3 Altcoins at Risk of Major Liquidation This Week

Jakarta, Pintu News – Market sentiment turned to extreme fear on December 1. Short positions dominated the derivatives market. A number of major altcoins showed significant imbalances in their liquidation maps, potentially triggering a new record in the number of liquidations.

The following analysis highlights the underlying factors that may cause market movements to deviate from short-term expectations in the first week of December.

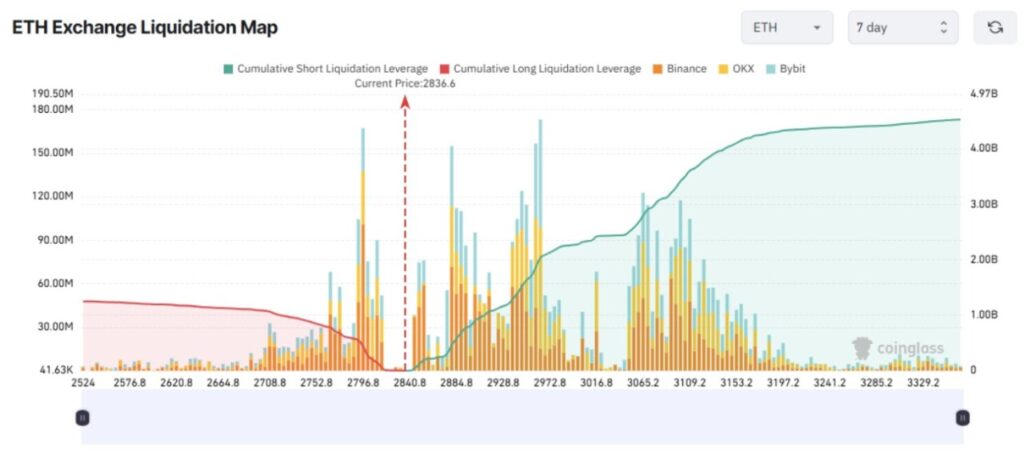

Ethereum (ETH)

The 7-day liquidation map for ETH shows that the cumulative liquidation volume of short positions is much larger than that of long positions. This indicates that traders are aggressively short selling ETH.

Read also: Arthur Hayes: Bitcoin Could Break $500K and 5 Top Altcoins to Watch in 2026

If ETH recovers to the $3,150 level within this week, the total liquidation of short positions could surpass $4 billion.

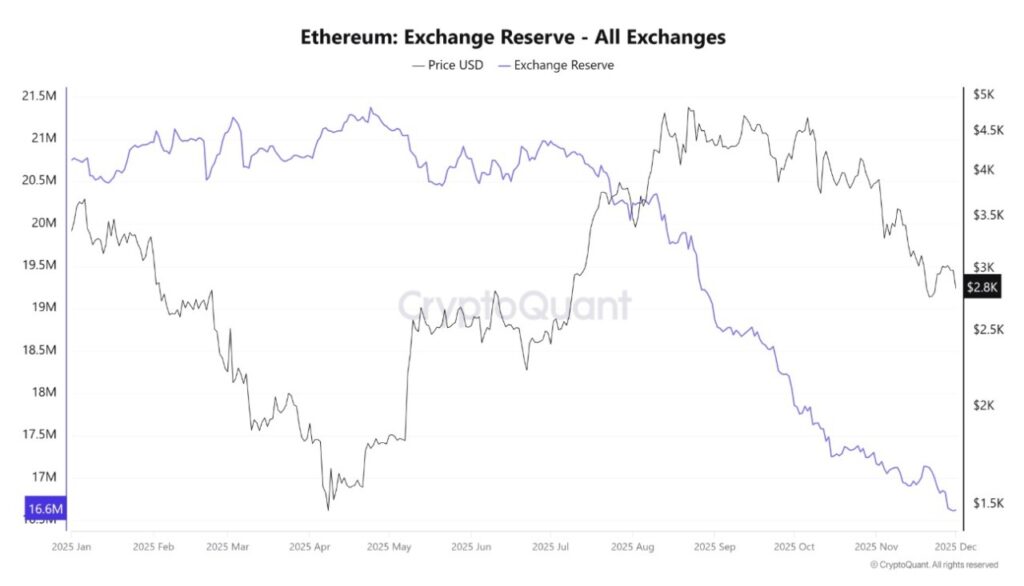

On-chain data related to ETH balances on exchanges could be an important signal. According to data from CryptoQuant, the current supply of ETH on exchanges has dropped to an all-time low of 16.6 million ETH. The trend of ETH withdrawals from exchanges has accelerated over the past month, despite the decline in ETH prices.

