Trump Financial Scandal: Alleged Crypto Case Payments Revealed

Jakarta, Pintu News – A recent report from The New York Times revealed allegations that President Trump and his family received financial benefits from crypto settlements during his tenure. The investigation highlights the connection between political donations and legal decisions that favored several major crypto companies.

Investigation Continues

An investigation conducted by The New York Times found that a number of enforcement actions against crypto companies were halted or scaled back after Trump began his second term.

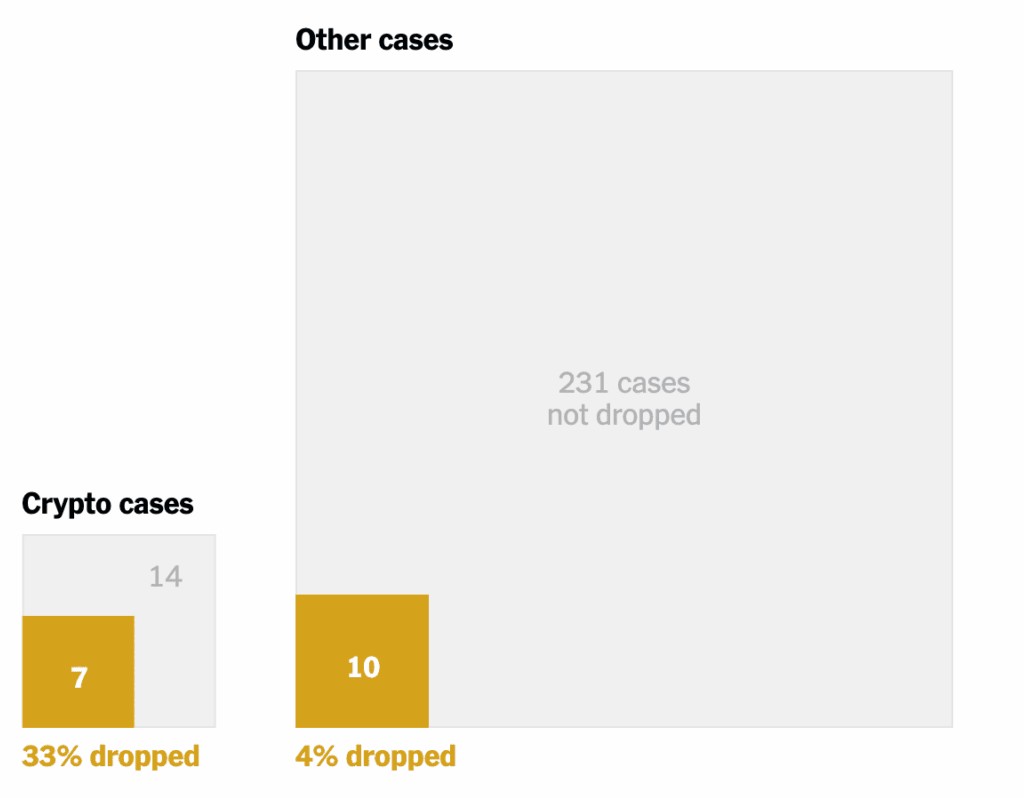

Of the 23 crypto cases inherited from the Biden era, about one-third were recalled by the SEC, a significant number compared to other industries which only amounted to about 4%.

