3 Altcoins to Watch Out For If Bitcoin Falls to $80,000 Level!

Jakarta, Pintu News – Traders may start looking for coins to buy if Bitcoin price drops below $80,000, as the market trend continues to weaken. BTC itself has experienced a decline of around 24% since November 11 and continues to pressure most other major assets due to its strong dominance in the market.

However, there are some altcoins that show a strong structure or movement opposite to Bitcoin . These altcoins could potentially hold up better if BTC moves towards $80,000 or even breaks below that level.

Here are the top picks, starting from the one with the strongest setup, according to BeInCrypto’s report.

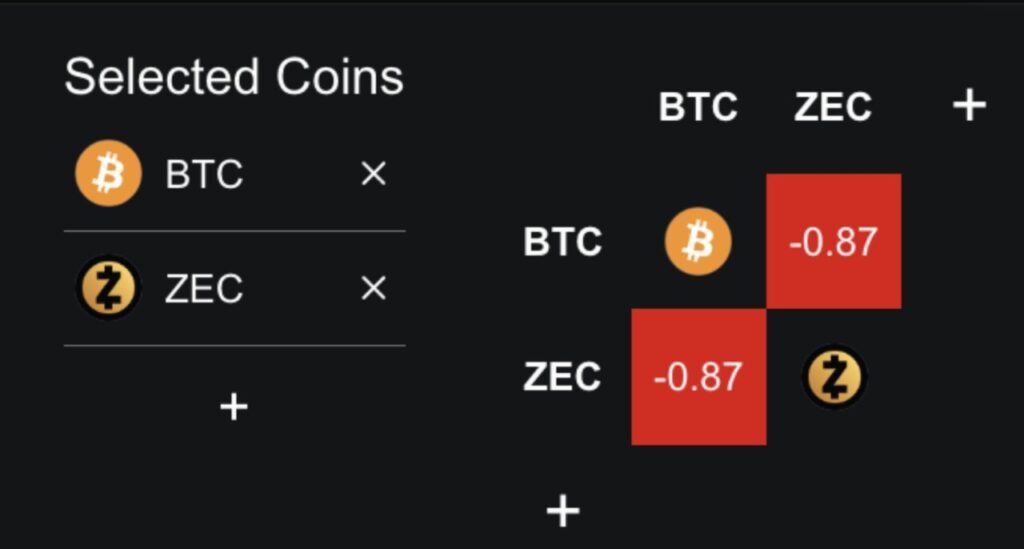

Zcash (ZEC)

Zcash remains one of the assets with a cleaner-looking price chart amidst a market filled with bearish patterns. ZEC also has a negative correlation of -0.87 against Bitcoin in the past month, meaning its movements are often in the opposite direction of BTC.

Read alse: 4 Powerful Catalysts that Could Push Zcash (ZEC) Price to $1,000

This is important now as Bitcoin’s trend is weakening, signaled by the 100-day EMA indicator approaching a crossover below the 200-day EMA. If this crossover occurs, the possibility of BTC falling below $80,000 will increase.

The price of ZEC is still holding above the flag breakout pattern since November 14. Every time the price drops, buyers continue to appear and maintain the trend, even when BTC loses its support level. ZEC’s major resistance level is around $749. If the price manages to break this level strongly, the next target is at $898, and then the psychological zone around $1,010.

If Bitcoin weakens again, this negative correlation opens up opportunities for Zcash to rise while the general market declines.

There is one additional signal supporting this upside potential: the Bull Bear Power indicator – which measures the dominance of buyers or sellers against the basic trendline – has remained in positive territory for more than a month. This suggests that buyers are still in control despite a minor correction.

With Bitcoin’s current weakness, the steady strength of buyers as well as ZEC’s negative correlation provide a real opportunity for Zcash to climb higher if BTC continues to fall.

However, the invalidation level is around $488. If the ZEC price closes daily below this level, then the breakout pattern is considered a failure, and the price could potentially drop to around $421. This scenario is only likely to happen if Bitcoin prices begin to stabilize again.

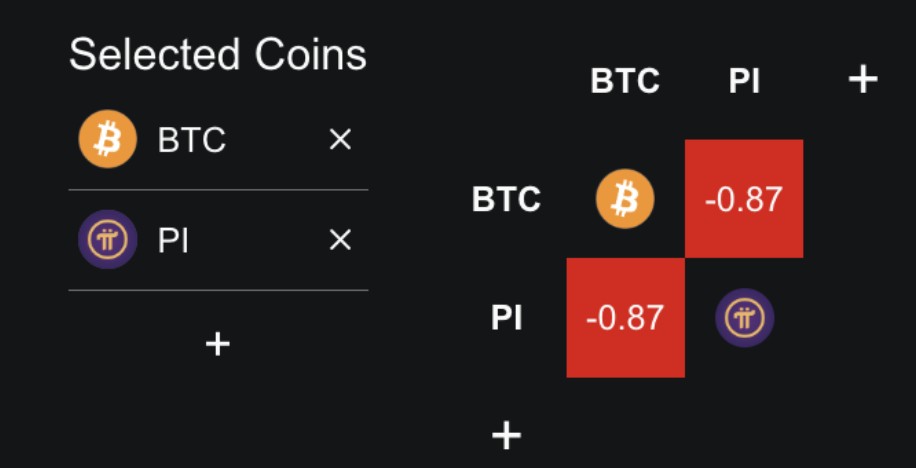

Pi Network (PI)

Pi Network is one crypto asset worth keeping an eye on if Bitcoin drops below $80,000, especially since the coin is showing clear strength amid a weakening market. Over the past month, while Bitcoin fell by around 19%, Pi Coin rose by almost 18%.

