Bitcoin Price Slows Down Today, But Institutional Investors Remain Strongly Supportive

Jakarta, Pintu News – Bitcoin price is under pressure again after the latest drop pushed BTC close to the lower limit of its current price range. At the time of writing, Bitcoin is holding above the crucial $85,000 level.

Although downside risks remain, the strong confidence of long-term holders helped prevent a deeper correction. Long-term investors remain the balancing force in the market.

Bitcoin Price Drops 0.84% in 24 Hours

On December 18, 2025, Bitcoin was trading at $86,678, or approximately IDR 1,450,209,773, marking a 0.84% dip over the past 24 hours. During this period, BTC hit a low of IDR 1,430,593,224 and a high of IDR 1,509,853,486.

At the time of writing, Bitcoin’s market capitalization is around IDR 28,643 trillion, while its 24-hour trading volume has increased by 8% to IDR 818.1 trillion.

Read also: XRP Price Prediction: Bullish Structure Maintained, ETF Assets Top $1.18 Billion

Bitcoin Investors Remain Optimistic

According to Rafael, co-founder of Glassnode, Bitcoin holdings by public companies have continued to increase even though the price of BTC has fallen from its peak of $125,000. This trend shows that institutional holders are not engaging in massive sell-offs.

Some Bitcoin-linked stocks are trading below their net asset value (mNAV), but accumulation continues on company balance sheets.

This behavior reflects the resilience of large investors who seem to be preparing for a long-term recovery rather than a short-term exit. The absence of panic selling suggests that they still believe in Bitcoin’s long-term value.

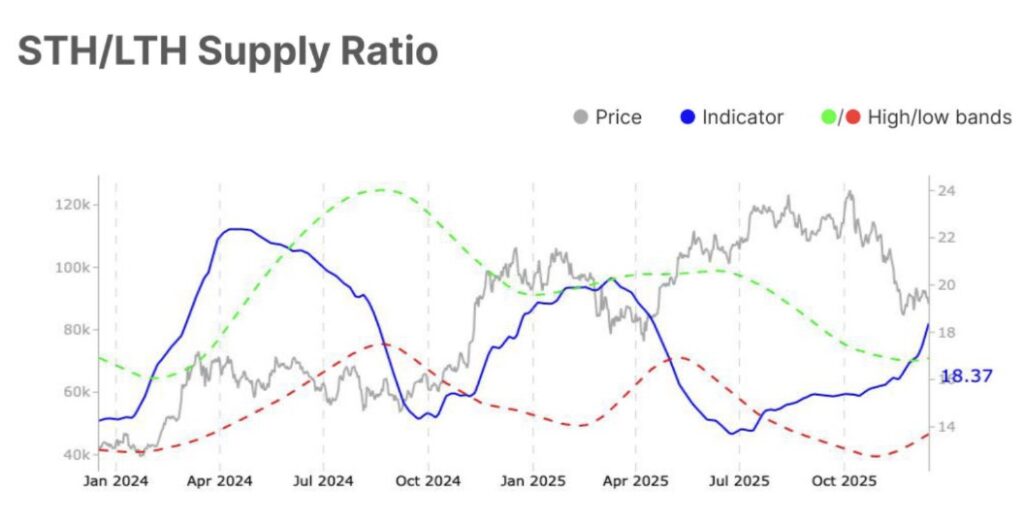

On-chain data also shows a change in macro momentum. The supply ratio of short-term holders to long-term holders has increased to 18.4%. This exceeds the upper statistical limit of 16.9%, signaling the increasing influence of short-term market participants.

The dominance of short-term holders usually makes the market more sensitive to capital flows. They tend to react more quickly to price changes, which in turn increases volatility.

Read also: Shiba Inu Takes a Big Step with the Launch of Regulated Derivatives in the US

Therefore, Bitcoin may experience sharper intraday price movements, while long-term holders continue to provide structural support during downturns.

BTC Price Returns to Support Area

Bitcoin currently faces mixed signals between resilient long-term holders and more reactive short-term holders. This balance is likely to limit sharp declines, but also inhibit rapid rises.

With momentum dominance by short-term holders, BTC is likely to resume the consolidation phase.

As of December 17, Bitcoin price was at $86,581, still holding above the support level of $86,361. If overall market conditions improve and selling pressure from short-term holders eases, BTC has a chance to recover towards the $90,401 resistance level. A break above this level could help restore market confidence after the recent decline.

However, if the $86.361 support fails to hold, the momentum could reverse downwards. A further drop could take BTC to the next support level of $84,698.

Failure to hold this area could push Bitcoin down below $85,000 and increase the risk of a deeper drop towards $82,503, potentially invalidating the existing bullish outlook.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Holds Above $85,000 as Institutional Investors Cushion the Downside. Accessed on December 18, 2025