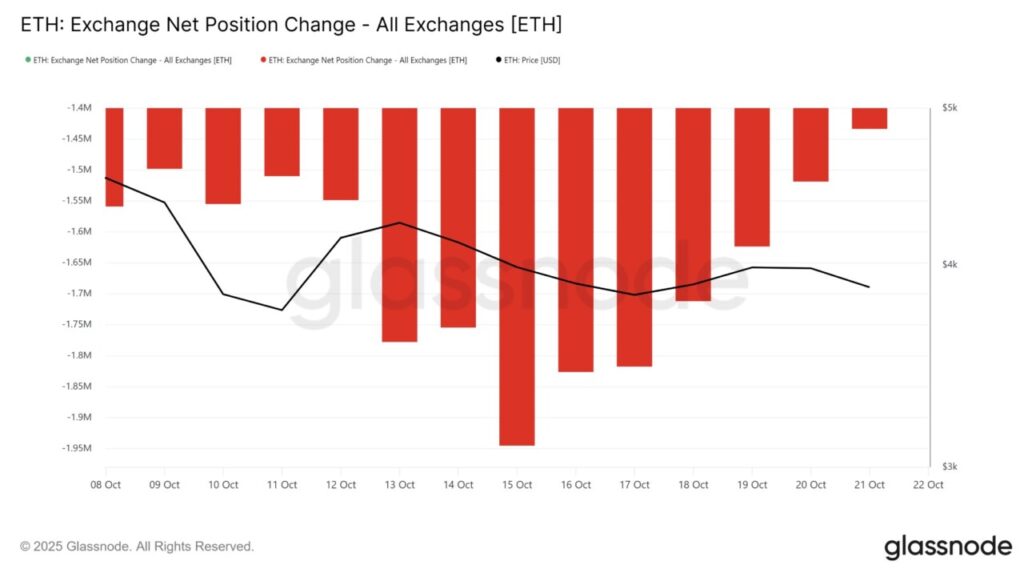

Exchange net position data shows a significant change in trader behavior over the past 10 days. Ethereum outflows from exchanges – which usually signal accumulation – have sharply decreased.

This slowdown indicates that investors are starting to hold back on buying, reflecting uncertainty over Ethereum’s performance in the short term as the market digests the latest price fluctuations.

As outflows fall, inflows show an increase, meaning more ETH is being sent to exchanges for possible sale. This shift is often the first sign of increased selling pressure (bearish), as traders look to secure profits or minimize losses.

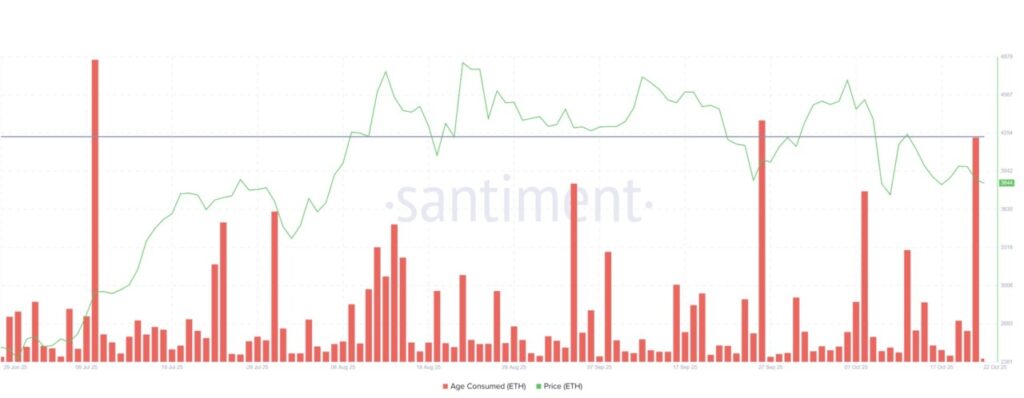

Ethereum’s on-chain data also points to weakening macro momentum. The Age Consumed indicator – which reflects the movement of old coins that were previously inactive – recorded a large spike in the last 24 hours.

The increase was the third largest in more than three months, suggesting that previously passive long-term holders are starting to sell their assets.

Such an increase in Age Consumed usually signals a wave of profit-taking or loss prevention. When long-term holders begin to re-circulate their assets, it reflects growing impatience with stagnant prices.

Read also: Can BNB Overthrow Ethereum? 3 Key Signals Heating Up the Debate

ETH Price Fails to Break Through Resistance Level

As of October 22, 2025, Ethereum price is trading at $3,846, dropping below the $3,872 support area. For almost a week, the “altcoin king” has remained stuck below the psychological $4,000 level, reflecting the weakening momentum and narrowing volatility in the crypto market in general.

With the ongoing selling pressure and weak inflows, Ethereum price has the potential to fall further towards the support zone at $3,742.

If this level is unable to withstand the pressure, a deeper correction could occur, pushing ETH down to $3,489. Such a drop would further strengthen the ongoing bearish sentiment.

However, if ETH holders start to refrain from selling and demand strengthens again, the ETH price has a chance to recover and break above $4,000. If it is able to convincingly overcome this resistance, the price could rise towards $4,221 – a new signal of optimism that could derail the current bearish scenario.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Struggles to Reclaim $4,000 Amid Long-Term Holder Pressure. October 23, 2025