Many Bitcoin Whales Rise from the Grave in 2025: Bull Run or New Crisis?

Jakarta, Pintu News – In July this year, eight long-dormant Bitcoin wallets suddenly made their move after nearly 14 years of silence. Each of these wallets held 10,000 BTC, with a value of about $8.6 billion in July.

Analysts from Cointelegraph reported that 80,000 of the coins were moved in a single package. These coins can be traced back to 2011, when they were worth around $210,000.

The wallet saw its value increase by almost 4,000,000% (four million percent). According to data from LookOnChain and Whale Alerts, more than 62,800 Bitcoins (BTC) that were more than seven years old were moved in early to mid-2025. Let’s discuss the reasons behind the movement of these coins after such a long time.

Reasons for the Rise of Old Bitcoin Wallets

The movement of coins from large wallets often leads to speculation among retail investors. However, the movement and resurgence of old wallets does not always mean that the coins are sold. In many cases, the coins are being moved to other self-storage wallets. Most likely, the investor or investment firm behind the wallet is simply restructuring their holdings.

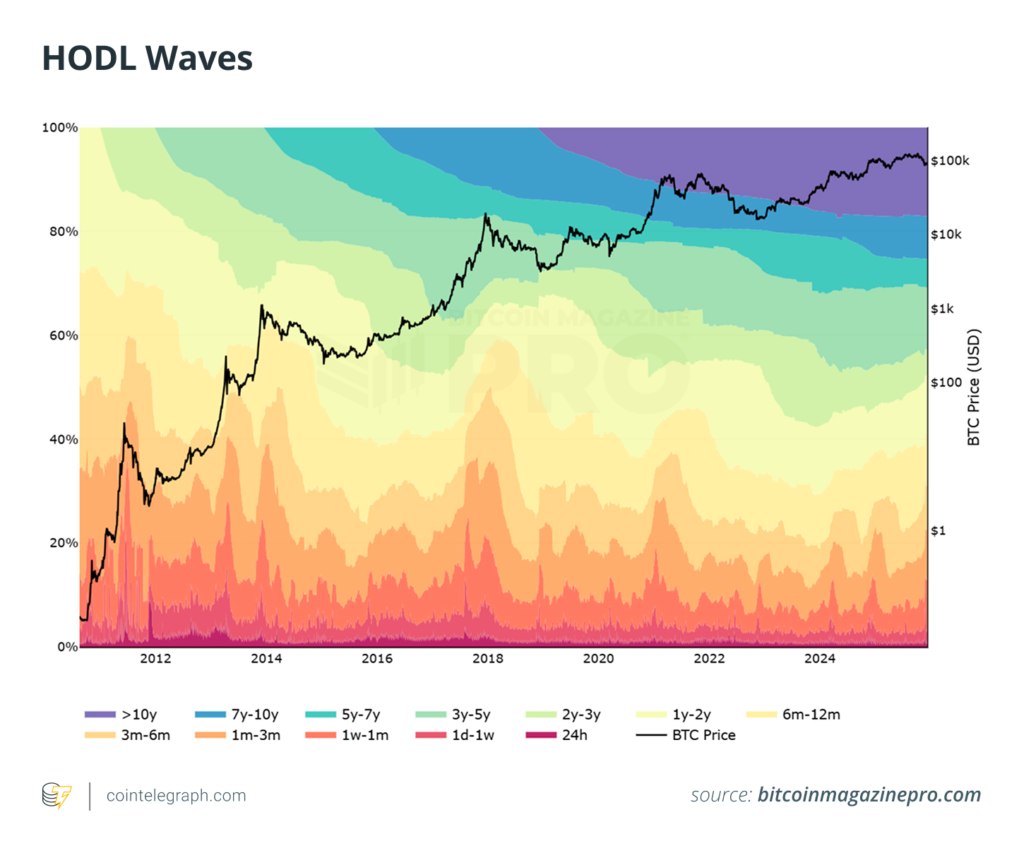

According to data from Glassnode, the supply of long-term Bitcoin (BTC) holders often reaches record highs just before the price reaches a new peak. It is possible that some early BTC holders are selling off some of their holdings to make a profit.

Read also: Gemini’s New Breakthrough: RLUSD and XRP Ledger Integration for Fast and Cheap Transactions

Other Factors Driving the Revival of Old Wallets

Other factors that might prompt old Bitcoin (BTC) wallet owners to reactivate their wallets include tax events, lawsuits, estate planning, and corporate restructuring. The year 2025 was a great year for Bitcoin (BTC), despite the bearish market.

The increased flow of funds into ETFs caused BTC to reach a new peak of $126,000. Although the rise of large wallets has raised concerns among investors, it may be wrong to assume that the coins are being sold. Many experts expect BTC to reach a new peak in the following year.

Read also: Australia Moves Fast to Modernize Crypto Regulation with New Policy for Stablecoins

Future Prospects of Bitcoin

Grayscale and Bernstein claim that BTC is moving on from its 4-year cycle. Bernstein predicts Bitcoin (BTC) will reach $150,000 in 2026 and $200,000 in 2027. It is expected that more whale wallets will be active again in the coming years.

Conclusion

The resurgence of long-dormant Bitcoin (BTC) wallets demonstrates an interesting dynamic in the cryptocurrency ecosystem. Despite concerns, this movement also signals potential growth and restructuring in digital asset ownership. Investors and market watchers should continue to monitor this trend to understand its impact on the overall market.

FAQ

What is Bitcoin (BTC)?

Bitcoin (BTC) is a digital currency created in 2009 by a person or group using the pseudonym Satoshi Nakamoto. BTC functions without a single central authority or bank and is the first cryptocurrency in existence.

Why is the old Bitcoin (BTC) wallet active again in 2025?

Old Bitcoin (BTC) wallets are active again for various reasons, including ownership restructuring, tax events, lawsuits, and estate planning.

How much is Bitcoin (BTC) worth at its peak in 2025?

In 2025, Bitcoin (BTC) reached a new peak of $126,000.

What are the Bitcoin (BTC) price predictions for 2026 and 2027?

According to predictions from Bernstein, the price of Bitcoin (BTC) is expected to reach $150,000 in 2026 and $200,000 in 2027.

Does a big Bitcoin wallet (BTC) movement always mean the coin is on sale?

No, a large Bitcoin (BTC) wallet movement does not necessarily mean that the coins are sold. Many coins are moved to other self-storage wallets for restructuring purposes.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. Many Dormant Bitcoin Whales Have Awakened in 2025 – Why. Accessed on December 12, 2025

- Featured Image: Generaetd by AI