One of the main factors is its seven-day correlation with Bitcoin. Pi Coin has a negative correlation of -0.87, which means its movements are often opposite to BTC. When Bitcoin falls, Pi tends to have room to rise. This negative correlation alone makes PI an attractive hedge asset in current market conditions.

The price structure also supports such a positive outlook. Currently, the price of Pi is approaching important resistance at the $0.25 level. If it is able to break this level cleanly, there is upside potential towards $0.29 – especially if Bitcoin remains in a weak trend. However, if the price drops below $0.22, the next support is around $0.20.

Money flow data also confirmed Pi Coin’s short-term strength. The Chaikin Money Flow (CMF) indicator, which measures whether large funds are moving in or out of an asset, remains above zero.

Numbers above zero indicate that buying pressure is stronger. Between November 14 to 21, both the price and CMF showed higher lows, indicating that large buyers supported the recent price bounce.

Currently, the CMF value is near 0.11. If it manages to break above this level, a higher high will be formed, signaling a return of buying interest from big players – which could drive further upward movement if Bitcoin continues to weaken.

Read also: 3 Altcoins Worth Watching Before Black Friday Arrives, According to ChatGPT Predictions!

Pi Coin is one of the rare green dots in a market dominated by red. With strong fund flows, a -0.87 negative correlation to Bitcoin, as well as a clear breakout level at $0.25, Pi Coin stands out as one of the assets with the best potential technical setup amidst the BTC-driven market decline.

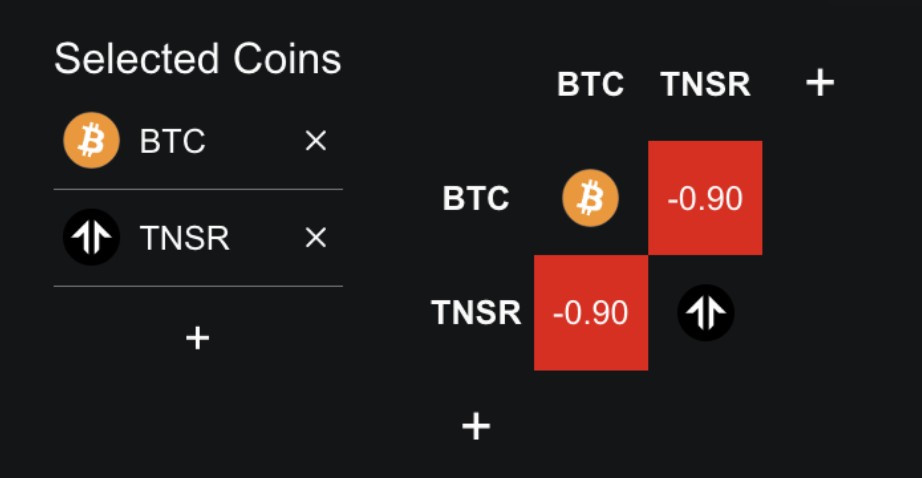

Tensor (TNSR)

Tensor is also on the list of coins worth buying if Bitcoin drops below $80,000, mainly because it shows one of the strongest short-term negative correlations to Bitcoin. Its seven-day Pearson coefficient hovers around -0.90, which means its movements are often opposite to BTC’s direction.

Recent movements support this view. In the past week, Tensor gained more than 340%, despite the general market decline. One newly created wallet accumulated over 16 million TNSR during the rally.

This consistent buying action pushed prices up, despite sluggish activity on Tensor’s NFT marketplace, with trading volumes and fee revenue declining in recent months.

The price chart shows that the current momentum is still strong. The 20-day exponential moving average (EMA) has broken above the 50-day EMA, and is now approaching the 100-day EMA.

If the 20 EMA manages to break the 100 EMA from below, this is often considered a stronger bullish signal as it shows that short-term strength is starting to overpower long-term weakness.

An EMA is a price average that gives more weight to the most recent data, making it more responsive than a simple moving average (SMA).

Currently, Tensor is trading at around $0.24 after briefly reaching a peak of $0.36. To continue the rally, the price needs to break the $0.36 level and then $0.38 on net. If Bitcoin continues to weaken and the negative correlation remains strong, Tensor could potentially rise to $0.44, even up to $0.72 based on extension levels.

However, if the market reverses and Bitcoin rebounds sharply, the price of TNSR could retreat back to around $0.17 – the previous support zone.

For now, massive accumulation, average trend improvement, and a strong negative correlation make Tensor a reasonable choice in the list of potential assets if Bitcoin’s price gets depressed again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins To Watch If Bitcoin Drops Under $80,000. Accessed on November 21, 2025