3 Altcoins Accumulated by Whales and Smart Money — Set to Surge in November 2025?

Jakarta, Pintu News – After a slow October for many altcoins, traders are now starting to look at tokens with upside potential as market sentiment improves. With rising optimism regarding interest rate cuts and stronger liquidity in the crypto market, November could potentially be a moment of revival for the market as a whole.

Among these tokens, there are three hidden altcoins that are quietly forming strong structures despite their weak performance in October. Each is showing early signs of accumulation, breakout potential, and renewed buying interest – signals that could drive significant gains through November 2025, citing BeInCrypto’s report.

Chainlink (LINK)

Among the three hidden altcoins, Chainlink stands out as one of the strongest recovery candidates for November. This RWA oracle network underperformed in October, dropping more than 15%, but its technical structure and current whale activity hint at potential upside in the near future.

Read also: Pi Network Price Prediction: Rally Slows Ahead of 121 Million Token Unveiling

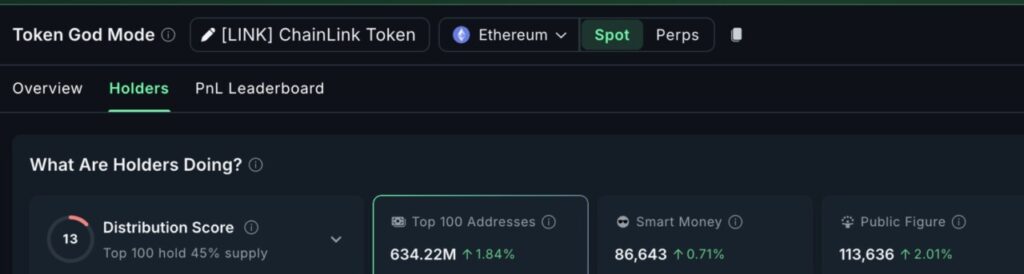

On-chain data shows that the 100 largest addresses, known as mega whales, increased their holdings by 1.84% in the past week, bringing their total holdings to 634.22 million LINKs. This means that the whales added about 11.46 million LINKs, equivalent to about $205 million.

Wallets belonging to institutional investors and public figures also slightly increased their accumulation. Technically, LINK is currently moving within a symmetrical triangle pattern, which supports the higher low formation previously emphasized by Ray Youssef, founder and CEO of NoOnes.

The pattern signals uncertainty between buyers and sellers. The new lower trendline has two touch points, meaning that if the selling pressure strengthens, a downward breakout scenario could occur and invalidate the pattern.

However, if LINK is able to close above $18.25 and confirm the breakout, the price could potentially rise towards $20.18 and even $23.69 – providing an upside opportunity of around 13% to 30%.

The Relative Strength Index (RSI) indicator, which measures buying and selling momentum, previously showed a hidden bearish divergence (price made a lower high while the RSI made a higher high), indicating potential weakness. But the latest RSI recovery suggests that these negative signals are starting to subside – a sign that whale accumulation may be starting to restore market confidence.

If the market weakens again, important support levels are at $17.38 and $16.98. If both are broken, then the price could test $15.72, which would confirm the bearish scenario.

Litecoin (LTC)

The story around Litecoin ETFs took center stage this week. A new ETF called Canary Litecoin ETF (LTCC) set a record with $1.1 million in organic volume just two hours after launch-a remarkable achievement for a crypto-based ETF.

However, despite this strong institutional debut, LTC prices actually fell 2.7% in the 24 hours on October 29 and nearly 8.5% over the past month. This suggests that most of the optimism may have already been reflected in the price earlier.

However, the resurgence of on-chain buying activity suggests that this hidden altcoin could be entering the next phase of its rise, making it one of the tokens that could potentially rise in November.

