7 facts about the drop in the price of Mantra (OM), which is the talk of the crypto market

Jakarta, Pintu News – The price of Mantra , the crypto token of a Layer 1 project focused on tokenizing real-world assets, spiked sharply in the 2024-2025 rally but then exploded and dropped nearly 99 percent, stealing the global crypto community’s attention. Recent data shows intense dynamics between the project team and the OKX exchange regarding the main cause of this crash and its implications on market sentiment.

1. Crash 2025: Down Nearly 99 Percent and Sparking Controversy

In April 2025, the price of OM exploded down more than 90 percent in a short period of time, and then continued to plummet to about 99 percent of its previous level, sparking widespread concern in the crypto market. The OKX exchange declared abnormal activity related to large loans using OM as collateral, which triggered risk controls and partial liquidation of the token.

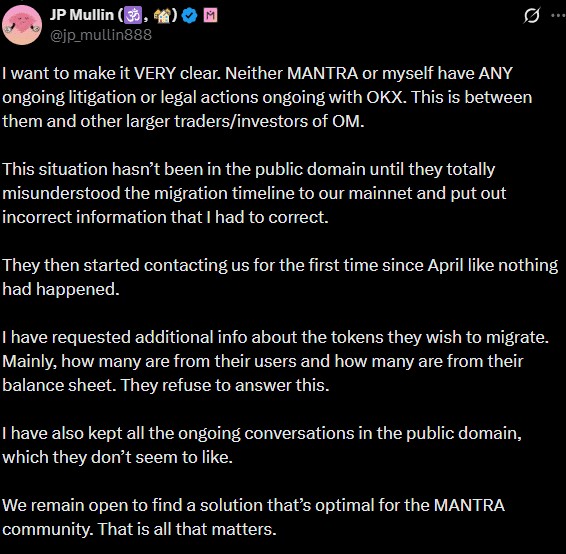

Mantra’s project team rejected this narrative, stating that no legal action was taken against OKX and that the legal issues were more related to other large investors, not Mantra’s own team. This crash comes after a period of rallying in which OM once soared around 600 percent in late 2024 to early 2025, indicating a drastic change in market sentiment.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

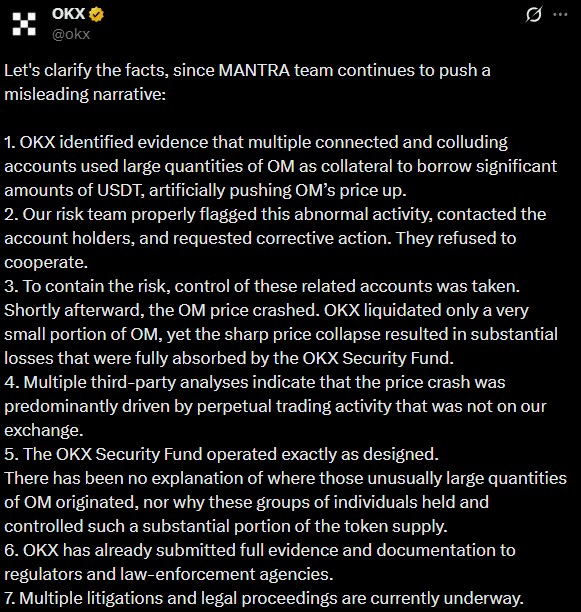

2. OKX and Mantra Team Blame Each Other

OKX claimed that some connected accounts used large amounts of OM as collateral to borrow USDT, which the exchange said was a major market risk concern and caused control risk to increase.

The Exchange also emphasized that such large movements are considered to be price manipulation of unexplained origin, so the OKX risk management team must take risk control measures.

Sisi Mantra denied the allegations and said that the legal position being discussed was more related to other large investors, not their internal issues or OKX directly.

3. Causes of Crash According to Blockchain and Exchange Analysis

On-chain research reports showed a large transfer of OM tokens to exchanges before the crash, worth hundreds of millions of dollars, becoming an important metric for downside price speculation.

Various sources also highlighted that the token’s highly concentrated ownership structure and relatively low liquidity magnified the impact of any major moves. Forced liquidations on some exchanges, likely triggered by large leveraged positions, were considered by the team to be the main cause of the market clearing that triggered the price drop.

4. Community Reaction and Skepticism

The crypto community responded to this crash with mixed reactions; some questioned whether the real problem was the project’s fundamental indicators or market manipulation by external parties.

Some observers have even likened this event to a major scandal like those that have occurred on other projects, sparking debate about transparency and governance in DeFi projects. Discussions on various online forums showed strong skepticism towards the official narrative, noting altcoin whale movements and leverage strategies as important factors.

5. Impact of Crash on Tokenized Markets and Price Metrics

The OM crash was highlighted not only because of the percentage drop, but also because of its implications for liquidity metrics and the perception of risk for tokens that have a predominance of high ownership levels.

The event also affected short-term price charts and liquidation volumes in the crypto market more broadly, creating selling pressure on some exchanges. While some rebound occurred shortly after the crash, many analysts warned that this may have been a technical bounce without strong fundamental support.

6. Next Steps: Token Migration and Market Reaction

Mantra plans to migrate the ERC-20 version of the OM token to a new version native on their network, with a migration deadline of January 15, 2026, a move monitored as an effort to restore trust.

This transition also includes changes in the token mechanism and other technical separations that are expected to strengthen the project’s infrastructure. The market reaction to this migration will be an important indicator of whether the project can move past this crash controversy.

7. Lessons from the Crash: The Risk of Concentrated Ownership

This event confirms that high token concentration and crypto whale activity can trigger extreme volatility in the market, especially if there is insufficient liquidity. Crypto market traders are now increasingly paying attention to metrics such as token distribution and on-chain activity before entering large positions.

This case is an example of how technical, legal, and market behavior aspects are intertwined in the dynamics of digital asset price movements.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What caused the big crash in Mantra (OM) prices in 2025?

The main crash was caused by a combination of large token activity to exchanges, forced liquidation in leveraged markets, and a concentrated token ownership structure.

What does OKX claim is the cause of the price drop?

OKX states that the use of OM as collateral for large loans and its associated abnormal activities drive market risk leading to risk control and partial liquidation.

Did the Mantra team do any major internal sales?

The Mantra team denied the involvement of any major internal sales and stated that there is no ongoing legal litigation between them and OKX regarding this issue.

Reference

– AMBCrypto. Mantra’s OM extends 2025 loss to 99% – Why the team blames OKX. Accessed December 15, 2025.