4 Market Signals That Make December the Best Time to Start an Altcoin DCA

Jakarta, Pintu News – The Dollar-Cost Averaging (DCA) strategy in the crypto market can help deal with volatility, although it remains risky when the downtrend is prolonged. However, some structural conditions suggest that December is a more ideal starting point to begin gradual accumulation.

Declining altcoin volumes, weakening social interest, extreme technical signals, and a correction in stablecoin dominance mark an environment similar to the market bottom phase. These four factors form the basis of the analysis in the following article!

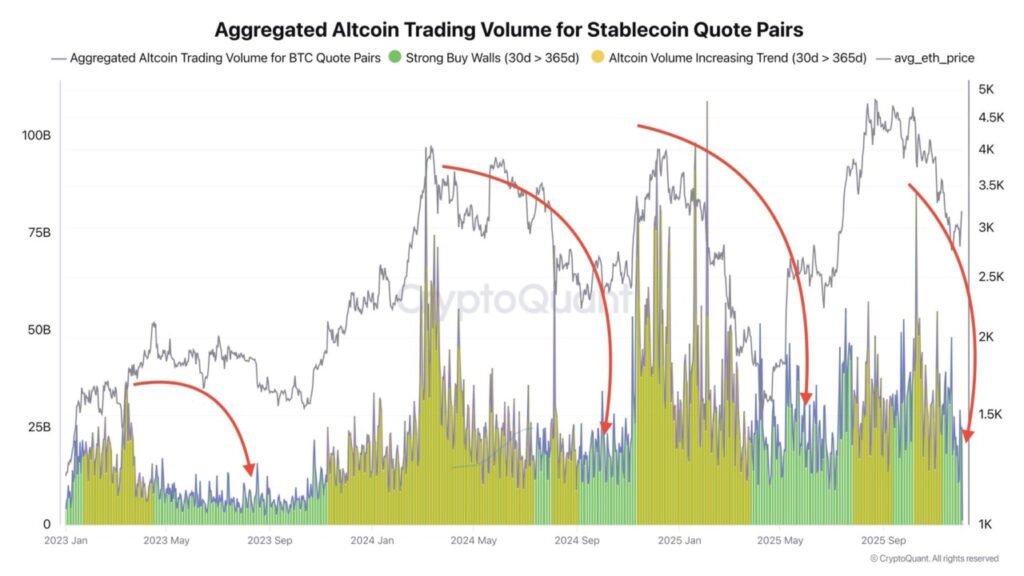

Altcoin Volume Weakens, Forms Strategic Buying Zone

A significant drop in altcoin trading volumes is an important signal that often precedes the recovery phase of the crypto market. Data comparing altcoins’ 30-day volume to their annual average shows that these cryptocurrencies have entered a zone that historically often marks the formation of a market bottom. Such a situation reflects quiet market activity and is often referred to as a period of “silent capitulation” before a new cycle begins.

These conditions show that many market participants have completed their sell-offs so that selling pressure tends to subside. However, the weak market sentiment means that price recovery is not instantaneous and may take place over a long period of time. This period has historically provided an ideal space for DCA strategies as prices tend to move within a stable range. Thus, December presents an opportunity to optimize capital allocation gradually.

Also read: 3 Altcoins of Crypto Whale’s Choice in December 2025

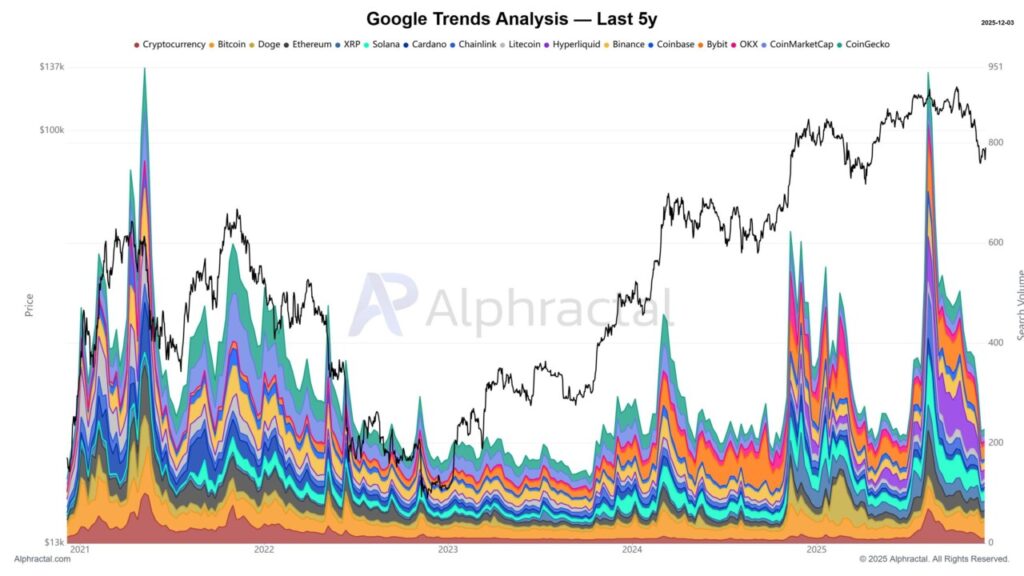

Declining Social Interest Illustrates the Capitulation Phase

Social interest indicators, such as crypto-related Google search trends, recorded a decline of about 70% from their peak in September 2025. This phenomenon suggests that the public is tending to move away from cryptocurrency discussions, a condition that statistically often arises when the market reaches an oversold phase. This decline in interest was also seen in searches for major exchange platforms such as Binance and OKX as well as tracking sites such as CoinMarketCap and CoinGecko.

