Is Bitcoin’s (BTC) $200,000 Price Target by Christmas Achievable?

Jakarta, Pintu News – After experiencing a sharp drop on October 10, Bitcoin’s short-term momentum appears to be weakening. However, according to data from on-chain platform CryptoQuant, long-term structural demand for Bitcoin (BTC) still looks strong.

Dolphin Cohort: Key Indicators of Structural Demand

Analysis from CryptoQuant suggests that the next few weeks will be crucial, depending on whether the pace of accumulation can be increased. The market is currently described as being in the “late-stage maturity segment” of an ongoing uptrend cycle, not a definitive end.

Analysts are of the opinion that increased accumulation will be the key to continuing this uptrend. If accumulation can be accelerated again, there is a possibility that Bitcoin (BTC) will reach and surpass its previous record high price.

Also read: First Ripple (XRP) ETF in the US Hits $100 Million, Here Are the Details!

Accumulation Determines Cycle

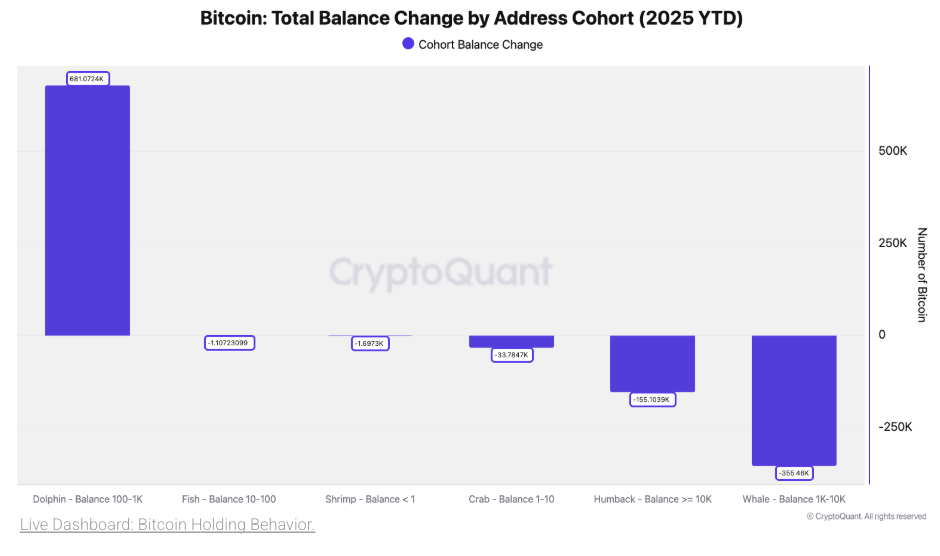

In 2025, the dolphin cohort was the only group to increase its total balance year-on-year, with an addition of over 681,000 BTC. On the other hand, the other five cohorts experienced a net decrease in their holdings.

This shows that dolphin cohorts play a crucial role in supporting Bitcoin (BTC) price through consistent accumulation. If this trend continues, they could be a major catalyst in pushing Bitcoin (BTC) price to higher levels.

Short-term Challenges and Price Targets

Despite long-term optimism, CryptoQuant warns against complacency. The crash on October 10 has weakened the short-term momentum, which requires a new accumulation phase for Bitcoin (BTC) to test and cross the $126,000 level.

Also read: 10 Coin Memes that Have the Potential to Rise in 2026

To continue the uptrend and achieve a new price record, the pace of monthly accumulation must accelerate again. This will be an important indicator to see if the $200,000 price target can be achieved ahead of Christmas.

Institutional Support Boosts Optimism

Meanwhile, Tiger Research, which released its short-term view on the same day, gave a more bullish forecast. They argued that the crash on October 10 and the subsequent liquidation showed the market transitioning from a retail-driven model to an institutional-led model.

Support from large institutions could provide a significant boost to Bitcoin (BTC), especially in the face of market volatility. This trust may be an important factor in achieving ambitious price targets.

Conclusion

With strong institutional support and continued accumulation by dolphin cohorts, the long-term outlook for Bitcoin (BTC) seems bright. However, it remains to be seen whether these factors are enough to push the price to reach $200,000 ahead of Christmas. The market will continue to watch closely.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Analysts Predict Bitcoin Price Target Amid Accumulation Trend. Accessed on October 27, 2025

- Featured Image: Generated by AI