Crypto Advances, Traditional Banks Resist: New Dynamics in Brazil and Venezuela

Jakarta, Pintu News – Amid opposition from a number of US banking groups to the issuance of a crypto trust charter by the Office of the Comptroller of the Currency (OCC), some developing countries are moving more progressively.

Brazil and Venezuela exemplify how digital assets are beginning to be integrated into mainstream financial practices, both through major banks and everyday use. This phenomenon reflects a structural change in the global financial system, where crypto and cryptocurrencies are increasingly treated as functional instruments, rather than simply speculative assets.

Crypto Trust Charter Controversy in the United States

Traditional banking groups in the United States have voiced objections to the OCC’s policy of granting national charters of trust to crypto companies. According to them, this policy creates regulatory uncertainty as crypto entities can operate like banks without obligations such as deposit insurance and comprehensive supervision. This concern was raised by the head of the American Banking Association who believes that the definition of a banking institution could potentially become blurred.

Similar views also came from representatives of community banks, who considered that the policy risked opening a loophole for regulatory arbitrage. The inconsistency of the supervisory framework could destabilize the financial system, especially if crypto companies gain widespread access without prudential standards on par with traditional banks. This debate highlights the tension between financial innovation and conservative regulatory approaches.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

Crypto Adoption in Brazil and Venezuela

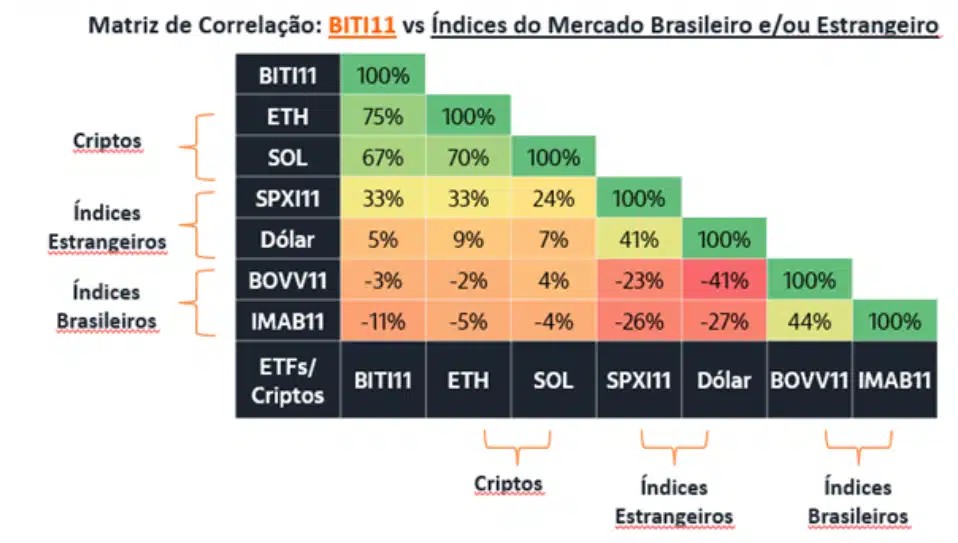

In contrast to the defensive stance in the United States, Brazil is showing a more open approach to crypto. Itaú Unibanco, the country’s largest private bank, recommends allocating up to 3% of clients’ investment portfolios to Bitcoin . This recommendation is based on Bitcoin’s role as a diversification instrument and hedge against domestic currency weakness, rather than solely for the pursuit of price gains.

Meanwhile, in Venezuela, the use of cryptocurrencies has evolved into a practical necessity. Stablecoins such as Tether are widely used for salary payments, remittances, transactions with suppliers, as well as cross-border purchases. Data shows that more than a third of local crypto activity takes place through peer-to-peer platforms, confirming the important role of digital assets in addressing high inflation and low trust in the conventional banking system.

Integration of Digital Assets in the Financial System

Despite the resistance of some traditional banks, the integration of digital assets into the global financial system appears increasingly difficult to avoid. Regulators, international institutions, and adaptive financial institutions are beginning to prioritize efficiency, system resilience, and meeting real market needs. Market structure reforms, increased institutional allocation, and cross-border adoption are strong indicators of this direction.

Resistance from incumbents has the potential to slow down the process, but not completely stall it. The difference in approach between traditionally cautious banks and the fast-moving dynamics of the crypto market is creating an increasingly visible strategic gap. In this context, global markets are showing a tendency to adjust to new financial technologies.

Conclusion

The debate between traditional banks and those supporting crypto development reflects a profound transformation in the world’s financial architecture. While some institutions are taking a defensive approach, other countries and market participants are adopting technologies that are considered to increase economic efficiency and resilience.

With all the regulatory challenges and risks that come with it, crypto and cryptocurrencies are likely to remain an important component of the global financial landscape going forward.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the OCC’s crypto trust charter?

A crypto trust charter is a license that the Office of the Comptroller of the Currency grants to digital asset companies to operate as national financial entities without full bank status.

Why did banks in the United States reject the OCC’s policy?

US banking groups say this policy risks creating regulatory uncertainty because crypto companies can operate like banks without obligations such as deposit insurance and strict supervision.

How does Brazil’s approach to crypto differ from the United States?

Brazil shows a more open approach, with major banks starting to recommend Bitcoin as a portfolio diversification instrument and hedge against the domestic currency.

Why is cryptocurrency widely used in Venezuela?

Cryptocurrencies, particularly stablecoins, are widely used in Venezuela to cope with high inflation, limited banking access, and the need for cross-border transactions.

What role do stablecoins play in Venezuela’s economy today?

Stablecoins like Tether are used for salary payments, remittances, business transactions, and international trade because their value is relatively stable compared to local currencies.

What are the global implications of this different attitude towards crypto?

The difference in attitude reflects a shift in the global financial system, where crypto adoption is increasingly influenced by the needs of the real economy, not just the policies of developed countries.

Is crypto integration into the global financial system inevitable?

Based on trends in institutional adoption and cross-border usage, the integration of crypto and cryptocurrencies into the global financial system is increasingly difficult to avoid despite regulatory resistance.

Reference

- AMB Crypto. Crypto moves on as banks push back: What Brazil and Venezuela reveal. Accessed on December 15, 2025