3 Crypto Predictions for November 2025: XRP $3, SHIB Stagnant, & ETH Back to $4,000?

Jakarta, Pintu News – The crypto market is showing interesting dynamics again with several major cryptocurrencies showing significant movement. Ripple is in a critical phase that could take it to $3, while Shiba Inu seems to be losing momentum. On the other hand, Ethereum is trying hard to return to the $4,000 level after several weeks of fluctuations.

1. XRP: Reaching Critical Point

Ripple (XRP) is currently trading near $2.63 and is attempting to break resistance in the $2.75-$2.80 range. If successful, this could be the first step towards the $3 target. This rise is supported by increased market interest after a period of consolidation. By surpassing the 200-day daily moving average, XRP is showing a potential change in direction towards bullish control.

Momentum indicators such as increasing volume and Relative Strength Index (RSI) at 52 indicate balanced conditions with a chance to go up. If XRP can break and hold above the $2.80-$2.90 range, it may trigger momentum-based buying that could change its course in the fourth quarter. However, if unsuccessful, XRP may experience a brief correction back to the $2.55-$2.45 range.

Also Read: 7 Altcoins that Cross-Chain with XRP Most Often

2. Shiba Inu: Loss of Volatility

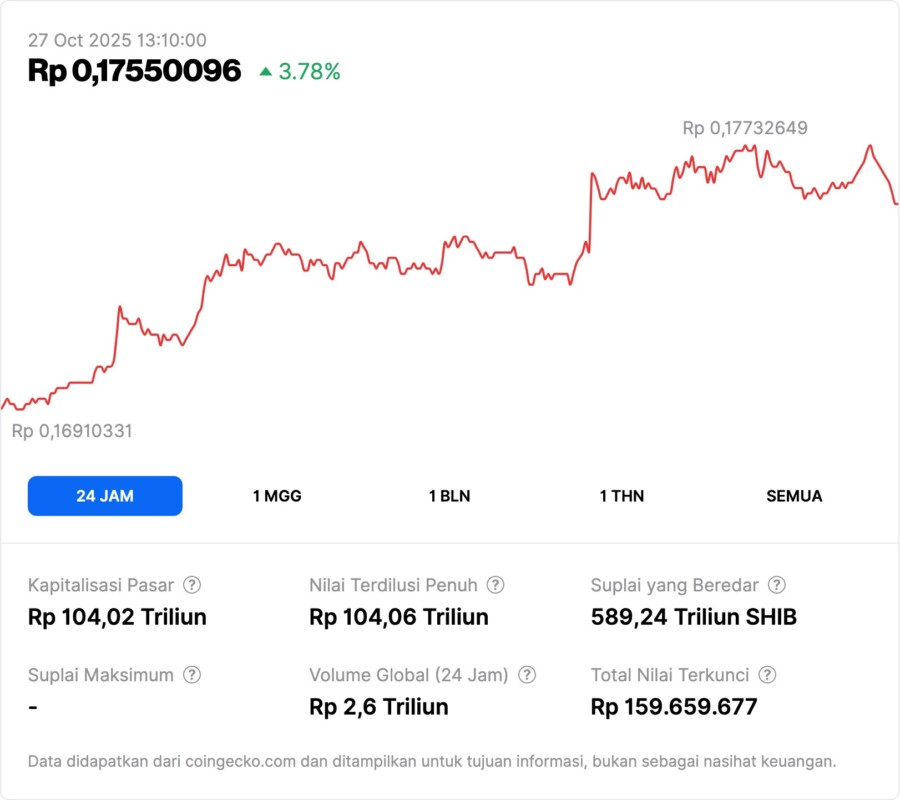

Shiba Inu is currently in its slowest trading phase in recent months, with the price moving flat around $0.0000103. Volatility has almost completely disappeared, indicating exhaustion on the part of both buyers and sellers. This signals that a significant recovery may not be in the near future.

