3 Crypto Mining Stocks that Have the Potential to Rise Despite the Bitcoin Price Crash

Jakarta, Pintu News – Despite Bitcoin’s price dipping below $100,000 in the past month, some crypto mining stocks are still showing upside potential. This is due to their business diversification into developing artificial intelligence data centers and other initiatives. Here are three crypto mining stocks that could rally despite the Bitcoin price correction.

Nebius (NBIS)

Nebius has shifted its focus from crypto mining to developing AI data centers. The company invested heavily in two brands, Avride, which develops autonomous vehicles, and TripleTen, which is engaged in technology education. These long-term investments have significantly increased the value of NBIS shares.

In addition, Nebius recently secured a five-year contract with Meta Platforms worth around $3 billion. This deal comes not long after they signed a multi-billion dollar contract with Microsoft. This partnership shows the growth potential of Nebius beyond the crypto sector.

Read also: Bitcoin under Threat? Analyst Calls 2025 Cycle “Upside Down” and Potentially Fatal

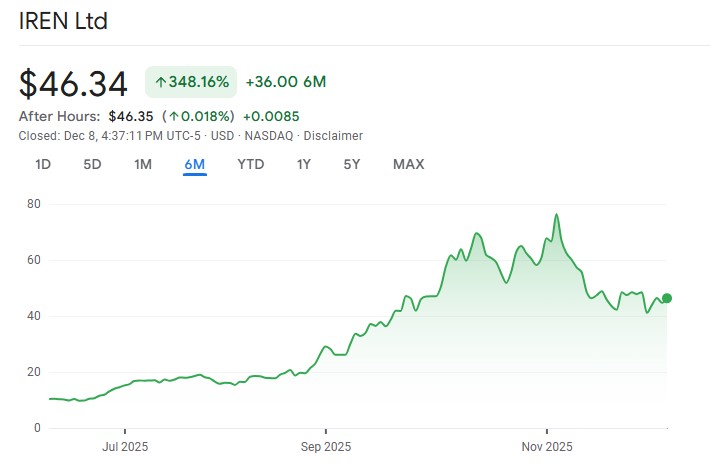

IREN (IREN)

Unlike Nebius, IREN is fully focused on providing AI cloud services. The company addresses the energy problem faced by AI with a 3.2 gigawatt pipeline and the ability to produce AI data centers at scale. These advantages give IREN a strategic position in the industry.

IREN has also secured a major deal with Microsoft worth $9.7 billion over five years, giving Microsoft access to 200 megawatts. Although the current revenue from AI cloud services has not changed much, the deal with Microsoft is expected to drive significant growth in this segment.

Read also: Spike in Google Search for Keyword “Dollar Debasement”, What Does It Mean?

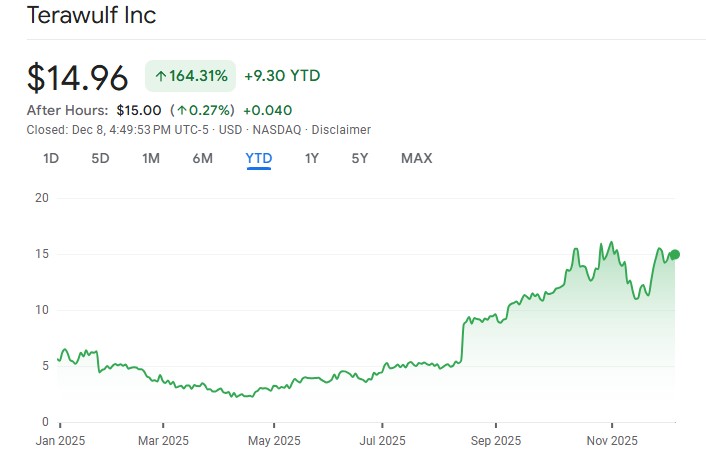

Terawulf (WULF)

Terawulf shares similarities with IREN in its reliance on crypto mining, but has also signed a major deal that paves the way for a pivot to AI data centers. The company plans to increase its capacity by 250-500 megawatts per year.

For example, Terawulf has allocated 168 megawatts to Fluidstack in a 25-year lease agreement worth $9.5 billion. With Google as Fluidstack’s backer, this opens up opportunities for further deals. This plan could generate additional annual recurring revenue of $565 million to $1.13 billion.

Conclusion

Despite the downturn in the Bitcoin (BTC) market, diversification into the development of AI data centers and strategic partnerships with major tech companies offer significant growth opportunities for crypto mining stocks. Investments in these new technologies and infrastructure can help these companies cope with Bitcoin price volatility and strengthen their position in the global market.

FAQ

What is Bitcoin (BTC)?

Bitcoin (BTC) is a digital currency or cryptocurrency used for peer-to-peer transactions on the internet.

Why can crypto mining stocks still rise despite Bitcoin’s price drop?

The stock could rise as these companies have diversified their business into the development of AI data centers and partnerships with large tech companies.

What are the benefits of Nebius’ partnership with Meta Platforms and Microsoft?

The partnership helps Nebius secure stable revenue and expand their operations beyond crypto mining, increasing long-term growth potential.

How will IREN’s deal with Microsoft affect its revenue?

The deal gives IREN access to significant resources and the potential to increase revenues from AI cloud services, which had previously not changed much.

How much additional revenue could Terawulf potentially earn from increasing its capacity?

With a planned capacity increase of 250-500 megawatts per year, Terawulf could generate additional annual recurring revenue of $565 million to $1.13 billion.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Crypto Mining Stocks That Can Rally as Bitcoin Falls. Accessed on December 13, 2025

- Featured Image: Generated by AI