Ethereum Price Drops to $3,100 Today: ETH ETF Experiences $177 Million Outflow!

Jakarta, Pintu News – Over the weekend, Ethereum price briefly held above the $3,200 level after a brief dip in the bearish trend, following a week-long period of consolidation. The cryptocurrency briefly tested the support level at $3,100 and managed to bounce back.

However, market forces are still weak, so it is possible that Ethereum could test the support zone at $3,000 again if selling pressure increases. Meanwhile, other major crypto markets such as Bitcoin , XRP , and Solana are also facing difficulties to recover, while the market in general is looking forward to a potential trend reversal.

Then, how will Ethereum price move today?

Ethereum Price Drops 0.64% in 24 Hours

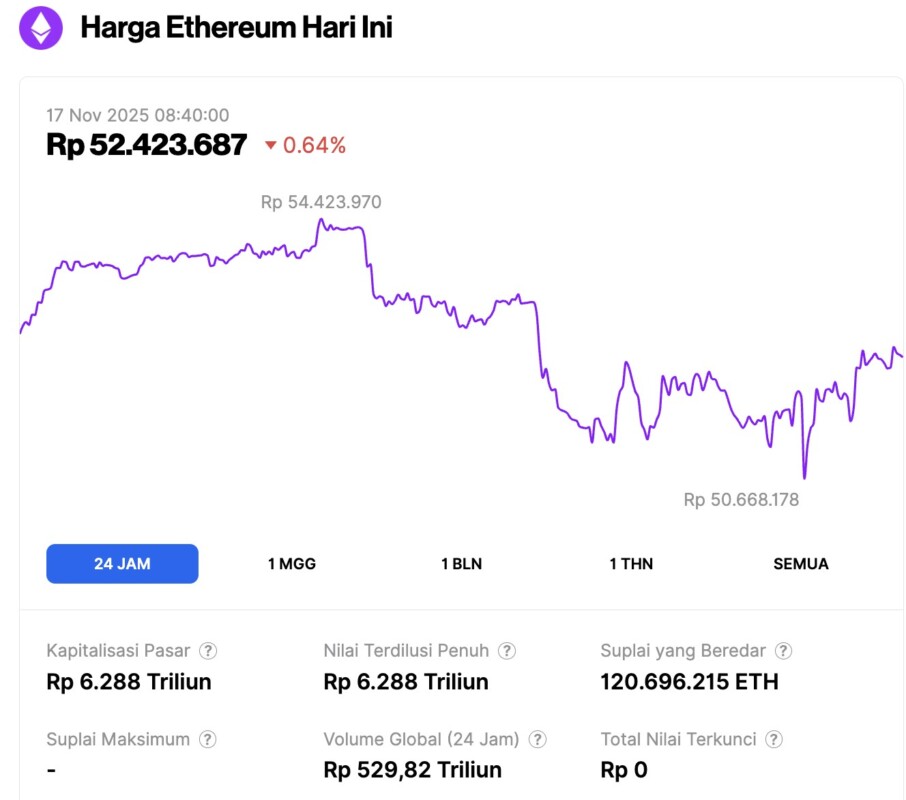

As of November 17, 2025, Ethereum was trading at approximately $3,127, equivalent to IDR 52,423,687, marking a 0.64% decline over the past 24 hours. During this time, ETH dipped to a low of IDR 50,668,178 and reached a high of IDR 54,423,970.

At the time of writing, Ethereum’s market capitalization stands at around IDR 6,288 trillion, with 24-hour trading volume surging 68% to IDR 529.82 trillion.

Read also: Ethereum Foundation Launches “Trustless Manifesto” to Affirm Commitment to Decentralization

Ethereum Slumped at $3,200: What’s Next?

Reporting from Coingape (16/11), Ethereum price briefly broke above the $3,200 level, marking a crucial phase for the market. The $3,500 zone is considered a key resistance area; if it is able to pass, the price has the potential to push towards the $3,800 level.

However, some analysts warn that if Ethereum fails to master this zone, a drop below $3,000 could occur, which risks triggering a liquidity sweep in the lower price range.

Ethereum previously touched the $3,100 support level before bouncing back, but the weak price push raised market concerns.

Analysts still see a possible drop below $3,000 if the market doesn’t show enough strength. A drop below this level could form a local low followed by a short-term recovery rally.

Longer-term, Ethereum’s price outlook remains positive, with attention focused on important moves at key technical levels.

Ethereum ETF Experiences Significant Outflows of $177.9 Million

The Ethereum ETF experienced significant outflows of $177.9 million the previous day. This coincided with a major liquidation action by BlackRock, which sold $173.3 million worth of Ethereum holdings.

An analysis of the financial flows shows that BlackRock’s ETFs were impacted by the large sale. The repositioning by institutions such as BlackRock is a clear signal of where the market is headed, reflecting a strategy of gradual disposal of crypto assets.

Read also: Crypto Millionare 2025 Listicle: List of 5 Biggest Crypto Owners!

ETH Price Tests Key Support

At the time of writing this report, Ethereum price is hovering around $3,235, registering a modest gain of 2% in the last few hours. The Moving Average Convergence Divergence (MACD) indicator is showing neutral conditions at 12.37.

Nonetheless, the dominant trend remains bearish, as the MACD histogram is still below the zero line, indicating ongoing selling pressure in the market.

Meanwhile, the Relative Strength Index (RSI) stands at 46.40, reflecting market conditions that have not shown any overbought or oversold tendencies.

Trading volumes remain stable, but fluctuations in buying and selling activity reflect the high level of uncertainty among market participants. The next significant resistance level is around $3,400, and if this level is convincingly broken, the potential for a price rally could open up.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Outlook: Will Bulls Defend $3,000 Support Level? Accessed on November 17, 2025