3 Altcoins Poised to Benefit from the Fed’s Interest Rate Cut

Jakarta, Pintu News – The Fed’s 25 basis points rate cut has left the crypto market in a mixed bag. Bitcoin remained weak as the cut was expected.

In such a situation, the top three altcoins whose movements diverge from Bitcoin could potentially experience a rise.

Some DeFi tokens could also perform well as the crypto community tends to look for safer ways to profit, versus taking large positions in the spot market. Here are three major altcoins that may be positively impacted by these conditions, according to a report by Coin Republic.

Zcash Leads the Top Three Altcoins if Bitcoin Remains Weak

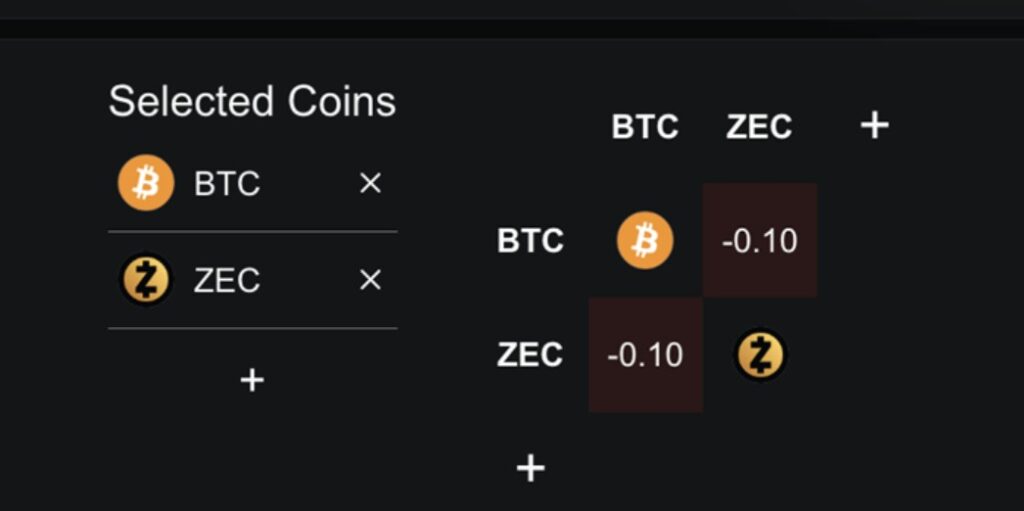

Zcash often moves in the opposite direction of Bitcoin. Its one-year correlation is close to -1.0, which means that Zcash often rises when Bitcoin declines. In addition, privacy coins like ZEC have recently performed quite well, despite the overall market turmoil.

Read also: Raoul Pal Highlights 3 Potential Altcoins That Deserve Your Attention

The 25 basis point rate cut had been anticipated for several weeks. Because of this, many traders sold Bitcoin after the announcement. If the price of Bitcoin continues to fall, Zcash has the potential to rise due to the opposite movement.

On December 11, 2025, Zcash was down about 8%, but in the past week it still recorded a gain of about 13%. The price chart shows an important level at $573, which is the 0.618 Fibonacci level. If Zcash manages to break above that level, there is potential for a larger upside movement.

It is also worth noting that the price of ZEC is still holding above the ascending trendline, which indicates the movement pattern is still bullish enough for a higher price push.

The privacy narrative has also made a comeback in this market cycle, and that favors Zcash especially when Bitcoin remains weak. This makes Zcash one of the three main altcoins worth watching after the Fed’s rate cut.