Technical analysis shows that SHIB is in a long descending triangle pattern, with tight price consolidation between $0.0000095 and $0.0000106. The flat RSI and declining volume are negative indicators for traders looking for confirmation of a trend change. If SHIB is unable to break the 50-day daily moving average, it is likely to be stuck below this key resistance level for a long time.

3. Ethereum: Recovery attempt to $4,000

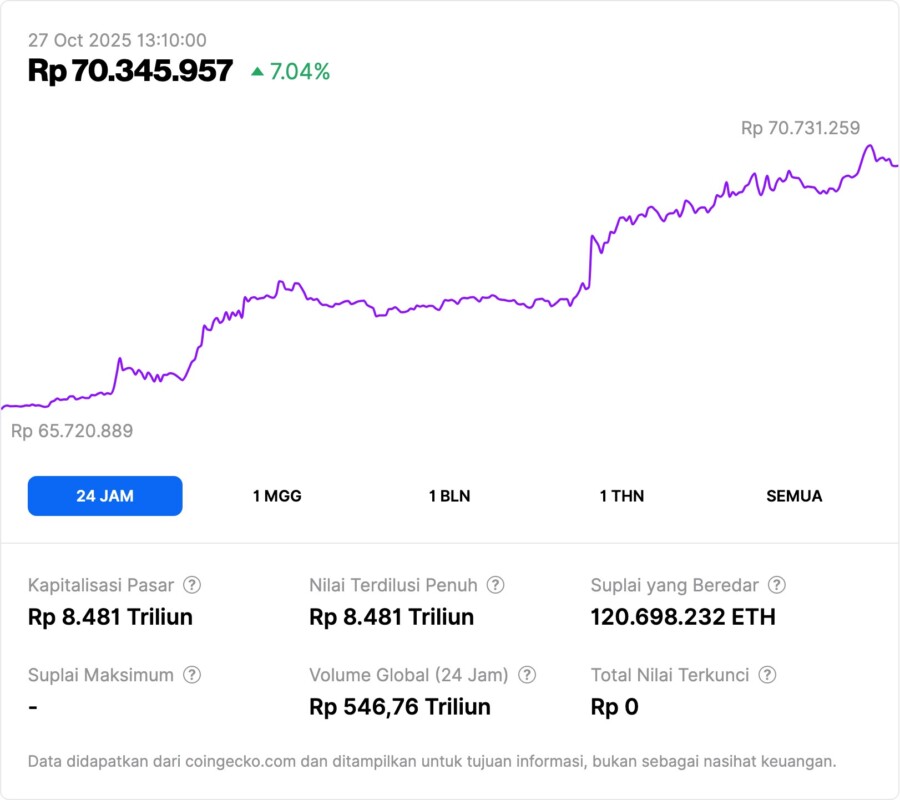

Ethereum (ETH) is attempting to return to the $4,000 level after several weeks of volatile trading. Currently, ETH is trading near $3,980, showing signs of recovery by successfully crossing several short-term resistance levels. The $4,000 level is not only technically important but also a significant psychological threshold.

Momentum indicators such as RSI, which is at 46, show that there is still room for upside. If Ethereum (ETH) can stabilize above $4,050-$4,100, the next target is the $4,400-$4,500 range, where the previous rally suffered a rejection. However, if it does not manage to break this resistance, Ethereum (ETH) may return to the $3,850-$3,750 support range.

Conclusion

The current dynamics of the crypto market suggest that opportunities and challenges go hand in hand. Ripple (XRP) is on the verge of a possible major surge, while Shiba Inu (SHIB) seems to be entering a stagnation phase. Ethereum (ETH), on the other hand, is showing resilience with its latest attempt to return to the $4,000 level. Investors and traders should pay attention to technical indicators and market momentum to make informed decisions.

Also Read: 5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Crypto Market Prediction: XRP Hits Level Critical for $3, Shiba Inu (SHIB) Price Flatlines Here, Ethereum. Accessed on October 27, 2025