Revealed! Human Psychology in the Crypto World According to Dogecoin’s Creator

Jakarta, Pintu News – In a digitalized world, cryptocurrency has become a topic that is not only interesting in terms of its technology or investment value, but also as a reflection of human psychology.

Billy Markus, the co-founder of Dogecoin known by the alias “Shibetoshi Nakamoto”, recently revealed that the most interesting aspect of cryptocurrency is what it can tell us about human psychology. This highlights how market sentiment can affect price movements and volatility in the crypto market.

The Influence of Psychology in Cryptocurrency

According to Markus, cryptocurrency is more than just a transaction or investment tool; it is a reflection of how emotions and collective perceptions can affect market value. This phenomenon is evident in price fluctuations that are often driven by news, rumors, or even memes on the internet. This shows that psychological factors can be more influential than technical or fundamental analysis in the short term.

When cryptocurrency markets experience volatility, it is often due more to a change in sentiment than a change in economic fundamentals. Investors and traders in these markets often react to changes in mood rather than concrete economic news. This shows how important understanding crowd psychology is in managing investments in the crypto space.

Also Read: Bitcoin Wins Hands Down According to Mark Yusko: The Future of Digital Currency!

Dogecoin and the 12 Year Celebration

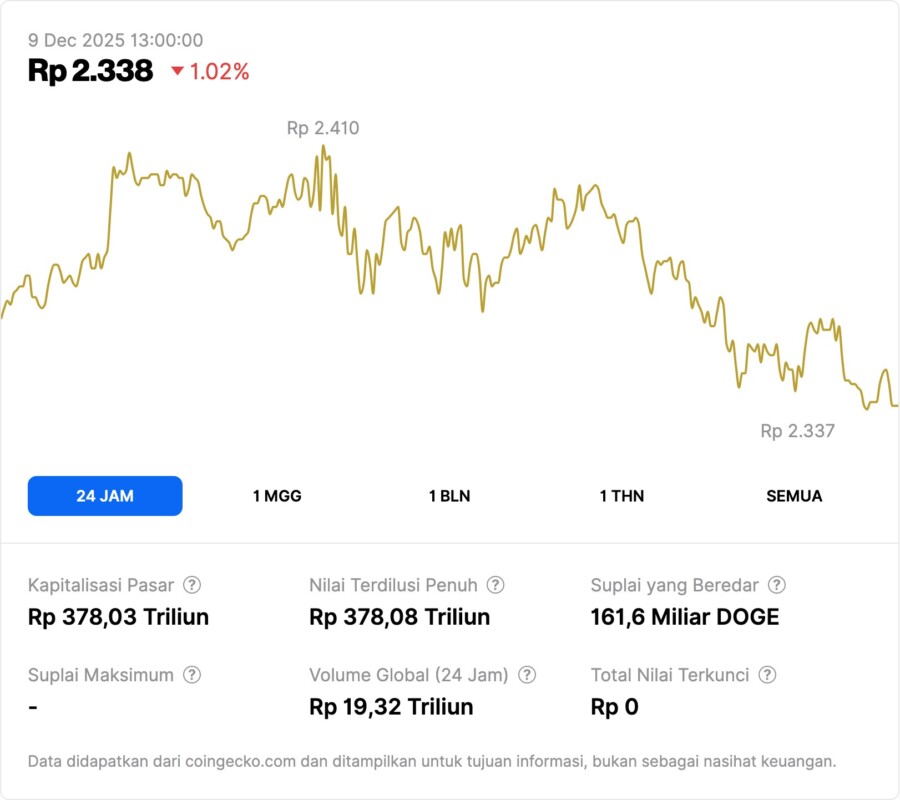

Dogecoin, originally created as a joke, has now grown into one of the largest cryptocurrencies with a market capitalization of $23.07 billion. On December 6, Dogecoin celebrated its 12th birthday, a significant milestone marking its journey from meme to serious digital asset.

Markus, in his trademark humorous style, commented on this journey on social media platform X. In a tweet celebrating Dogecoin’s anniversary, Markus said, “12 years ago I made something silly, then many more silly things happened and now I post about it on the internet to 2.15 million followers.

Happy 12th genesis day, Dogecoin.” These remarks show how Dogecoin has changed many people’s views on the value and function of cryptocurrencies.

Market Dynamics and Rate Cut Expectations

The cryptocurrency market is generally showing a positive performance with most digital currencies trading in the green. This comes ahead of the anticipated decision on an interest rate cut by the Federal Reserve, with the probability of a 25 basis point cut standing at around 87% according to CME data.

This decision was highly anticipated as it could affect liquidity and investment in the crypto market. Despite the gains in the market, sentiment remains cautious with the potential for further declines if no new catalysts emerge. This shows that the crypto market is still very sensitive to macroeconomic expectations and monetary policy, which once again emphasizes the importance of psychological factors in cryptocurrency trading.

Conclusion

A deep understanding of human psychology and how it affects crypto markets is not only important for traders and investors, but also for anyone who wants to understand the dynamics of modern markets. The commentary from Billy Markus provides valuable insight into how emotions and perceptions can shape the world of finance, especially in this digital age.

Also Read: December on Fire: SHIB, XRP, BTC Price Outlook, Ready for 2025 Year-End Rally?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What does Billy Markus mean when he says cryptocurrency reflects human psychology?

Billy Markus explains that cryptocurrency price movements are often influenced by collective emotions and perceptions, rather than solely fundamental or technical factors. Market sentiment, rumors, and community dynamics can move prices in the short term.

Why does market sentiment affect the price of crypto assets so much?

Since most cryptocurrencies are traded in markets that are highly reactive to news, public comments, and social trends. Changes in investor mood can trigger volatility even without any significant changes in economic conditions.

Why is Dogecoin often used as an example of a market psychology phenomenon?

Dogecoin evolved from a meme to a billion-dollar asset, showing how humor, community, and internet virality can create market value. Its market capitalization stands at around $23.07 billion, confirming the influence of mass psychology.

What does Dogecoin’s 12-year anniversary mean to the community?

The celebration showed Dogecoin’s journey from a joke project to a major digital asset. Billy Markus’ commentary highlights the unique dynamics of the Dogecoin community and how social factors shape the sustainability of the project.

How could the Fed’s interest rate decision affect the crypto market?

Expectations of a rate cut increased speculation over market liquidity. The 87% probability of a 25 bps cut according to CME shows investors’ strong anticipation, which is then reflected in the strengthening prices of various crypto assets.

Why does the crypto market remain cautious despite being in the green?

Because there are no new catalysts that really drive big rallies. Markets are sensitive to macro factors, so volatility may increase if economic projections fall short of expectations.

What are the key lessons from a market psychology perspective in crypto trading?

Understanding collective behavior can help interpret short-term price movements, but psychological factors do not replace the need for data analysis and risk management.

Is crypto market volatility always related to fundamentals?

Not always. Volatility often arises from changing perceptions, social dynamics, or momentum in the community, so price movements may not necessarily reflect the fundamental value of the asset.

Reference

- U.Today. Not Utility: Dogecoin Creator Names Most Interesting Thing About Crypto. Accessed on December 9, 2025