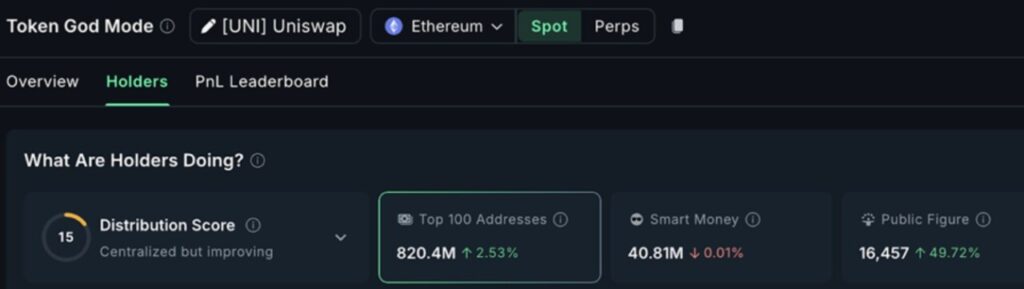

Uniswap makes it to the top altcoin list as DeFi usage grows

Uniswap remained stable during the market movements caused by the Fed’s decision. However, in times like these, traders looking to make profits without taking huge risks in the spot market tend to turn to the DeFi sector.

Uniswap is the largest decentralized exchange (DEX). As DeFi usage increases, swap volumes and transaction fees rise. This can drive demand for the altcoin.

Over the past 30 days, UNI’s 100 largest wallets increased their holdings by 2.53%. This suggests accumulation by whales ahead of the Fed announcement.

Technically, the UNI price chart is still showing strength. The price remains above the key support level at $4.74. If Uniswap is able to hold above this level, the next target is at $6.47.

After that, the $7.20 level becomes an important point that must be broken to unlock the potential for a stronger rise. If DeFi usage continues to grow after the rate cut, Uniswap could become one of the top three altcoins that react quickly to market conditions.

Read also: Solana Price Potentially Breaks $150? Here are the Drivers!

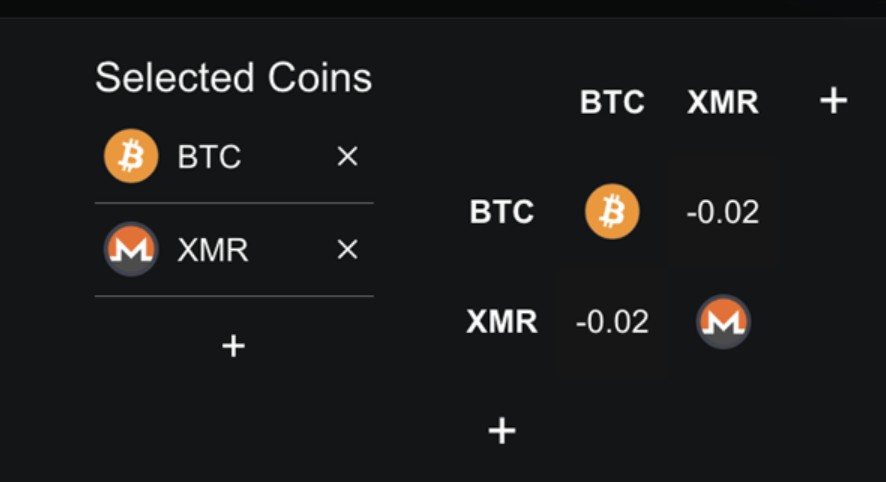

Monero completes the list with strong support

Monero has recorded a positive performance in the last 30 days with a gain of around +2.7%, while most other altcoins have either stagnated or declined. In addition, Monero has a negative correlation to Bitcoin in the last 7 days, indicating that its movements do tend to diverge in the short term.

Currently, Monero is still trading in an upward channel. The nearest resistance is at $439, and if broken, the next target is $470.

As long as Bitcoin remains weak, this altcoin could continue to benefit from the negative correlation. In addition, the privacy narrative also works in Monero’s favor, making it one of the three main altcoins that could potentially rise after the Fed’s rate cut.

The Fed’s interest rate cut did not immediately lift the crypto market. However, it does change the direction of fund flows. If Bitcoin continues to weaken due to the calculated cut, then Zcash and Monero could potentially rise due to the opposite movement.

Meanwhile, if market participants prefer to earn from the DeFi sector, then Uniswap could benefit from the increased activity. These three cryptocurrencies – Zcash, Uniswap, and Monero – are the top altcoins to watch in the period following the Fed’s rate decision.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Republic. Top Three Altcoins That Might Benefit From the Fed Rate Cut. Accessed on December 12, 2025