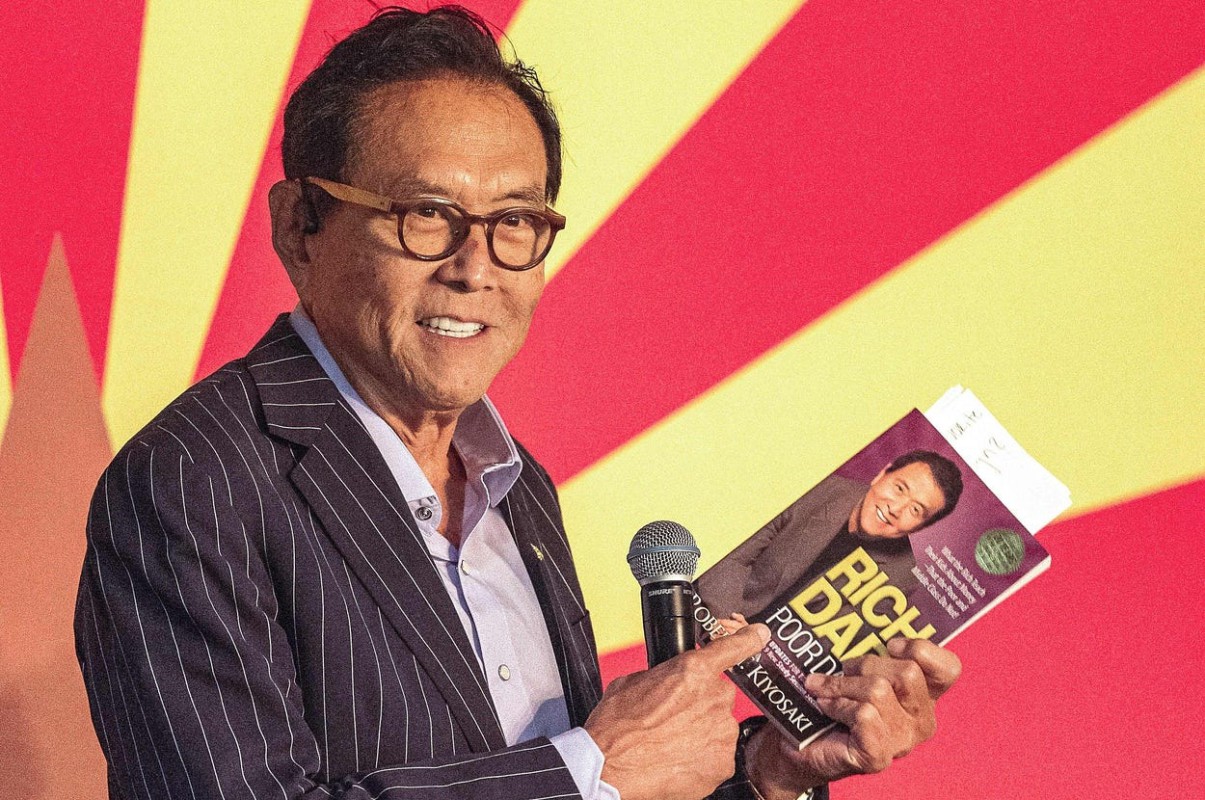

5 Robert Kiyosaki’s Warnings About Bitcoin that is Trending and Hunted by Global Investors!

Jakarta, Pintu News – Bestselling author of Rich Dad Poor Dad, Robert Kiyosaki, has once again delivered his controversial and incisive views on the future of finance. In a series of posts on the X platform (formerly Twitter), Kiyosaki warned that the FOMO (fear of missing out) phenomenon among investors towards Bitcoin and Ethereum is real – and is increasingly being hunted down because they are considered rare assets.

Based on quotes from the Bitcoin.com article, Kiyosaki considers that those who still survive in the traditional financial system will be left behind. Here are 5 important points from his statement that are being discussed in the crypto community.

1. Bitcoin & Ethereum Valued as “Real Money”

According to Robert Kiyosaki, Bitcoin (BTC) and Ethereum (ETH) are no longer just speculative assets, but have become a form of “real money”. This is based on Bitcoin’s limited supply of only 21 million, making it a rare and anti-inflationary asset.

In his October 22 post, Kiyosaki said, “Bitcoin is the world’s first rare money … only 21 million will ever be mined.” With Bitcoin currently valued at $115,458 (around Rp1.9 billion) and Ethereum at $4,228 (around Rp703 million), both continue to attract attention as future stores of value.

Also Read: 7 Altcoins that Cross-Chain with XRP Most Often

2. Real FOMO: Don’t Get into Crypto Too Late

Kiyosaki reminds investors that FOMO is real, especially when looking at the recent surge in Bitcoin and Ethereum prices. He mentioned that more and more people and institutions are getting into the crypto market, making the price and demand increase significantly.

He added that those who buy Ethereum now at around Rp700 million will be like the early adopters of Bitcoin when it was still $4,000 or around Rp66 million. Kiyosaki implies that momentum like this doesn’t come twice.

3. Scathing Criticism of the Traditional Financial System

Kiyosaki calls those who still survive by saving fiat money, working overtime, and relying on pensions “old thinkers.” According to him, this approach is no longer relevant in today’s inflationary and uncertain global economy.

Instead, he suggests investing in real assets such as gold, silver, Bitcoin, and Ethereum as a form of survival strategy in the modern economy. He believes that fiat money such as the US dollar is “fake money” that is losing value due to the ever-expanding national debt.

4. Economic inequality is the main reason for the transition to crypto

In another post, Kiyosaki likens the current global economic inequality to the “Grand Canyon”-thewide gap between rich and poor. He blames the traditional financial system for this condition, which he says keeps millions of people trapped in a fruitless cycle of hard work and savings.

As a solution, he thinks crypto provides a way out because it can be accessed more widely and is decentralized. Kiyosaki believes that those who follow the flow of technology such as crypto will be better prepared for the financial future.

5. Kiyosaki Strategy: Build a Business & Accumulate Digital Assets

Kiyosaki doesn’t just rely on crypto as the only way. He suggests a more proactive approach, which is to build your own business, and then store wealth in hard assets like gold, silver, and cryptocurrency.

This strategy is based on his belief that only by controlling one’s own sources of income can individuals truly break free from dependence on a system that “favors” most people. He concludes that “new thinkers” will be the leaders of the new economy in the next 10-20 years.

Will Kiyosaki’s warning come true?

Robert Kiyosaki’s statements about Bitcoin, Ethereum, and the global financial system have always sparked debate. However, based on market data and current crypto adoption trends, many analysts feel that what he has to say is worth paying attention to-especiallyby investors looking to diversify assets amid economic uncertainty.

Even so, investors are still advised to do their own research (DYOR) and consider their individual risk profile before entering the crypto market. One thing is for sure, the crypto world is now trending and the center of attention of global investors.

Also Read: 5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Kevin Helms / Bitcoin.com. Robert Kiyosaki Predicts Bitcoin Rush, Warns Investors: ‘FOMO is Real, Don’t Be Late’. Accessed on October 27, 2025