Aster (ASTER) Price Drops 10%, What’s Up? (23/10/25)

Jakarta, Pintu News – In the turbulent world of crypto investment, Aster experienced a significant price drop, reaching its lowest point of the year. The 10% drop in a day was triggered by large investor withdrawals and a sharp drop in trading volume. Current technical analysis suggests that market momentum is trending negatively, with the potential for further price declines.

Main Causes of Aster Price Decline

The decline in Aster’s price can be attributed to the decline in the protocol’s usage. The Total Value Locked (TVL), which measures the total value of assets invested in the protocol, has seen a drastic drop. In the space of a week, Aster’s TVL dropped by about $326 million, indicating a decline in investor confidence in the protocol. In addition, the trading volume on Aster’s perpetual trading exchange also decreased significantly, reaching only $78 million in the last 24 hours.

Compare this to other exchanges such as Lighter and Hyperliquid which recorded trading volumes of $10.14 billion and $8.06 billion respectively. This stark difference confirms that users are starting to abandon Aster, which negatively impacts the token’s performance.

Read More: Bitcoin (BTC) Price Prediction: Influenced by the Fed’s Interest Rate Decision on October 29, 2025

Technical Analysis Shows Lurking Dangers

Aster is now at a critical junction, with technical analysis suggesting further downside potential. Currently, Aster is trading in a low demand zone between $1.03 and $1.14. This zone has historically shown low liquidity and weak price recovery.

In the previous five instances when Aster entered this level, price recovery tended to be minimal. If this trend continues, there are two major downside targets that may be reached, which are $0.7 and $0.5. However, if the market momentum changes, Aster may be able to bounce off this demand zone and start a short-term recovery.

Market Momentum Favors the Selling Party

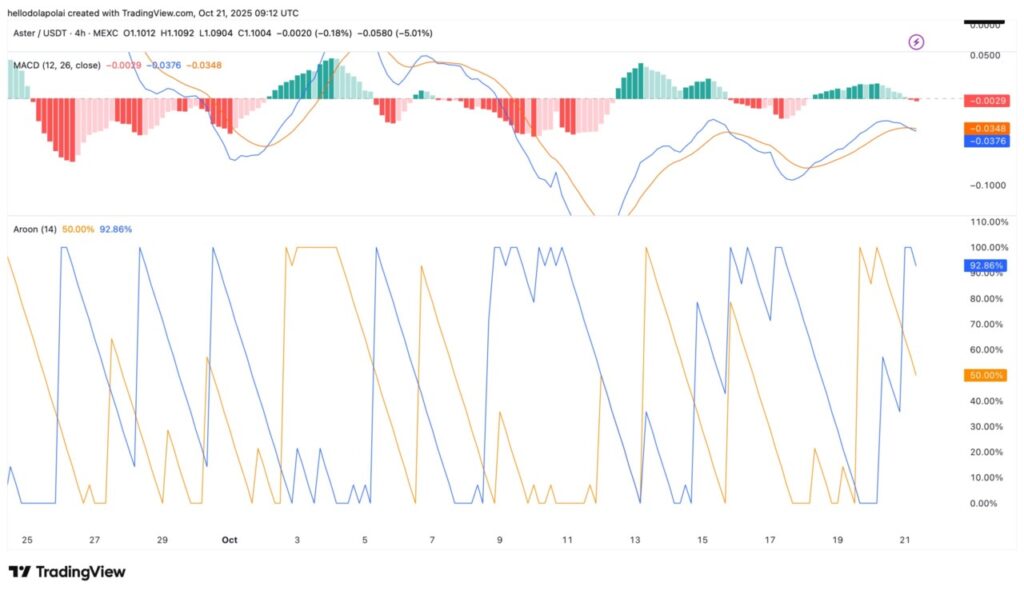

Current market indicators show that momentum remains strongly bearish. The Moving Average Convergence Divergence (MACD) has formed a death cross, a pattern that usually precedes a major price drop, as the blue MACD line crosses below the orange signal line.

In addition, the Aroon Indicator is also showing a similar bearish signal. The Aroon Down (blue line) is currently at 92.86%, well above the Aroon Up (orange line) which is only 50.00%. This suggests that the traders’ bias is currently skewed towards selling, increasing the risk of further downside from the current demand zone.

Conclusion

With various technical and fundamental indicators showing negative trends, the future of Aster looks bleak. Investors and users of the protocol seem to be losing confidence, which is reflected in massive fund withdrawals and declining trading volumes. Unless there is a significant change in momentum, Aster will probably continue to face selling pressure.

Read More: Ethereum Price Prediction: Here’s the Long-Term & Short-Term Bullish Potential

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Aster investors flee, trading activity crumbles, price risks a new yearly low. Accessed on October 23, 2025