3 Altcoins Facing Major Liquidation Risks This Week — What’s Next?

Jakarta, Pintu News – The market entered the last week of October with two main topics dominating: Artificial Intelligence and Privacy. As a result, some altcoins in these sectors face a high risk of liquidation if price movements go against traders’ expectations.

Here are the altcoins at risk of liquidation, which traders need to pay attention to, based on BeInCrypto’s analysis.

Solana (SOL)

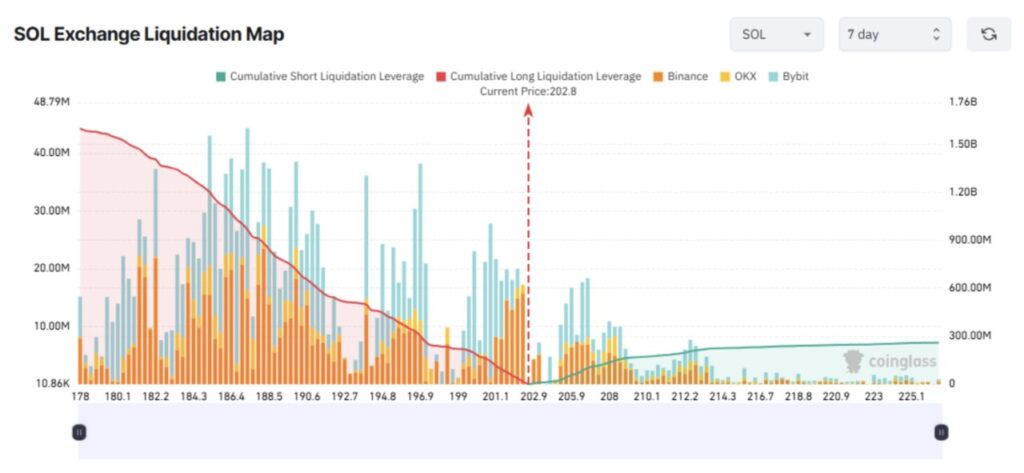

The 7-day liquidation map for Solana shows a large imbalance between long and short positions.

Short-term derivatives traders tend to open long (up) positions with high leverage. They are the ones most at risk of losses if SOL prices do not continue to rise this week.

Read also: These 3 Altcoins Are Likely to Rise in Halloween 2025 Based on Historical Records

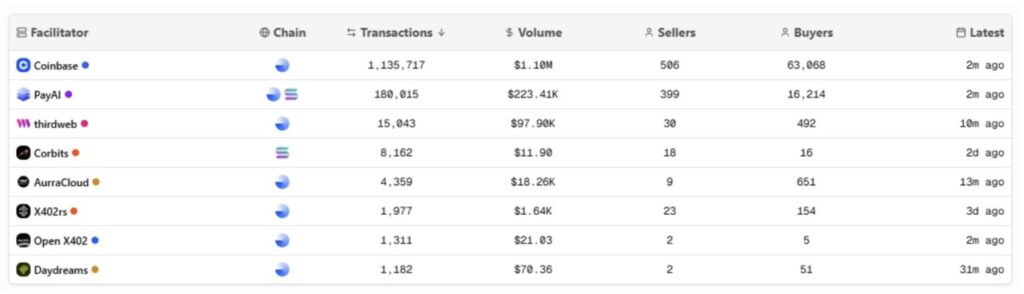

There are several reasons why traders are optimistic that SOL will increase. The recent surge in interest in the x402 token is a boon for Solana, as it-along with Base-is one of the two main networks supporting x402 ecosystem payments through the Payai Network facilitator.

However, on-chain data shows that SOL reserves on exchanges have been steadily increasing since early October. This trend indicates a growing readiness of holders to sell, which means the risk of a sudden price drop is also increasing.

If the SOL price drops to $178, the total liquidation volume for long positions could reach $1.6 billion. Conversely, if the price rises to $225, around $260 million could be liquidated from short positions.