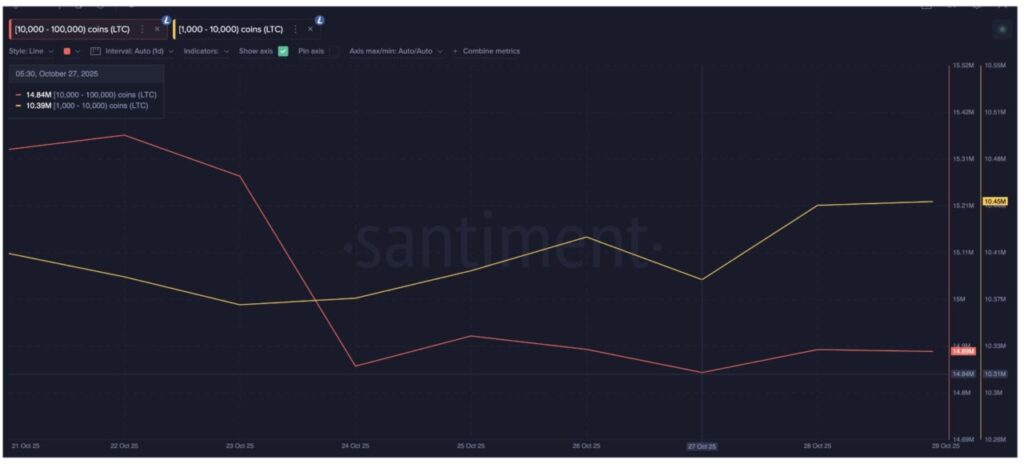

In the past 48 hours, two major investor groups-“sharks” holding 10,000-100,000 LTC and “dolphins” holding 1,000-10,000 LTC-have added to their holdings.

In total, these two groups accumulated nearly 110,000 LTC, worth approximately $10.7 million at current LTC prices. This steady inflow signals growing confidence from mid- to large-scale holders, likely in anticipation of a post-ETF rally.

Technically, LTC is currently in an ascending triangle pattern reinforced by Fibonacci levels. The first resistance is around $98.65. If the price manages to break this level, then the potential for an increase towards $106.97 is open – about 10% of the current level.

If buyers are able to keep the price above this level, the next upside target is $135.98. This target is in line with the momentum from the ETF news and broader market sentiment ahead of November.

Read also: These 3 Altcoins Are Likely to Rise in Halloween 2025 Based on Historical Records

However, this setup still comes with risks. A daily close below $94.86 would weaken the bullish scenario. If the price drops further and misses the $93.51 level, then LTC could test deeper support at $89.35 or even $79.27.

Uniswap (UNI)

Uniswap has the potential to be one of the tokens that experiences a pump in November. Despite dropping more than 17% during October, the native token of the DeFi platform is starting to show signs of recovery, with last week’s close in the green.

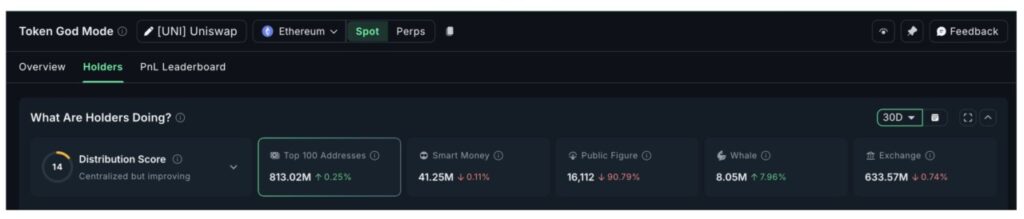

Over the past 30 days, two large investor groups have quietly increased their exposure. Whale wallets holding between 100,000 and 1 million UNI increased their holdings by 7.96%, bringing their total to 8.05 million UNI.

Meanwhile, the mega whale group-consisting of the top 100 addresses-added 0.25% to their holdings, making their total 813.02 million UNI.

Combined, these two groups have accumulated approximately 2.62 million UNI, worth approximately $16.6 million at current prices. This consistent accumulation amidst a bearish month indicates a growing belief that Uniswap’s price structure could soon turn bullish.

Technically, UNI’s 12-hour chart shows a developing inverse head and shoulders pattern – a formation that often signals a trend change from bearish to bullish. The neckline of this pattern is around $6.90, and a clean candle close above this level could confirm a breakout, opening up potential upside towards $8.17 – or about 29% of the current price.

But before reaching the target, there are minor resistances at $7.08 and $7.30 that could test the buyers’ strength. On the other hand, this bullish scenario will weaken if UNI drops below $6.25.

And if the price moves clearly below $5.83 – the bottom of the formation – then the pattern will be considered invalidated.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Tokens to Pump in November: LINK, LTC, UNI. Accessed on October 31, 2025