Will Altcoins Experience a Recovery in November 2025? Check out the Review!

Jakarta, Pintu News – The crypto market is currently showing some indications that altcoins may be experiencing a recovery after a period of decline. With Bitcoin breaking $110,000 again, the situation is giving altcoin investors new hope.

Current View of the Crypto Market

The stabilization of altcoin prices above unfavorable levels for buyers is one of the important indicators. This coincided with the recovery of Bitcoin (BTC) price, which managed to return above $110,000. This suggests potential market forces that may not be fully utilized.

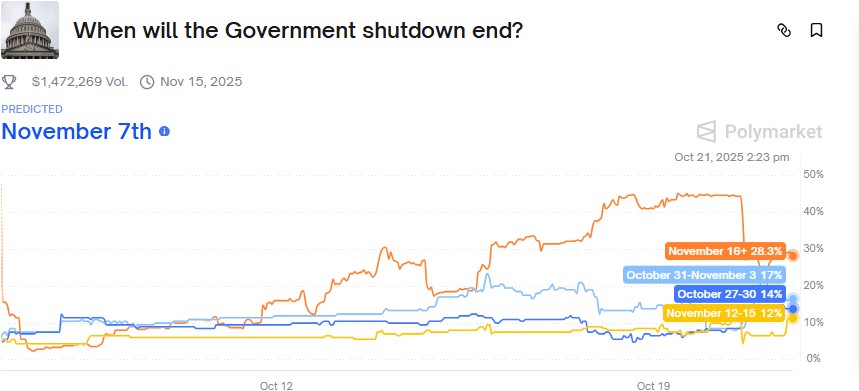

The US government shutdown that seems to be coming to an end is also giving positive signals. The end of the shutdown is expected to reduce uncertainty in the market, which could further support the recovery of altcoin and Bitcoin (BTC) prices.

Read More: Bitcoin (BTC) Price Prediction: Influenced by the Fed’s Interest Rate Decision on October 29, 2025

Altcoin Buy/Sell Ratio Analysis

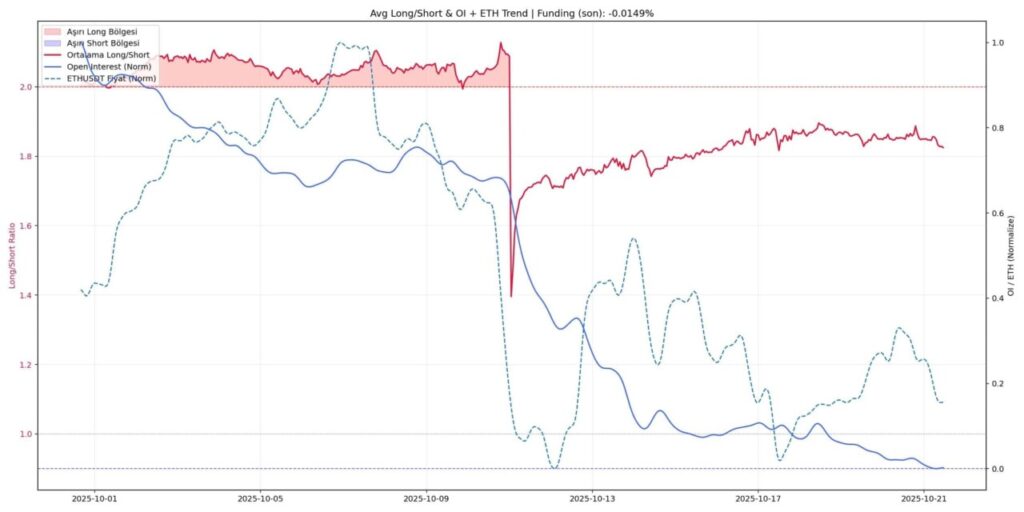

The Long/Short ratio for altcoins showed a decline, reflecting a decrease in buying activity. This ratio briefly reached 1.4 during the sudden market crash, down from a high score above 2. This signals that the market may have bottomed out and is ready for a rebound.

Despite this, the altcoin is still holding above the weak buyer zone around 1.8. This suggests that bulls (aggressive buyers) are starting to enter the market, which could be the start of a recovery in altcoin prices.

Altcoin Season Index Shows Decline

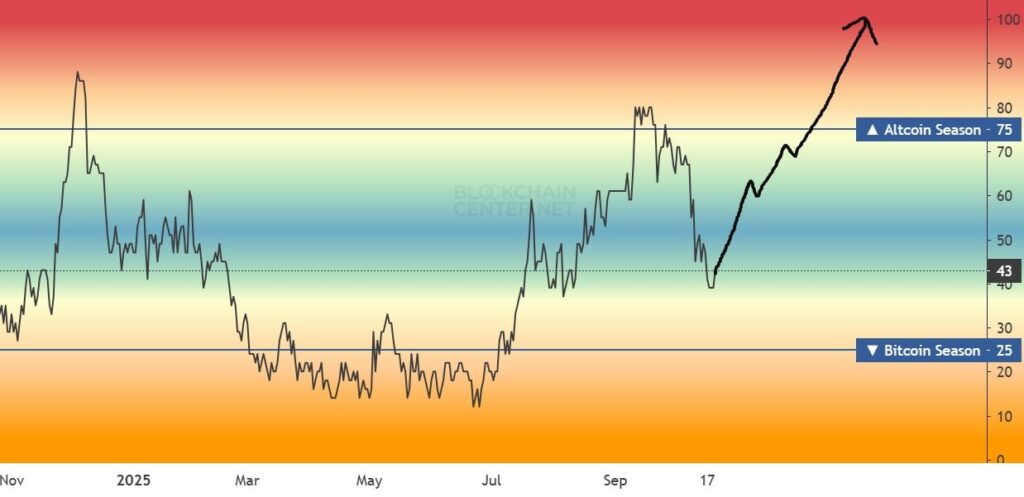

The Altcoin Season Index, which measures the performance of altcoins compared to Bitcoin (BTC), has dropped to 40. This indicates that altcoins are currently more oversold compared to the times of the COVID-19 pandemic, the FTX crash, and the tariff war triggered by Trump. These oversold conditions are often followed by a price rebound.

Analyst Rekt Fencer states that this may be the last shock before a bullish surge. However, this move has yet to show significant momentum at the time of writing.

Potential Reversal or Further Decline?

A 30% drop in open interest in Bitcoin (BTC) has cleared excess leverage from the market, with altcoins following Bitcoin’s (BTC) lead. Currently, open interest stands at around $35 billion according to data from Glassnode.

This decline suggests that capital flows are becoming neutral and the market is becoming less vulnerable to another chain liquidation. In addition, with the US government shutdown scheduled to end on November 7, the market may get a further bullish boost, especially after November 16.

Conclusion: Will Altcoins Rise?

The crypto market is currently showing some indications that point to a potential recovery, but there is still no certainty as to when this will happen. Investors are advised to keep a close eye on market indicators and breaking news to make informed investment decisions.

Read More: Ethereum Price Prediction: Here’s the Long-Term & Short-Term Bullish Potential

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Here’s how altcoins could be shaping up for a market reversal. Accessed on October 23, 2025