“As ETH reserves on exchanges reach historic lows… I believe Ethereum will lead the next market rise,” investor Momin said.

Although many analysts predict further declines, continued accumulation – reflected by reduced supply on exchanges – could increase scarcity as selling pressure weakens. This could trigger a sudden recovery in ETH prices.

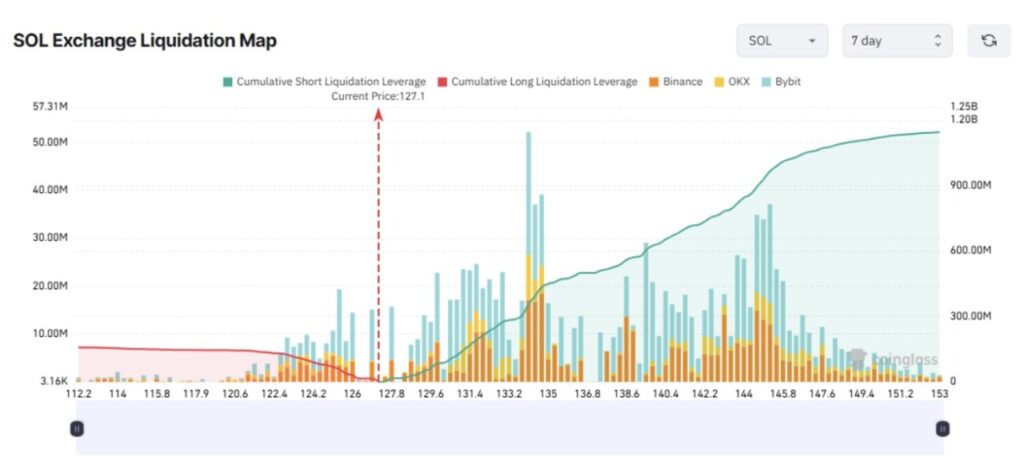

Solana (SOL)

Similar to ETH, the liquidation map for Solana also shows a clear imbalance. Traders were actively shorting SOL in early December. If SOL experiences a recovery to $145 this week, the total liquidation of short positions could exceed $1 billion.

On-chain indicators are showing positive signals. According to the Nansen report, Solana has continued to lead in the number of transactions over the past week.

In the prediction market, many investors still expect a price range of $150-$200 in December. In addition, US-based SOL ETFs have recorded five consecutive weeks of fund inflows.

Recently, BitMEX co-founder Arthur Hayes also stated that only Ethereum and Solana have strong enough institutional use cases to survive in the long run.

