Antam Gold Price Today October 31, 2025: Sharp Rebound After Correction?

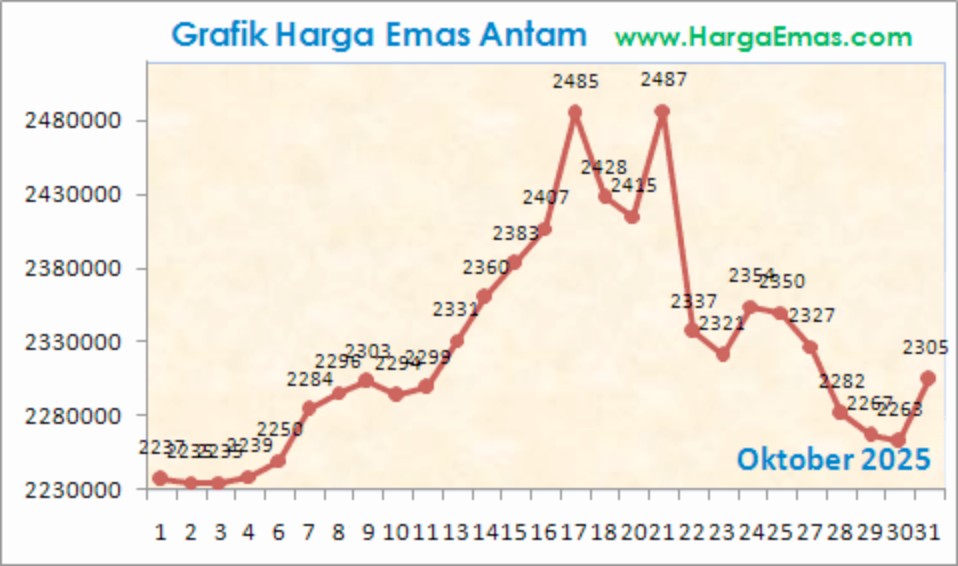

Jakarta, Pintu News – The price of Antam gold bars stole the market’s attention again at the end of October 2025. Based on a chart from HargaEmas.com, the price of the precious metal was recorded to rise to IDR 2,305,000 per gram, up from its monthly low of IDR 2,262,000 which occurred on October 29.

This increase is interesting because it occurred after a downward trend over the past two weeks. According to the observations of the HargaEmas.com team, positive sentiment from global markets and the weakening of the rupiah exchange rate helped drive the rebound of Antam gold which had previously been under pressure.

1. Antam Gold Rebounds from Monthly Low

According to the daily chart at HargaEmas.com, the price of Antam gold plunged to a low of IDR 2,262,000 on October 29, 2025. This correction occurred amid global pressures such as expectations of higher interest rates and the strengthening of the US dollar against other currencies.

However, the price jumped back to IDR2,305,000 per gram on October 31, 2025. The increase was significant, and according to the data, showed a recovery of IDR43,000 per gram in the last two days-a movement that is closely monitored by precious metals market participants.

Also Read: 5 Strong Signals Dogecoin (DOGE) Could Explode in November: Here’s What Analysts Say

2. Global Spot Prices Strengthen, a Key Driver

The main catalyst behind the strengthening of Antam gold prices is the strengthening of world gold spot prices. Based on data from HargaEmas.com as of October 31 at 16:40 WIB, the global gold price is at the level of US $ 4,019.40 per troy ounce or around IDR 66,791,789 (using an exchange rate of IDR 16,618/USD).

According to market analysis, the spot price of gold strengthened US$16.90 compared to the previous day. This strengthening reflects rising safe haven demand, mainly due to stock market uncertainty and a softening Fed policy outlook.

3. Weakening Rupiah Exchange Rate, an Additional Trigger

In addition to global gold prices, the weakening rupiah against the US dollar also contributed to the increase in local gold prices. Data from HargaEmas.com shows the USD/IDR exchange rate at IDR16,638.71, a weakening of IDR14.36 from the previous day.

With this weakening, the price of gold in rupiah was also pushed up. The spot gold price in rupiah rose by IDR 8,173 per gram, from IDR 2,141,993 to IDR 2,150,166 per gram. This is an important metric for investors who pay attention to exchange rate fluctuations in physical gold trading.

4. Spot Gold Chart Shows Positive Momentum

If you review the chart of spot gold movement in one day, you can see a fairly consistent upward trend throughout the October 31 trading session. The chart from HargaEmas.com shows that the price had touched a daily high of IDR 2,162,303 and was above the support level of IDR 2,110,309.

According to market watchers, this consolidation suggests that the precious metal’s price is forming the foundations for a potential further strengthening. These levels are currently being monitored as important boundaries by traders and investors looking for short-term buying opportunities.

5. Antam Gold Price is Still Volatile, But Predicted to Stabilize Towards the End of the Year

Although prices are currently showing a strengthening, price fluctuations are still a concern. Antam ‘s price chart during October shows the highest peak at IDR 2,487,000 on October 20, before correcting sharply to IDR 2,262,000 at the end of the month.

According to precious metals market analysts, this volatility is normal and reflects the market’s reaction to global economic dynamics. However, many analysts expect gold prices to stabilize in the fourth quarter, especially if global inflation is contained and demand for physical gold increases towards the end of the year.

Conclusion

Antam’s gold price increase to IDR2,305,000 at the end of October is a positive signal amidst uncertain market conditions. Supported by strengthening global gold prices, a weakening rupiah, and increased demand, the precious metal has once again caught the attention of market participants, especially investors looking for alternatives to crypto and other risky assets. Although it has not been “bought up” like the resilient altcoins in the cryptocurrency world, this trend is still important to monitor regularly, especially for portfolio diversification.

Also Read: Will Ripple (XRP) Surge Before 2030? Check out his bold prediction!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- HargaEmas.com. Spot Gold Price Today October 31, 2025. Accessed October 31, 2025.