Ethereum Holds Steady Around $2,900 as BitMine Increases ETH Holdings — What Could Happen Next?

Jakarta, Pintu News – Ethereum is still trading within a fragile structure as the overall market begins to move towards defensive positions. Currently, ETH price is hovering around $2,900 after experiencing a mild rebound from the current cycle low of $2,659.

The market is showing signs of indecision, as futures activity begins to subside, spot flows remain negative, and exposure from accumulating institutions increases. As such, traders are now watching to see if ETH is able to stabilize before further pressure tests the next support zone around $2,500.

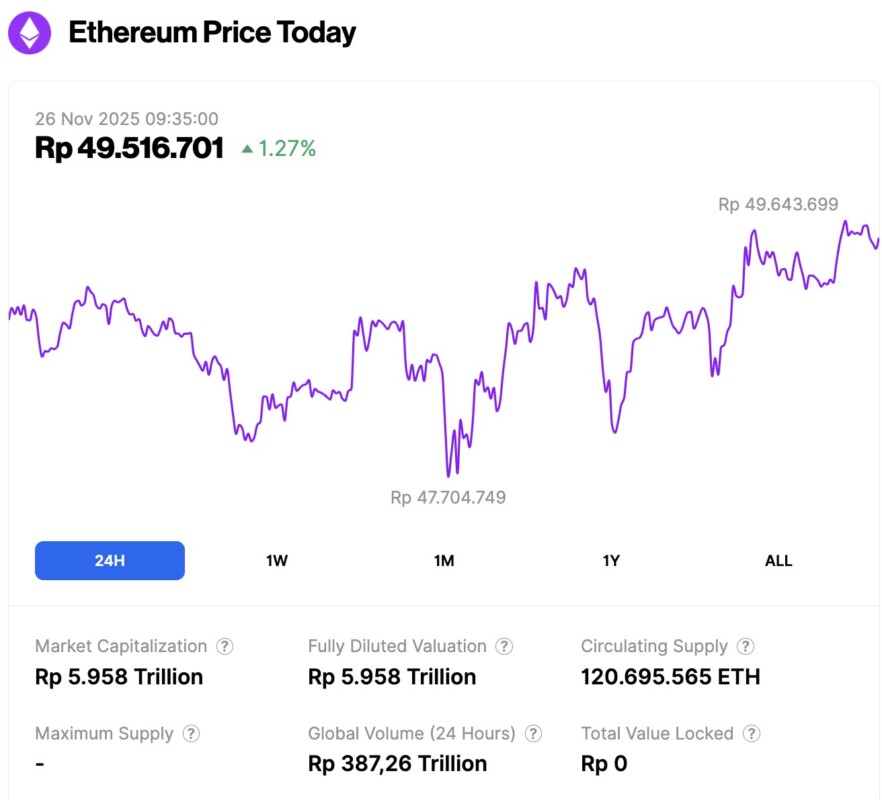

Ethereum Price Up 1.27% in 24 Hours

As of November 26, 2025, Ethereum was trading at approximately $2,965, or around IDR 49,516,701, marking a 1.27% increase over the past 24 hours. Within the same period, ETH dipped to a low of IDR 47,704,749 and peaked at IDR 49,643,699.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 5,958 trillion, while its daily trading volume has dropped by 25%, reaching IDR 387.26 trillion over the last 24 hours.

Read also: Bitcoin Holds Steady at $87,000 Today – Daily Chart Signals Renewed Strength

Market Structure Still Weak under Dynamic Resistance

Ethereum is still forming a clear lower high and lower low pattern on the medium-term chart. The price remains below the 9-EMA, which indicates weak momentum despite the recent slight increase.

Moreover, a retest of the short-term resistance around $2,886 continues to limit any meaningful recovery attempts. A close above this level could pave the way towards $3,166, where there is structural resistance aligned with the 0.236 Fibonacci zone. However, until that happens, the general trend still suggests caution.

Momentum readings also add to the uncertainty. The Chande Momentum Oscillator indicator is hovering around 32 – a slight improvement from previous oversold levels, but still below the centerline.

This makes market conditions considered neutral to bearish until there is a strong impulse that drives momentum upwards. As such, there is no clear confirmation that the trend has changed.