Zcash (ZEC)

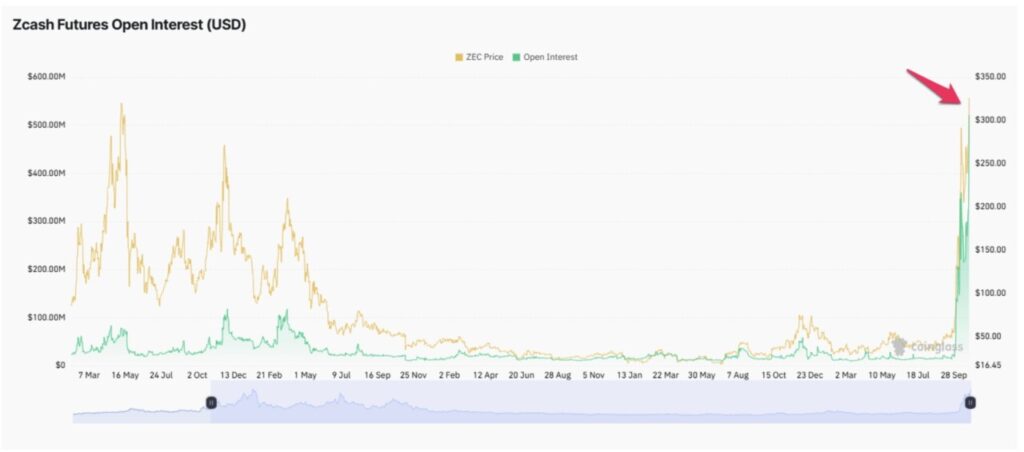

Former BitMEX CEO Arthur Hayes recently predicted that the ZEC price could reach $10,000, which helped fuel a huge rally throughout October that saw the price break $370.

“ZEC to $10,000,” said Arthur Hayes.

In the past three months, Zcash has surged by more than 750%, driven by increased attention to privacy coins.

A recent report from BeInCrypto highlights that Zcash’s shielded pool has now surpassed 4.5 million ZEC, meaning almost 27.5% of the total ZEC supply is now locked-indicating growing confidence in the privacy-focused technology.

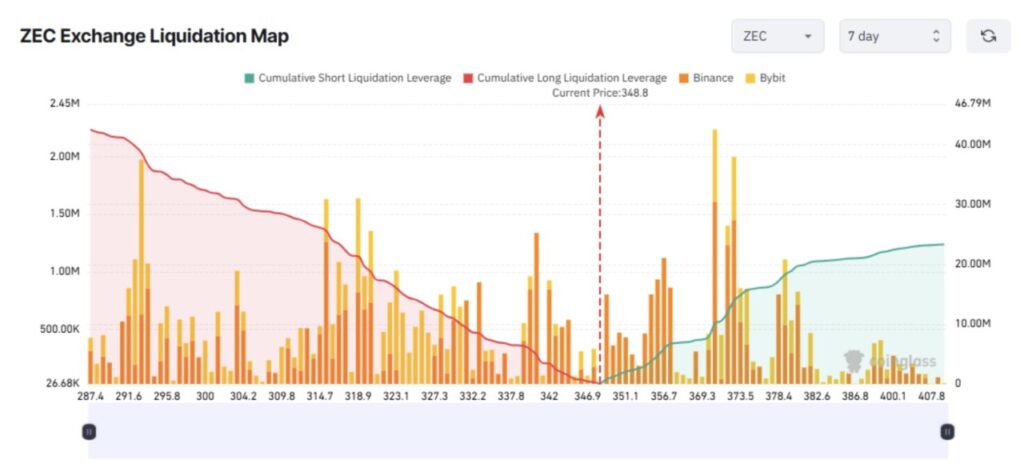

This development encouraged derivatives traders to open many long positions, causing the liquidation map to be heavily skewed towards longs over shorts.

However, long traders should still be wary. The current ZEC price has equaled its 2021 peak, which means that almost all ZEC holders in the last four years are now in profit. This could trigger massive selling pressure and sudden liquidation of long positions.

In addition, ZEC open interest has reached a record high of over $500 million-almost ten times its peak in 2021. This indicates that ZEC price movements are now heavily influenced by derivatives activity, which often results in sharp volatility.

Read also: Can ASTER Price Jump 50%? Whale Activity and Bullish Patterns Show Signal

If the price of ZEC drops to $287, long traders could incur liquidation losses of over $42 million. Conversely, if the price rises to $407, around $23 million of short positions could be liquidated.

Virtual Protocol (VIRTUAL)

This week, Virtual Protocol-an ecosystem for AI agents-underwent a number of important integrations, including the listing of all agent tokens on Coinbase Retail DEX.

