Can Gold and Silver Prices Predict Bitcoin’s Next Move?

Jakarta, Pintu News – Market observers often compare Bitcoin to digital gold, but as it turns out, the price movements of physical gold and silver can be an important clue to predict the future price trend of Bitcoin (BTC).

History of Mayer Multiple

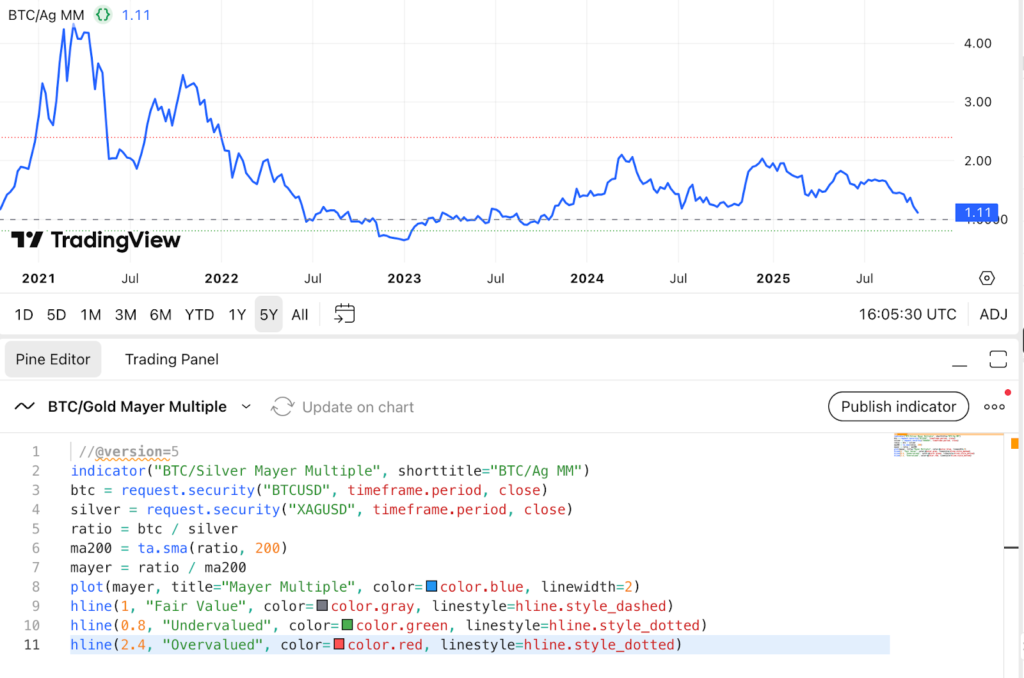

Mayer Multiple is an indicator that compares the ratio of Bitcoin (BTC) price to gold to the 200-day moving average. Proponents of this indicator believe that Bitcoin (BTC) is undervalued if the Mayer Multiple is below 1.

This suggests that Bitcoin (BTC) has the potential to increase in value when compared to gold. This indicator has been used by many traders to identify the right time to buy or sell Bitcoin (BTC) based on the historical movement of gold prices.

The Effect of Gold and Silver Prices on Bitcoin

When the price of gold or silver increases faster than Bitcoin (BTC) over an extended period, this is often an indication that Bitcoin (BTC) may be due for a rebound.

Read also: 1 Pi Network (PI) Price in Indonesia Today (10/29/25)

This phenomenon can be seen from historical data where Bitcoin (BTC) tends to catch up after periods where gold and silver have experienced significant gains. This analysis helps investors to understand the market dynamics and potential price movements of Bitcoin (BTC) based on gold and silver price trends.

What Gold and Silver Prices Mean for Bitcoin

Currently, the Mayer Multiple for gold and silver suggests a bullish outlook for Bitcoin (BTC). The logic is simple: when precious metals outperform Bitcoin (BTC) for too long, Bitcoin (BTC) tends to catch up and even outperform them.

This provides an opportunity for investors to utilize this information in making more informed investment decisions. By monitoring this indicator, investors can anticipate large movements in the price of Bitcoin (BTC) that may occur after the rise in gold and silver prices.

Conclusion

By understanding the relationship between gold, silver and Bitcoin (BTC) prices, investors can be better prepared for market fluctuations. Indicators like the Mayer Multiple provide insights based not only on speculation but also in-depth historical analysis. This opens up new opportunities in cryptocurrency investment strategies, especially for those looking to optimize the timing of purchases and sales.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Gold, Silver Prices & Bitcoin Mayer Multiple Analysis. Accessed on October 29, 2025

- Featured Image: Generated by AI