5 Reasons XRP Analysts Indicated a Correction Despite Previously Breaking into the Bullish Zone

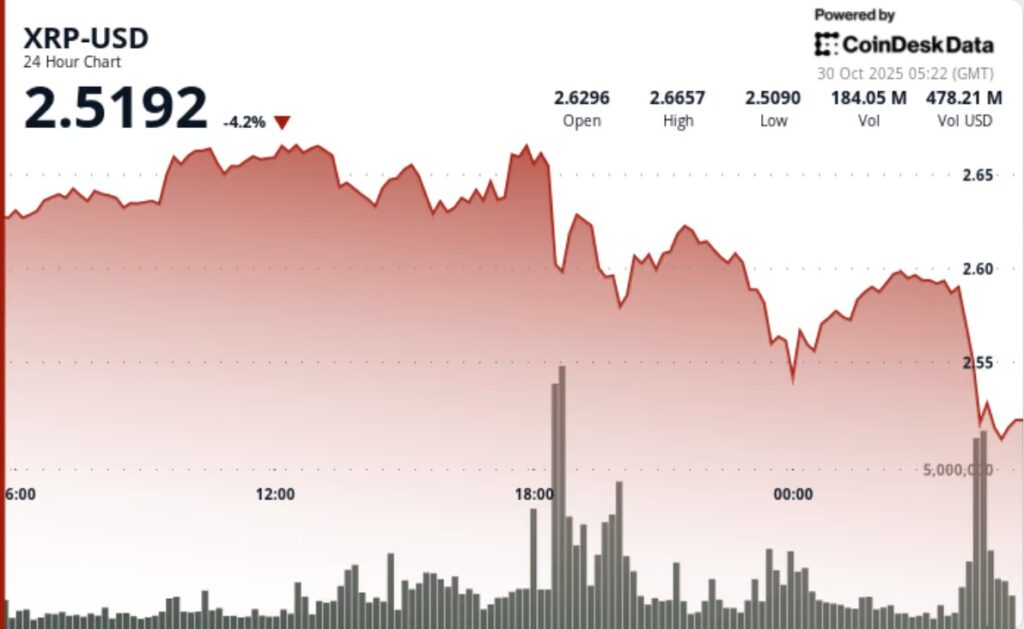

Jakarta, Pintu News – XRP was once one of the top cryptos to watch after trying to push the price beyond US$2.67 (around Rp 44,400 if US$1 ≈ Rp 16,618), but the attempt failed and raises the risk of a deeper correction.

Based on the on-chain data and the large trading volume recorded during the rejection, many observers concluded that the bullish momentum may be on hold-although the altcoin is still being hunted by institutional investors. This article discusses five technical and fundamental signals to monitor if you have or are considering a position in XRP.

1. Breakout Failed Around US$2.67

XRP attempted to break through resistance in the range of US$2.67-2.69 but failed and soon corrected to around US$2.59. During the rejection, trading volume was recorded at around 392.6 million tokens-about 658% above the normal average volume. This suggests that the resistance area was truly tested by the market and that profits may begin to be realized by investors.

Also Read: 5 Strong Signals Dogecoin (DOGE) Could Explode in November: Here’s What Analysts Say

2. Critical Support Around US$2.58-2.60

After the rejection of the breakout, the support zone in the range of US$2.58-2.60 (around Rp 42,900-Rp 43,500) is now an important level for XRP to defend. If the support is successfully maintained, there could be a bounce that takes the price back to US$2.70 or above. On the other hand, if that support falls-this could trigger broader selling pressure.

3. Indications of Decline from Domination Whale and Futures

On-chain data shows that large addresses (‘whales’) are starting to distribute or sell large amounts of XRP even though futures volumes remain high. This reinforces the signal that while there is institutional interest, large distributions have begun to take place – which could cause upward momentum to be curbed or even reversed.

4. Technical Momentum Divergence

The chart shows a divergence between the price and momentum indicators such as RSI or MACD – the price has risen to a peak while the momentum shows a smaller increase or even starts to weaken. This situation is often a sign that the upside is losing steam and the risk of a correction is increasing.

5. Risk of Correction to US$2.53 or US$2.50

If XRP fails to maintain support at US$2.58 and there is heavy selling pressure, the next correction target could be in the range of US$2.53 to US$2.50 (around IDR 42,000-IDR 41,500). Conversely, if a bounce occurs with strong volume, then a rise to US$2.70 or above could be possible-but this requires a strong catalyst, both from general crypto market sentiment and new inflows.

Conclusion

While XRP was once in the spotlight as a resilient altcoin that many investors were chasing, failed breakout events and indications of large distributions by whales put it in risky territory. For position holders or those considering entering the market, it is important to monitor critical levels such as US$2.58-2.60 and large volume flows. A correction is still very much possible, so a risk management strategy is key. In other words: opportunities still exist, but caution is much more necessary now than when the RSI and volume are soaring with optimism.

Also Read: Will Ripple (XRP) Surge Before 2030? Check out his bold prediction!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Shaurya Malwa / CoinDesk. XRP Rejects $2.67 Breakout in Risk of Deeper Pullback as Fed Cuts Cause Bitcoin Slide. Accessed October 31, 2025.