Futures and Spot Flow Show Defensive Market Positioning

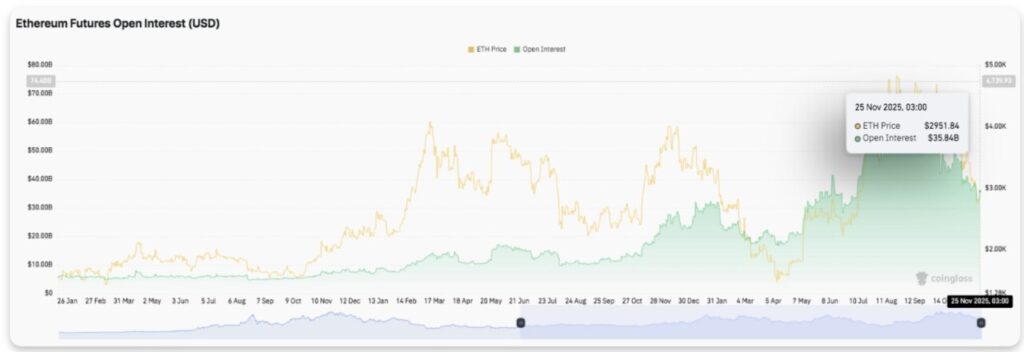

The open interest (OI) on Ethereum futures has declined from its September peak that briefly surpassed $40 billion. Currently, the OI stands at around $35.8 billion. This decline reflects traders’ reduced use of leverage after the previous spike.

Even so, the open interest remains high indicating that participation in the derivatives market is still active. This pattern indicates that traders remain engaged, despite the increased volatility.

Meanwhile, fund flows in the spot market tell a different story. Ethereum’s main products recorded consistent outflows during September and October.

In fact, on November 25, an outflow of $61 million was recorded. This trend signals that large holders continue to reduce risk exposure. More importantly, inflows have been brief and small – reinforcing the cautious and defensive feel of the market.

Read also: Bitcoin and Ethereum price drops, these 5 altcoins soar up to 85%!

BitMine Expands Accumulation as Treasury Strategy Evolves

BitMine Immersion revealed that the company’s total crypto asset and cash holdings now stand at $11.2 billion. Currently, BitMine holds 3.63 million ETH – equivalent to 3% of the total circulating Ethereum supply.

Furthermore, the company added nearly 70,000 ETH in just the past week, signaling a strategy of continued accumulation despite the market weakness. In addition, BitMine also holds $800 million in cash as well as small allocations to other assets.

The company aims to control up to 5% of the total ETH supply. Analysts see this move as a significant long-term strategy, especially as it aligns with expectations of increased demand for blockchain infrastructure in the future.

BitMine is also among the most actively traded US stocks, which makes it stand out even more as a crypto-focused treasury firm. As such, BitMine’s strategy is now starting to influence the broader discussion about institutional accumulation in the Ethereum ecosystem.

Technical Outlook for Ethereum Price

ETH is still trading in a medium-term downtrend with key levels remaining clear.

The major resistance levels are at $2,886, $3,166, and $3,479. If it manages to break through these three areas, ETH has the opportunity to move towards $3,732 and even $3,985.

Meanwhile, the nearest support level is $2,750, followed by the cycle low at $2,659. If ETH fails to hold $2,659, it could retest psychological support at $2,500.

Currently, a key resistance area exists around $2,900, where the 9-EMA (Exponential Moving Average) continues to limit any attempts at price recovery. Breaking and holding above this level is crucial to establish medium-term bullish momentum.

Technically, ETH is in a broad descending channel pattern, where compression pressure still limits volatility. A convincing breakout outside this channel will determine the direction of the next move.

FAQ

What was Ethereum’s lowest price in this cycle?

Ethereum’s lowest price in this cycle was $2,659.

What is BitMine Immersion’s total stake in Ethereum?

BitMine Immersion has a total of 3.63 million Ethereum, which is equivalent to 3% of the total supply.

What shows that Ethereum’s momentum is still weak?

Ethereum is still below the 9-EMA and is registering lower highs and lower lows, indicating that momentum is still weak.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Edition. Ethereum Price Prediction: ETH Struggles in Downtrend While Bitmine Grows to 3% Supply Share. Accessed on November 26, 2025