Read also: Altcoin Season Coming in 2026? Signs to Watch Out For

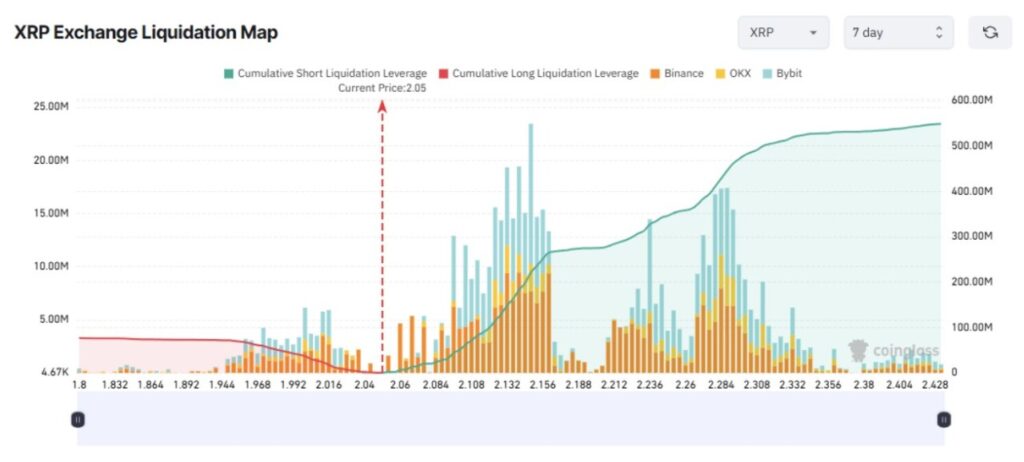

XRP

The 7-day liquidation map for XRP shows that short activity dominates. If XRP recovers and surpasses $2.30 this week, the total liquidation of short positions could surpass $500 million.

Ripple has received a number of positive developments. In late November, Ripple announced that RLUSD had been green-listed by the Abu Dhabi FSRA. Additionally, the Monetary Authority of Singapore (MAS) has approved the expansion of the Primary Payment Institution (MPI) license for Ripple Markets APAC.

Not only that, just like SOL, the XRP ETF also recorded net inflows of $643 million in the first month, indicating strong demand for XRP despite its stagnant price.

With these supporting factors, many analysts predict that XRP could reach $2.60 this month – which, if it happens, would be very costly for short sellers.

Rise in stablecoin supply signals potential market recovery

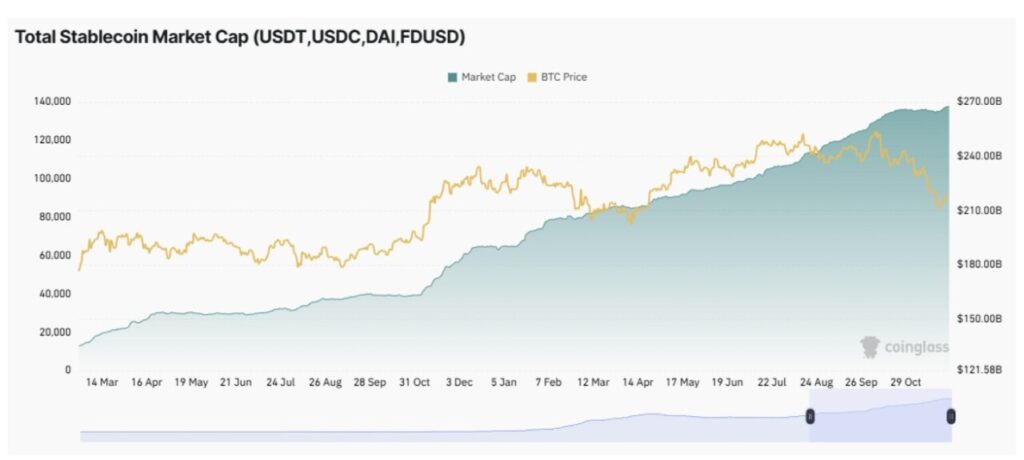

Another noteworthy factor is the increasing supply of stablecoins again. According to data from Coinglass, the combined market capitalization of USDT, USDC, DAI, and FDUSD reached a new record high of $267.5 billion in early December.

This increase in stablecoin supply suggests that market liquidity is likely to improve this month. An analyst named Ted noted that this upward trend ended four consecutive weeks of decline in stablecoin market capitalization.

“The market capitalization of stablecoins is rising again. It had previously fallen for four consecutive weeks, which was also the main reason for the decline in market prices. If this uptrend continues, new liquidity will enter the crypto market – this is positive for BTC and altcoins,” Ted said.

The three major altcoins mentioned earlier (ETH, SOL, and XRP) together account for a potential liquidation volume of $5.5 billion if the market experiences an unexpected recovery.

In the event of a real recovery, a new record in the number of liquidations could be reached. Investors need to consider all these factors to minimize the risk to their positions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins That Could Trigger a Liquidation Record in the First Week of December. Accessed on December 5, 2025