Bitcoin Holds Steady at $87,000 Today – Daily Chart Signals Renewed Strength

Jakarta, Pintu News – Bitcoin price started the week on a calmer note as the market began to stabilize after a tumultuous period. Market sentiment improved slightly as traders began to shift their focus on new macroeconomic expectations and the increased likelihood of policy easing.

In addition, general market conditions now suggest a more cautious approach, with investors weighing risks as well as opportunities. Meanwhile, signs of stability are beginning to appear on many charts, driven by strengthening short-term signals and easing volatility.

Then, how will the Bitcoin price move today?

Bitcoin Price Up 0.16% in 24 Hours

On November 26, 2025, Bitcoin was trading at $87,774, equivalent to approximately IDR 1,465,947,339, marking a slight 0.16% increase over the past 24 hours. During this time, BTC dipped to a low of IDR 1,439,240,375 and reached a high of IDR 1,478,926,153.

At the time of writing, Bitcoin’s market capitalization is estimated at IDR 29,080 trillion, while its 24-hour trading volume has declined by 10%, standing at IDR 1,124 trillion.

Read also: Arthur Hayes Predicts Bitcoin Will Hold Strong Above $80,000 as the Fed Winds Down Tightening

Fed Rate Cut Odds Shape BTC Direction

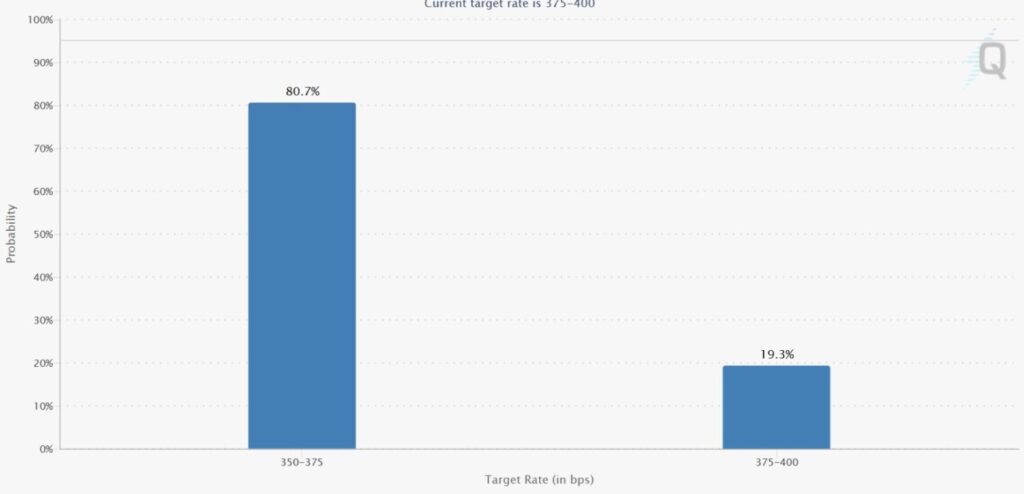

New interest rate expectations are starting to affect Bitcoin’s price, with the market estimating an 80.7% chance that the Fed will cut rates to a range of 350-375 basis points.

This surge in expectations comes just days after Fed Governor Chris Waller voiced support for a rate cut in December, citing a weakening labor market.

This easing policy direction favors risky assets like Bitcoin, especially in the midst of a cautious market recovery phase. Currently, Bitcoin’s price stands at $87,456, providing a clear benchmark to observe the market’s response to changing macro signals.

Furthermore, hopes for policy easing have given BTC room to stabilize after being under pressure for the past few weeks. Traders are now watching to see how these cut opportunities align with the overall market structure, especially as liquidity begins to improve at key junctures.

Moreover, any change in policy expectations often triggers a quick reaction in the crypto market, given its sensitivity to macro liquidity.

These signals combined create a crucial window in the next few weeks. BTC’s price movement is likely to remain closely following macro policy direction, and this linkage strengthens the chances of a steady rebound as long as macro conditions remain favorable.

Reversal Structure Reappears as Bitcoin Tests Crucial Breakout Zone

A prominent analyst highlighted a pattern that resembles the structure of the 2021 bear market, and the similarities are striking. The downward trendline, compression slope, as well as the behavior of the support show a close alignment with the previous cycle.

However, Bitcoin is currently defending the $82,000 region instead of breaking downward as before, creating a stronger foundation for a possible reversal. Each small increase also forms a neater “staircase” pattern compared to the sharp declines in previous cycles.

Additionally, the chart shows the presence of a potential area for reversal where BTC is gathering momentum just below the trendline. This form of movement reflects controlled intentions, not panic reactions.

Read also: XRP Price Surges to $2.10, EGRAG Crypto Analyst Predicts Big Breakout Coming Soon

This symmetry also helped build market confidence, especially as Bitcoin moved into a zone that has historically triggered widespread sentiment swings. Softer retests of technical levels also reduce structural pressure, giving BTC room to move more steadily.

This formation now plays an important role. If Bitcoin manages to break through this trendline, the broader market narrative could shift to a more constructive phase – especially since this structure aligns with key cyclical markers.

Bitcoin Price Eyeing Breakout as Daily Chart Shows Renewed Strength

Bitcoin’s daily chart (25 Nov) shows a clear reaction near the lower boundary of the channel. BTC briefly touched the $84,600 region and bounced back with striking precision.

Meanwhile, the upper limit of the channel is at $93,534 – being the next important breakout point that could potentially trigger a stronger uptrend continuation.

In addition, the Money Flow Index (MFI) is at 16, signaling deep oversold conditions. This value supports the potential for a gradual recovery as selling pressure eases. The projected green line on the chart suggests a gradual move towards $108,020 and subsequently $125,000, with each phase respecting clear resistance levels.

The current structure also favors a more controlled rise over aggressive surges. Bitcoin continues to form cleaner higher lows, creating a more solid foundation for long-term price performance. The interaction between the oversold signal, channel boundaries, and projection path forms a unified and directional recovery map.

In conclusion, Bitcoin is entering a more constructive phase after successfully defending the lower boundary of the channel. Expectations of interest rate cuts by the Fed reinforce this outlook and favor a gradual price recovery.

A comparison of the structure from leading analysts further boosts confidence, thanks to its similarity to previous cycles. Overall, BTC is set for a clearer upward path as technical and macro signals begin to align.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Is Bitcoin Price Set for Major Recovery as December Rate Cut Chances Hit 80.9%. Accessed on November 26, 2025