7 Facts Analysts Warn About Shiba Inu (SHIB) in the Middle of Crypto Market December 2025

Jakarta, Pintu News – Crypto market analysts warn that Shiba Inu faces serious risks if it fails to reclaim the support zone between $0.00001-$0.000014, which is an important technical area based on recent data analysis from Watcher.Guru and crypto market expert comments.

This information shows the increasingly complex state of the meme coin market, while highlighting the role of technical indicators in evaluating cryptocurrency assets.

1. SHIB rumored to be “dead” if it fails to recover crucial zone

BingX analyst Nebraskan Gooner stated that SHIB is considered technically “dead” if it cannot climb back to the $0.000014-$0.00001 price zone. This statement is based on technical analysis that places this range as multi-year support that has now turned into resistance.

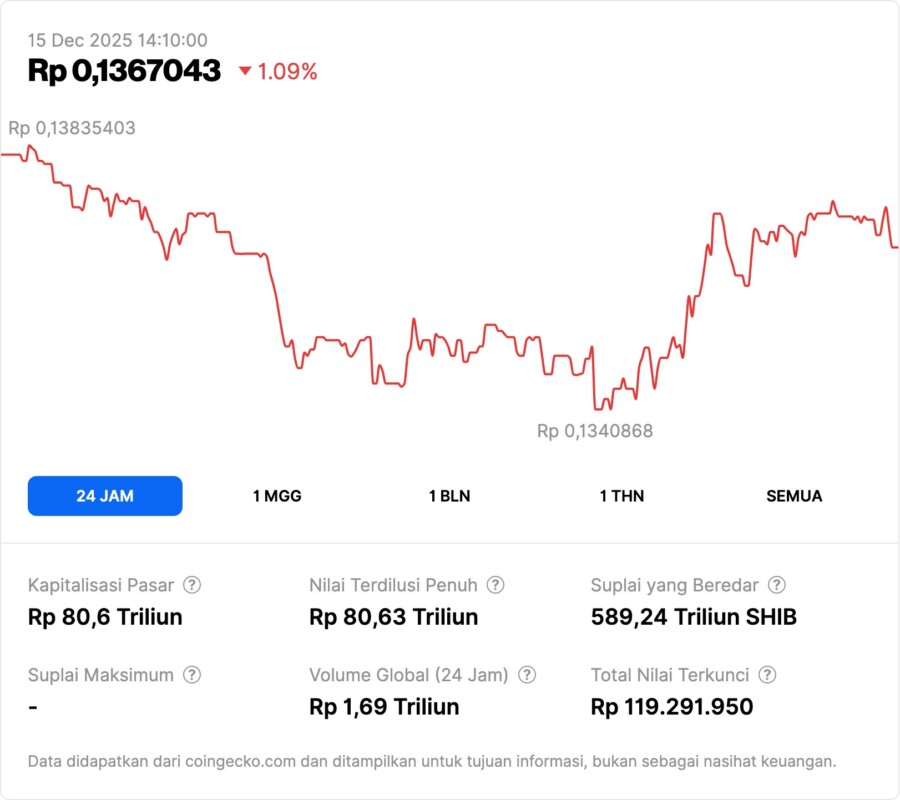

The price of SHIB as of the report is trading around $0.00000855, which percentage-wise indicates a drop of around 33-38 percent below the crucial zone. This technical indicator approach is commonly used to assess the strength of trends in the cryptocurrency market.

This reflects the bearish phase in many tokens other than SHIB, illustrating that support and resistance metrics are of great concern in the prediction of altcoin price movements.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

2. Support Zone Was Previously a Rebound Point for SHIB

The $0.00001-$0.000014 range is not just a random number; in previous periods, this zone served as an important consolidation point before some significant rallies. Historical data shows that SHIB briefly bounced off that area before reaching its highest levels in several market phases.

This kind of historical support is usually a strong psychological marker for traders, who are looking for levels where buying is likely to increase. When support is lost, that zone can turn into strong resistance that slows down rebound attempts, which is a big concern in market technical metrics.

3. Wider Bearish Phase Marks the Current Altcoin Market

In the last 24 reported hours, the price of SHIB fell by approximately 5.27 percent, a pattern that is in line with the broader bearish trend in the altcoin market. This movement indicates that the current market sentiment is likely to be negative, especially for meme coins like SHIB.

Technical analysis implies that a drop below the crucial support level indicates the potential for a continued downtrend in the short term. This situation is also a concern for traders monitoring metrics such as selling pressure and the formation of other bearish patterns on the SHIB price chart.

4. SHIB Rebound Potential Depends on Bitcoin Action

Some analysts see that Bitcoin price movements could be an important catalyst for a SHIB rebound, if BTC shows significant upward strength. Positive movements in BTC often bring momentum to the altcoin market.

In this context, a broader prediction of BTC’s movement could affect sentiment towards assets like SHIB. However, this effect does not automatically guarantee a rebound; this correlation relationship remains dependent on changes in overall market risk and demand.

5. Technical Indicators Are the Main Focus of SHIB Traders

Traders who use technical indicators, such as support, resistance, and price trends, are now closely monitoring SHIB’s movements below these critical levels. This method helps assess the likelihood of a price reversal based on historical chart data.

A price threshold that fails to be maintained can make negative sentiment stronger among market participants. In the cryptocurrency market, technical signals are often a key consideration in short-term trading decisions.

6. Risk of Extended Downtrend if Support is not Reclaimed

Analysis suggests that if SHIB continues to fail to reclaim lost support, further declines could potentially occur, indicating a prolonged downtrend. Such conditions are usually seen as a strong signal for continued selling pressure.

It also reflects that the market is not finding a clear reversal point at current price levels. This extended downtrend risk is an important component in the risk assessment of crypto assets in a trader’s portfolio.

7. SHIB Recovery Evaluation Remains Unclear

Although some technical analysis suggests a possible rebound, uncertainty remains high as leading indicators still show strong bearish pressure on SHIB.

News from various sources reflects that market participants are paying attention to both high and low technical signals, with no absolute consensus. Fundamental factors of the project ecosystem as well as broad market sentiment may influence SHIB’s medium-term direction.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is SHIB’s crucial support zone?

Crucial support zones are historical technical price ranges that are considered important for the rebound or reversal of SHIB price trends based on market chart analysis.

Why is SHIB called “dead” by analysts?

The term “dead” is used technically to describe that the price of SHIB failed to maintain that important support level, which could extend the bearish phase.

Is there a possibility of a SHIB rebound?

Some analysts see the potential for a rebound if there is a change in momentum in the broader market, especially regarding Bitcoin’s movement.

Reference

– Watcher Guru. Expert Warns SHIB Is ‘Dead’ If It Fails to Recover Crucial Zone. Accessed December 14, 2025.