New Investor Interest in Ripple (XRP) Declines, Will Price Correct Again?

Jakarta, Pintu News – Ripple has stagnated in recent days, struggling to find momentum amid sluggish market conditions. The lack of bullish signals in the crypto sector at large has the token consolidating near key support levels. A decline in investor participation and profitability adds to the pressure, indicating a possible downside risk.

Ripple (XRP) Investor Withdrawal

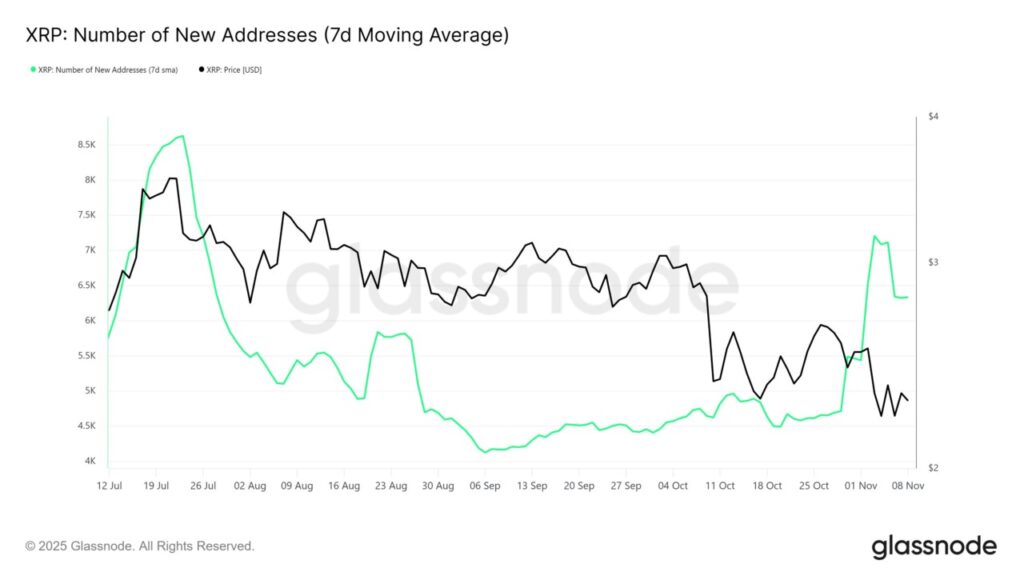

Ripple’s (XRP) new address creation saw a significant drop, reflecting reduced interest from new investors. At the beginning of the month, new wallet creation reached a four-month peak but has since dropped dramatically to around 6,336. This decline in growth signals that new buyers see little incentive to invest in Ripple (XRP) at current price levels.

This decrease in participation may weaken liquidity and hinder price recovery. Without an influx of new capital, the demand needed to push the price of Ripple (XRP) higher may be missing. If this trend continues, the altcoin could remain in the same range.

Also Read: Market Crash? Here are 5 Cryptos Predicted to Explode Due to Whale Activity in Futures Market

Ripple (XRP) Needs a Boost

Ripple (XRP) is trading at $2.32, holding above the critical support level of $2.28. The altcoin has made several attempts to break $2.36 but has struggled to maintain momentum amid weak investor participation. Given the current on-chain and technical setup, Ripple (XRP) may continue to consolidate between $2.28 and $2.13 if selling pressure increases.

If the price drops below $2.13, it will reinforce the bearish outlook and delay the recovery. However, if investor confidence improves and fund flows strengthen, Ripple (XRP) could manage to turn $2.36 into support. This move would pave the way towards $2.45 or even $2.52, signaling a renewed bullish sentiment and invalidating the current bearish thesis.

Potential Ripple (XRP) Price Correction

With unfavorable market conditions and declining interest from new investors, Ripple (XRP) faces the risk of further price correction. The weak market performance and lack of positive signals from the crypto market in general add to the uncertainty. Existing and new investors should consider these risks before making investment decisions.

Constant monitoring of market indicators and investor sentiment will be crucial in determining the future direction of the Ripple (XRP) price. Investment decisions should be based on in-depth analysis and a solid understanding of market dynamics.

Conclusion

In the current market conditions, Ripple (XRP) needs a significant push from both the fundamental and technical side to break out of consolidation. Investors should be alert to changing market conditions that could impact their investment in Ripple (XRP).

Also Read: 3 Memecoins that Whale is Starting to Look at in the Futures Market as of November 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. XRP Investor Decline: Long-Term Holders in Losses. Accessed on November 10, 2025