Solana (SOL) price plummets 5% after ETF launch, here’s how it looks in November 2025!

Jakarta, Pintu News – After the highly anticipated debut of the Solana ETF by Bitwise, the price of Solana experienced a sharp drop of 5%. Although the ETF managed to attract $69 million in the first day, profit-taking by traders seems to be the main cause of this decline. Here’s an in-depth look at the dynamics that followed the ETF’s launch.

Causes of Solana (SOL) Price Decline

Bitwise’s launch of the Solana ETF, named BSOL, caught the market’s attention with fund inflows reaching $69.45 million on the first day. However, this excitement was short-lived as the price of Solana (SOL) corrected to $194, down almost 5% from its pre-launch price. Technical analysis showed strong selling pressure, characterized by a large red candle and a spike in trading volume.

Profit-taking by traders seems to be the main factor behind this decline. The Relative Strength Index (RSI) indicator shows weakening momentum, while the On-Balance Volume (OBV) indicates reduced buying activity. Although inflows into the ETF have been strong, Solana’s (SOL) short-term outlook is still filled with uncertainty as traders look to lock in their early gains.

Also Read: 5 Strong Signals Dogecoin (DOGE) Could Explode in November: Here’s What Analysts Say

Liquidity Risk in Solana ETFs

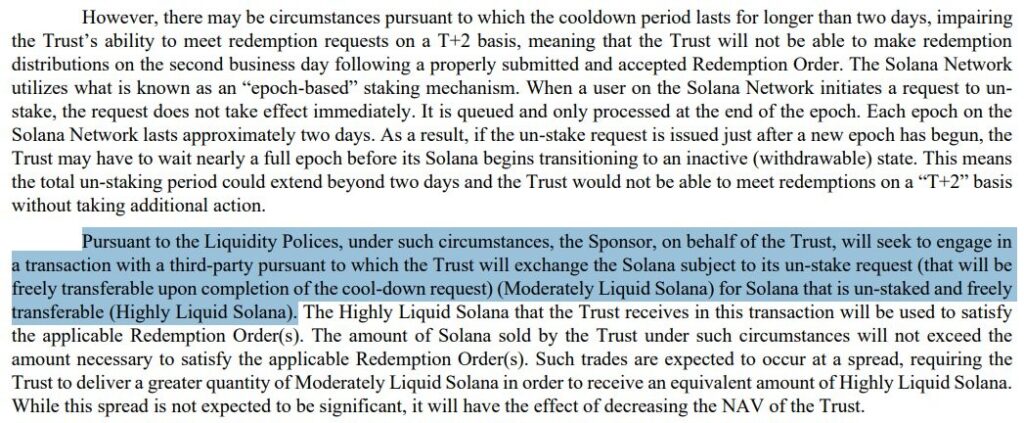

One of the structural risks faced by the Solana ETF is Bitwise’s plan to stake 100% of the Solana (SOL) held by the fund. This could lead to tight liquidity in the event of a large redemption. Nate Geraci, an ETF expert, highlights that if there is a delay in the unstaking process, the net asset value (NAV) of the fund may be affected.

Bitwise has stated in their filing that in the event of delays, the trust may swap the cooling-off “Moderately Liquid Solana” for “Highly Liquid Solana” through third-party trading. This process may slightly reduce the NAV of the fund during periods of high redemption, adding risk to investors.

Market Sentiment and Leverage Outlook

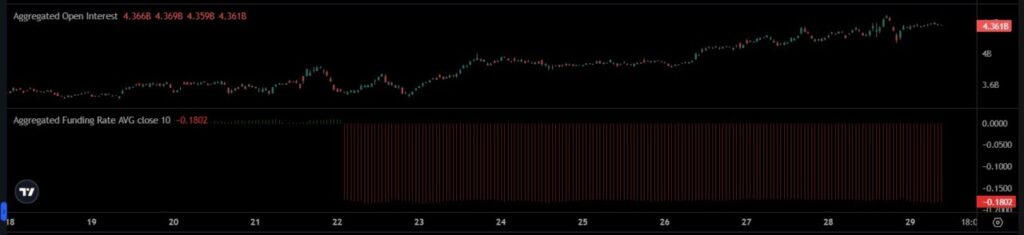

Despite the price drop, interest in Solana (SOL) remained high, as seen by the increase in Open Interest to $4.36 billion. This shows that traders started to open leveraged positions post the ETF launch. However, the average funding rate remained negative at -0.18%, indicating that shorts still dominated the market.

Current market sentiment is cautious, with many traders betting on further declines. For Solana (SOL) prices to move higher, a shift in funding rates towards positive territory and sustained demand on Open Interest will be key indicators of bullish confidence.

Conclusion

With all these dynamics, investors and market watchers should pay close attention to further developments in the Solana (SOL) ecosystem. While these new ETFs offer an attractive way to invest in Solana, the risks associated with liquidity and price volatility should be carefully considered.

Also Read: Will Ripple (XRP) Surge Before 2030? Check out his bold prediction!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Solana slips 5% after $69 mln ETF debut, profit-taking hits SOL hard. Accessed on October 31, 2025