Positive reports from a16z regarding the potential of AI Agents further increased investor interest in VIRTUAL. In addition, the x402 token trend also provides an additional boost, as Virtual Protocol serves as the main launch platform for AI Agent tokens.

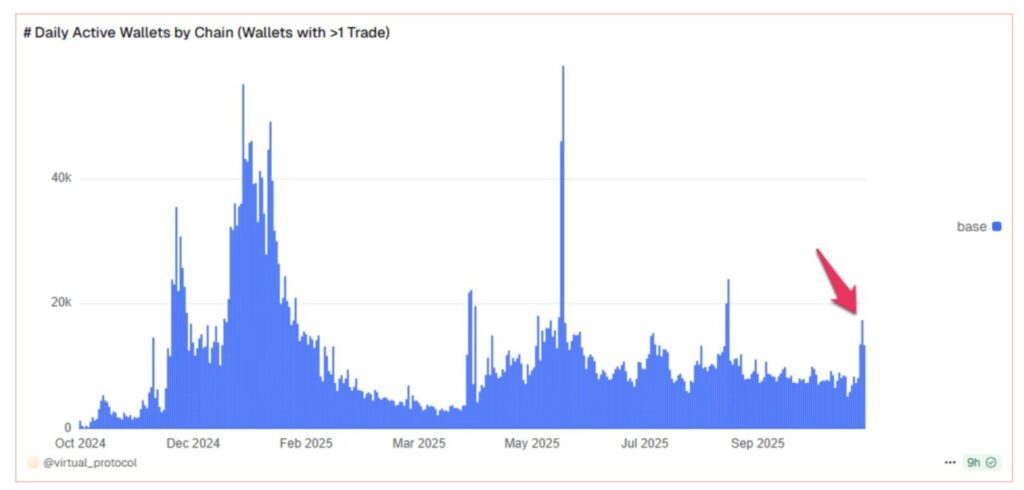

According to data from Dune, the number of daily active addresses on the Virtual network doubled during October, reaching over 17,000 wallets. This resurgence strengthened bullish sentiment among traders who opened long positions.

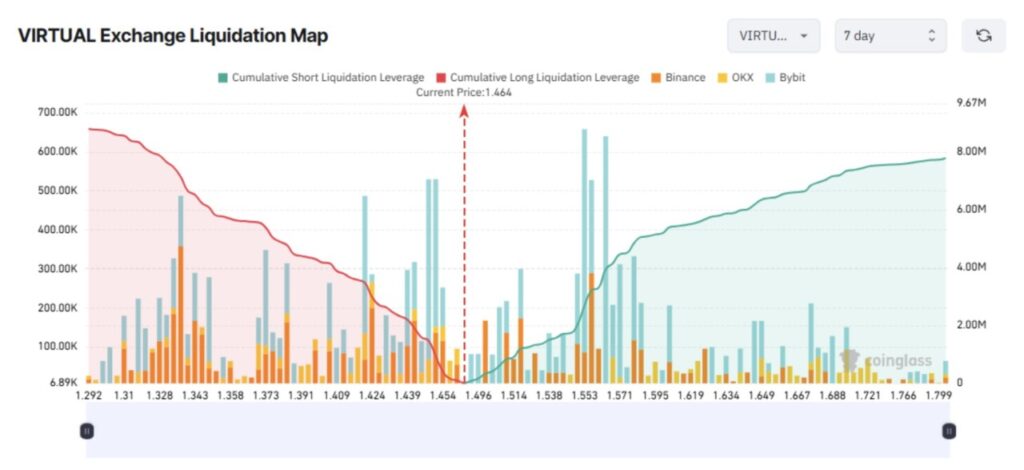

If the price of VIRTUAL rises to $1.80, the total liquidation of the short positions could reach $7.8 million.

However, the token’s price surged more than 100% last week-from $0.71 to $1.64-before correcting to around $1.45 at the time of writing. If profit-taking continues and the price drops to $1.29, then the potential liquidation of long positions could reach $8.8 million.

The main question now is: will the narrative around AI agents and privacy lose momentum as quickly as it emerged?

Many analysts warn that the hype behind the x402 token-which is currently the main driver of the AI Agent asset rally-has the potential to fade as quickly as the meme token trend. Meanwhile, discussions around privacy coins also began to show signs of decline towards the end of October.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins Facing Major Liquidation Risks in October. Accessed on October 31, 2025