Japan’s Metaplanet Plans to Raise $135 Million for Bitcoin Investment

Jakarta, Pintu News – Tokyo-listed Metaplanet announced plans to issue $135 million worth of Class B Perpetual shares. The move is to expand their Bitcoin reserves, marking an aggressive strategy amidst the strengthening adoption of Bitcoin by companies around the world.

Share Issuance Strategy for Bitcoin Expansion

On Thursday, November 20, Metaplanet revealed that it will be issuing 23.61 million Class B Preferred Shares. The issue is valued at approximately $135 million and will be priced at ¥900 per share. The shares offer an annual dividend of 4.9%. Shareholders can then convert these shares into voting common shares.

Shareholders are also given the option to redeem their shares if they are not listed within 20 business days after December 29, 2026. This move is similar to the strategy used by Michael Saylor’s Strategy, which allows companies to raise more capital for Bitcoin accumulation.

Metaplanet Investment and Expectations Analysis

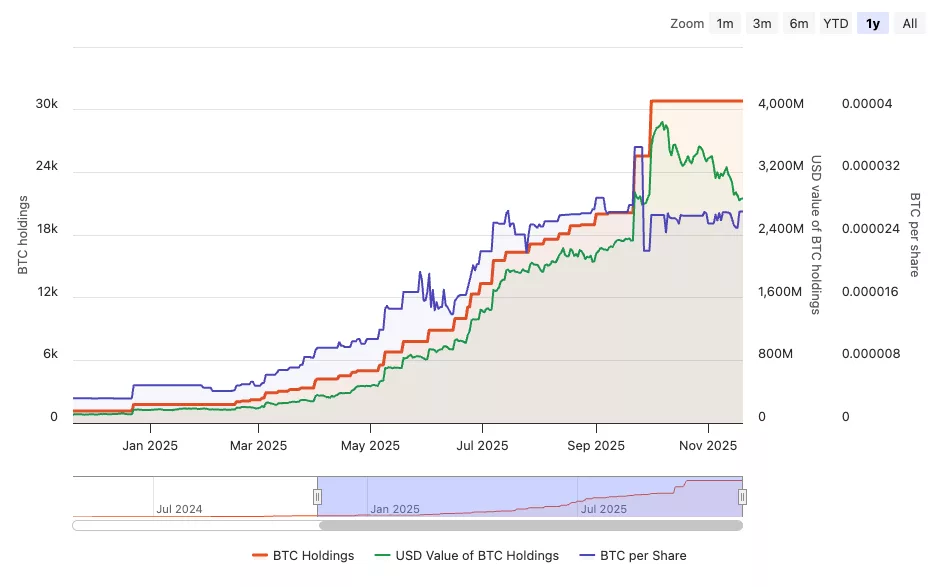

Metaplanet currently owns 30,823 Bitcoin , valued at approximately $2.69 billion. The company bought their Bitcoin at an average price of $108,036 per BTC, and is currently down 19.33% on their investment. Despite this, the company’s market capitalization value is still higher than their BTC holdings, at around $3 billion.

Also read: AI Startup Numerai Raises $30 Million, the End of All Hedge Funds Has Begun?

The company believes that Bitcoin will provide long-term returns that exceed the dividend yield of preferred stocks. This shows Metaplanet’s optimism for the future growth of Bitcoin’s value, despite its current decline.

Implications for Shareholders and Markets

The issuance of these shares will initially cause dilution for shareholders, but will not immediately increase the number of common shares. The success of this strategy largely depends on the growth of Bitcoin’s value in the short term. Metaplanet is gambling on a rise in Bitcoin’s price that will cover the cost of the dividend and provide further profits.

This aggressive strategy appeals to investors who are growth-oriented and who have a bullish view of the cryptocurrency market. However, it also poses risks if Bitcoin’s growth forecasts do not materialize as expected.

Conclusion

Metaplanet’s move to increase its Bitcoin reserves through the issuance of Class B shares shows a strong belief in the future of cryptocurrencies. It also marks a growing trend where listed companies are using digital assets as part of their financial strategy. Going forward, it will be interesting to see how this strategy affects Metaplanet’s performance and the market’s perception of Bitcoin.

FAQ

What are the Class B Perpetual Shares issued by Metaplanet?

Class B Perpetual Shares are a type of share that has no maturity date, offers an annual dividend of 4.9%, and is convertible into voting common shares.

How much Bitcoin does Metaplanet currently hold?

Metaplanet currently owns 30,823 Bitcoin (BTC), which is worth about $2.69 billion.

How is Metaplanet’s Bitcoin investment currently performing?

Metaplanet bought Bitcoin at an average price of $108,036 per BTC and is currently down 19.33% on their investment.

What are the risks of Metaplanet’s share issuance strategy?

The main risk is if the Bitcoin price does not grow as expected, which could result in losses for the company and shareholders.

Why is Metaplanet investing heavily in Bitcoin?

Metaplanet believes that Bitcoin will provide a long-term yield that exceeds the dividend yield of preferred stocks, indicating their bullish view on cryptocurrencies.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Japan’s Metaplanet to Raise About $135M to Buy Bitcoin. Accessed on November 21, 2025

- Featured Image: UEEX