History shows that phases when public attention dips dramatically are often the best periods for market participants targeting accumulation. Negative discussions on platforms such as X, Reddit, Telegram, and BitcoinTalk forums have also increased, confirming a similar pattern of market emotions as the price bottom. This context suggests that December is in a market psychological phase conducive to measured accumulation strategies like DCA.

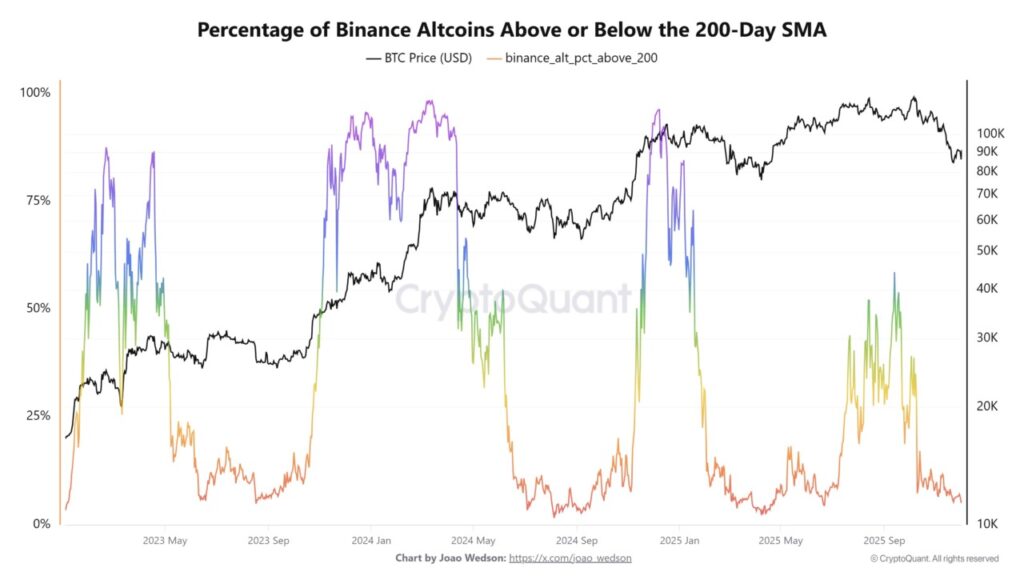

95% of Altcoins Are Below 200-Day SMA, Marking Extreme Pressure

Technical indicators show that around 95% of altcoins on major exchanges are trading below the 200-day Simple Moving Average (SMA). This figure is rare and is often considered an extreme oversold signal for the crypto market. When this level appears, many altcoins are undervalued, with most investors experiencing a significant phase of portfolio impairment.

Historically, when the percentage of altcoins that are below their 200-day SMA drops to below 5%, the market is usually nearing or has even hit its cyclical bottom. Such situations provide opportunities for investors who have long-term accumulation plans as selling pressure is at a weakening point. By starting DCA during this period, investors can get a more optimized price range in the next few months.

Also read: 3 Meme Coins that Become Idols in the Crypto Market in December 2025

USDT dominance begins to weaken, signaling capital rotation

USDT dominance (USDT.D), a metric that shows the percentage of USDT capitalization to the total crypto market, started to correct from the 6% resistance zone in December. This decline in dominance usually signals a shift of capital away from stablecoins towards riskier assets such as altcoins. The phenomenon is often an early sign that market participants are starting to divert funds to capitalize on low price opportunities.

Another supportive indicator is USDT.D’s weekly stochastic RSI which is showing a bearish cross signal, indicating a potential continuation of the decline in dominance. In addition, the market capitalization of stablecoins started to increase again after weakening throughout November, signaling capital accumulation preparing to enter the altcoin market. This combination of signals reinforces the view that December is an important capital rotation period for the cryptocurrency market.

Conclusion

Four key indicators-declining altcoin trading volumes, weakening social interest, extreme technical signals, and a correction in stablecoin dominance-describe market conditions that favor the implementation of a DCA strategy. However, choosing the right altcoin requires additional analysis as not all cryptocurrencies will experience a recovery as strong as the previous cycle. By understanding market dynamics and capitalizing on December momentum, accumulation strategies can be implemented in a more measured manner.

Routinely Save Altcoins with the Auto DCA Explore Plans feature on Pintu

Auto DCA (Dollar-Cost Averaging) or Nabung Rutin in the Pintu app allows automatic and periodic purchases of crypto assets-daily, weekly, or monthly-with a fixed amount without the need for manual transactions.

The Auto DCA Explore Plans update adds the option of curated DCA plans based on asset categories, making the process of selecting and starting a regular saving routine simpler. With this feature, Pintu provides a structured and easily accessible accumulation mechanism for users looking to implement DCA strategies in crypto investing.

FAQ

What were the main reasons December was considered ideal for starting the DCA?

December showed several market indicators such as low volume, declining social interest, and extreme technical pressure that historically often appears near market bottoms.

Who is observing the decline in social interest in the cryptocurrency market?

Analysis from Joao Wedson, CEO of Alphractal, shows a huge drop in crypto-related searches on Google Trends.

When will the capital rotation from stablecoins to altcoins start?

This rotation became apparent when USDT dominance corrected from the 6% level in early December, accompanied by bearish technical signals.

Where are the technical indicator extremes seen?

An extreme indicator is seen in CryptoQuant data which shows that about 95% of altcoins are below the 200-day SMA.

Why is altcoin trading volume important for DCA strategies?

Low volume often signals the end of selling pressure, providing a stable price range ideal for gradual accumulation.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. 4 Reasons December Could Be the Best Time to Start DCA Into Altcoins. Accessed December 7, 2025.

- Featured Image: Generated by AI