5 Reasons Hong Kong Rejects Companies as Digital Asset Treasury (DAT)

Jakarta, Pintu News – Crypto regulation in Asia is back in the spotlight after Hong Kong authorities rejected the transformation plans of five publicly listed companies looking to become Digital Asset Treasuries (DATs). The rejection reinforces the signal that the region still views crypto-based treasury models as a legally gray area. Here are the five main reasons why these plans were blocked-according to a report from Cryptopolitan and the regulator’s official statement.

1. There are no regulations governing DAT specifically

According to Huang Tianyou, Chairman of the China Securities Regulatory Commission (CSRC), Hong Kong does not yet have a clear legal umbrella regarding the participation of public companies in crypto asset management. This means that every step towards transformation into a DAT is still “illegitimate” from a regulatory perspective.

This is in contrast to the current trend in the United States, where the DAT model has been widely adopted. However, without clear regulations, regulators consider such a move still risky for general investors.

Also Read: 5 Strong Signals Dogecoin (DOGE) Could Explode in November: Here’s What Analysts Say

2. Concerns Investors Don’t Understand DAT Risk

Huang also stated that most local investors do not understand what DATs are and their implications on company valuations. He emphasized the importance of investor education, especially since DAT companies can appear more valuable than they actually are simply because they hold crypto assets such as Bitcoin or Ethereum .

If DAT regulations are passed in the future, it is likely that the share value “premium” of DAT companies could disappear overnight, to the detriment of retail investors.

3. Business Transformation Considered Not Transparent

The Hong Kong Stock Exchange also questioned the motivation behind the five listed companies’ desire to change their business models to become digital asset managers. Many allegedly wanted to capitalize on the cryptocurrency hype to boost market valuations instantly.

According to a report from Wen Wei Po News, not a single DAT application has been approved yet. This shows the firmness of Hong Kong authorities in screening out potentially “exploitative” business transformations.

4. The Grey Zone in Crypto Treasury Holdings

The lack of clear limits on the amount of crypto assets that public companies can hold is a challenge. Huang questioned: “If you can buy one Bitcoin, what about ten? How about a hundred?” Without rules, there is the potential for companies to keep all their cash in volatile crypto assets.

This lack of clarity raises concerns that such practices could jeopardize the company’s financial health in the long run-and directly impact investors.

5. Pressure from Beijing on Stablecoins and Crypto

In addition to the DAT affair, Hong Kong regulators are also facing pressure from the Chinese central government regarding the issuance of stablecoins and other crypto projects. Some major companies such as Ant Group and JD.com were even reportedly asked to put their stablecoin projects on hold.

The People’s Bank of China’s (PBOC) scrutiny of this cross-border digital asset project shows that Hong Kong must tread carefully so as not to encroach on China’s central policies.

🧩 Closing Paragraph

Hong Kong’s decision to reject the conversion of five companies into Digital Asset Treasuries is a strong signal that a precautionary approach remains a priority in the development of the cryptocurrency ecosystem in Asia. While many companies are trying to capitalize on the rising crypto trend, without regulatory clarity, the risks to investors remain too great to ignore.

Also Read: Will Ripple (XRP) Surge Before 2030? Check out his bold prediction!

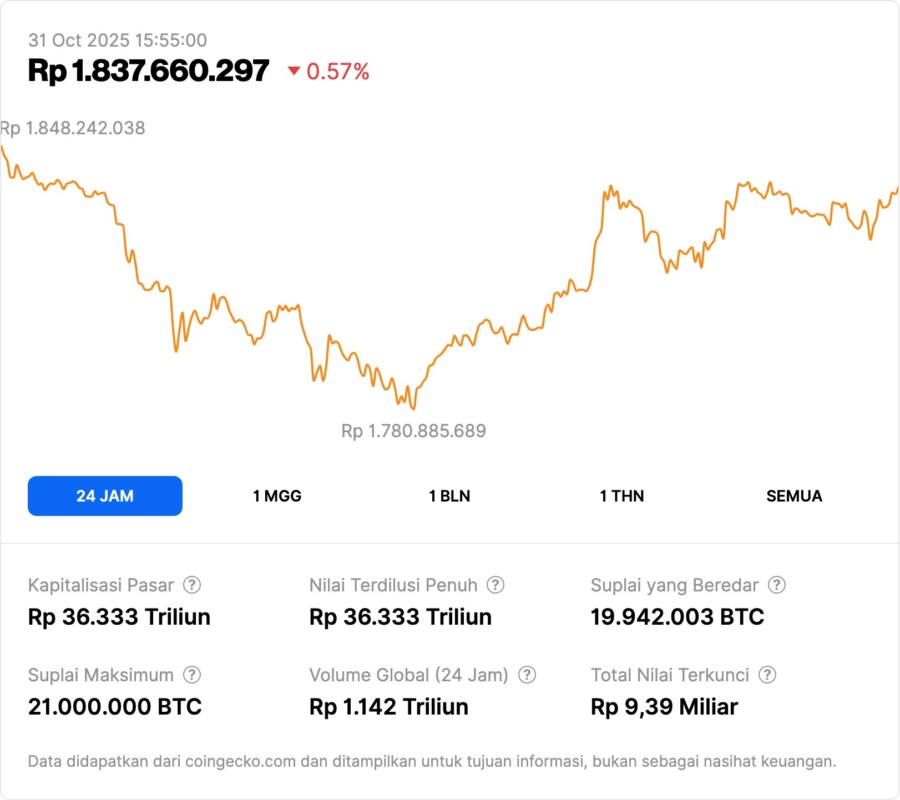

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Florence Muchai / Cryptopolitan. Hong Kong objects to the DAT transformation plans of at least 5 companies. Accessed October 31, 2025.