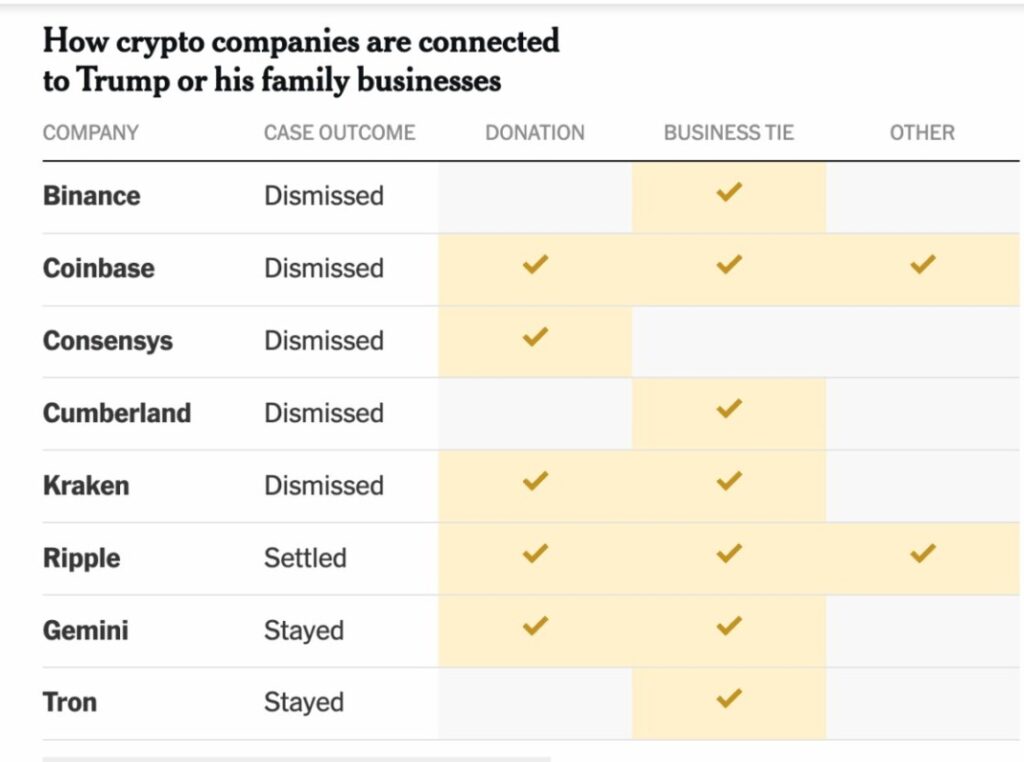

In some cases, the companies involved later formed financial or political ties with the Trump family. For example, a company founded by the Winklevoss twins faced a federal lawsuit that regulators later tried to freeze after a change in administration.

Also Read: Ethereum Headed to $5,000: Investment Opportunities Ahead of 2026!

SEC Seeks to Reduce Fines

One of the most striking cases was the SEC’s handling of the Ripple Labs case. After years of litigation, the SEC sought to reduce the court-ordered fine from $125 million to just $50 million. However, the judge rejected the request due to sudden changes made by the agency.

Another case involved Binance, where the SEC dismissed the entire case with no clear explanation. This decision raises questions about consistency and integrity in enforcement against major crypto companies.

White House response

The response from the White House to this report was quite defiant. Karoline Leavitt, White House Press Secretary, stated that the Trump administration’s actions aim to “fulfill the president’s promise to make the United States the crypto capital of the world by driving innovation and economic opportunity for all Americans.”

However, many feel that there is a clear conflict of interest that could undermine public confidence in the integrity of the administration. Lawyers representing Trump-related businesses deny any connection between government decisions and private companies.

Conclusion

This case opens up more questions than answers regarding the relationship between politics and crypto regulation. Are these policies truly for innovation, or are there other motives driving these decisions? The public and observers are keeping an eye out for further developments.

Also Read: Bitcoin Stuck Below $94,000: When Will Price Recovery Happen?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What was President Trump accused of in The New York Times report?

A1: President Trump has been accused of financially benefiting from crypto settlements related to political donations or business relationships during his time in office.

Q2: How many crypto cases were terminated by the SEC during the Trump administration?

A2: Of the 23 crypto cases it inherited, the SEC recalled 14, with eight of them involving defendants with political or financial ties to the Trump family.

Q3: How did the SEC handle the Ripple Labs case?

A3: The SEC tried to reduce Ripple Labs’ fine from $125 million to $50 million, but the judge rejected the request due to a sudden change by the agency.

Q4: What is the White House’s response to this report?

A4: The White House, through Press Secretary Karoline Leavitt, stated that the administration’s actions aim to make the US the crypto capital of the world, driving innovation and economic opportunity.

Q5: Were there any crypto cases that the SEC dismissed during the Biden administration that were inherited from Trump’s first term?

A5: No, during the Biden administration, the SEC did not voluntarily dismiss a single crypto case inherited from Trump’s first term.

Reference

- Coingape. President Trump Allegedly Got Paid to Settle Crypto Cases: NYT Report. Accessed on December 15, 2025