Is Ethereum (ETH) About to Experience a Price Spike?

Jakarta, Pintu News – The Ethereum market is showing some signals that have caught the attention of crypto investors and analysts. With increased activity from large holders and favorable technical indicators, the potential for an Ethereum (ETH) price surge seems increasingly real. Here is an in-depth look at the current state of Ethereum (ETH) based on on-chain data and technical analysis.

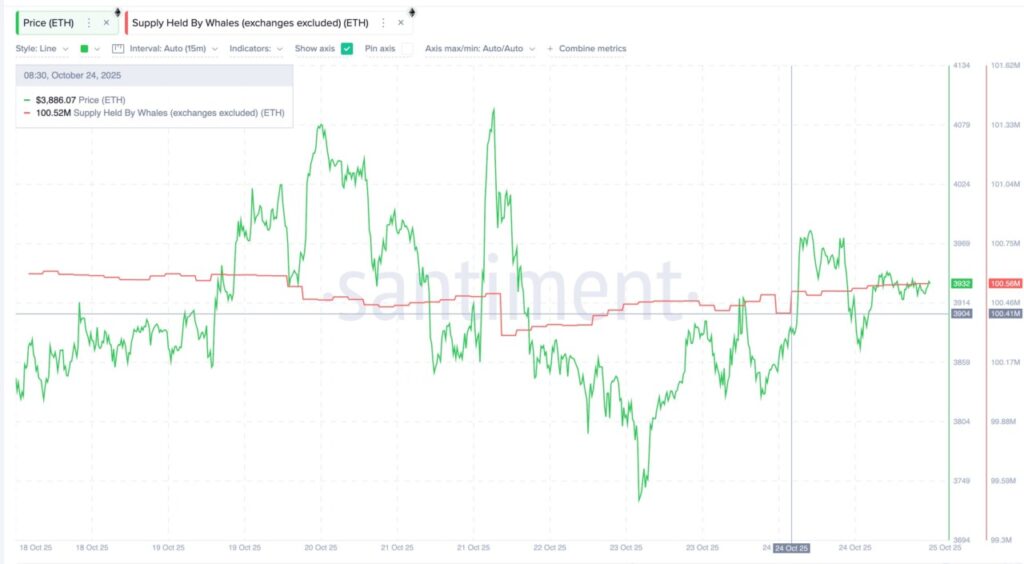

Decrease in Movement and Accumulation by Whale

At the end of October, there was a significant drop in the amount of Ethereum (ETH) moving between wallets. From 346,000 ETH on October 22, it dropped dramatically to just 42,100 ETH on October 25.

This indicates that more and more Ethereum (ETH) is standing still and being held by its holders. This phenomenon is usually interpreted as a sign that both long and short-term investors have high confidence in the future value of Ethereum (ETH).

Meanwhile, the whales who own more than 10,000 ETH have increased their holdings. In the past 24 hours, they have added about 150,000 ETH to their wallets, which is worth about $588 million. This massive accumulation shows the strong confidence of large investors in Ethereum’s (ETH) prospects going forward.

Also read: 3 Altcoins Being Hunted by Crypto Whales After US CPI Report

RSI Indicator and Price Reversal Theory

The Relative Strength Index (RSI) is one indicator that is often used to measure selling and buying pressure. Ethereum’s (ETH) RSI is showing a bullish divergence, where the RSI is making higher lows while the price is making lower lows. This is often a signal that the downtrend may be starting to lose its strength and that a reversal could potentially occur.

This divergence has been seen several times in recent months, including on October 10 and 17, each of which resulted in a short price bounce. However, with stronger on-chain data support at the moment, it’s possible that Ethereum (ETH) could experience a larger, sustained upward movement.

Also read: 10 Crypto DEXs That Could Potentially Rise by 2026

Fibonacci’s role in Ethereum’s price reversal

Despite positive signals from technical indicators and on-chain activity, Ethereum (ETH) price is still stuck below critical resistance zones. The 0.382 Fibonacci level at $3,986 and the 0.618 level at $4,281 have rejected several attempts at price gains. To confirm true market strength, Ethereum (ETH) needs to close above $4,281, which would be the first indication of a change in market control.

If Ethereum (ETH) manages to break and hold above these levels, the next price targets could be $4,491 and $4,954. However, if the attempt fails and the price drops back below $3,804, then there could be a deeper drop towards $3,509.

Conclusion

While there are no guarantees in the crypto market, current data and analysis suggests that Ethereum (ETH) is in a stronger position to experience price increases. With a combination of accumulation by whales, an increase in the number of long-term holders, and favorable technical signals, the chances of seeing a surge in Ethereum (ETH) price seem greater than ever.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum Price Reversal: Whales, Dormant Coins Rally. Accessed on October 27, 2025

- Featured Image: Generated by AI