Dogecoin Tumbles 4% as a Whale Scoops Up 138 Million DOGE — What’s Driving the Move?

Jakarta, Pintu News – Recently, whales accumulated 138 million DOGE, indicating renewed investor interest. Currently, the Dogecoin price is trying to break the resistance zone above $0.15 as the upward momentum begins to build.

On December 17, the overall crypto market saw a gain of 0.7%, bouncing back after recent losses despite macroeconomic concerns. So, how will Dogecoin price move today?

Dogecoin Price Drops 4.20% in 24 Hours

On December 18, 2025, Dogecoin’s price dropped by 4.20% over the past 24 hours, trading at $0.1260, or approximately IDR 2,097. During the same period, DOGE fluctuated between IDR 2,262 and IDR 2,084.

At the time of writing, Dogecoin’s market capitalization is around IDR 320.84 trillion, with a 24-hour trading volume of roughly IDR 23.55 trillion.

Read also: Ethereum Price Plunged 3% Today: Whale Pressure Strengthens, ETH Ready to Rise or Fall?

Dogecoin Whale Buys 138 Million DOGE in 24 Hours

Dogecoin whales accumulated more than 138 million DOGE tokens in just one day, signaling bullish interest in the meme coin is returning. According to data shared by one of the crypto investors on platform X, these big holders significantly increased their position in DOGE in the last 24 hours.

Such spikes in whale activity are usually followed by price volatility, both upwards and downwards. This development has also sparked enthusiasm among investors regarding a possible recovery in the Dogecoin price.

These aggressive moves by large investors could reflect optimism about potential future gains or an anticipated positive catalyst. Whale behavior is also an important indicator in Dogecoin market sentiment.

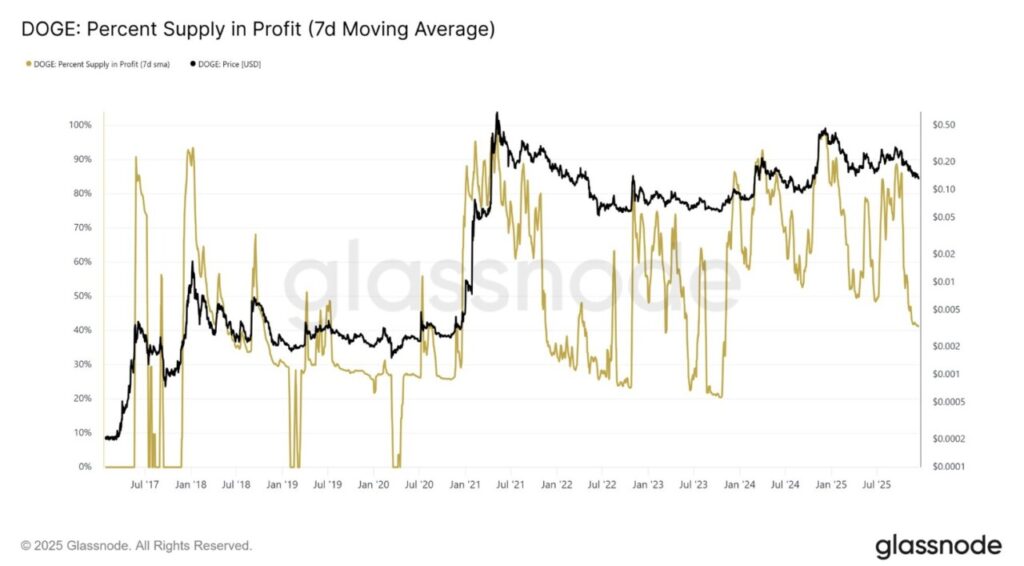

Data from Glassnode shows a change in market conditions, with the proportion of profit-making DOGE supply decreasing.

The seven-day moving average shows that the number of DOGE holders who are currently gaining is less than the previous peaks. This pattern is common when Dogecoin is in a consolidation or price correction phase.

Historically, a sharp decline in profit-making supply is usually accompanied by a market downturn. However, these conditions also tend to stabilize before new upward price momentum begins to build.

Dogecoin price holds at $0.13 support despite stalled recovery efforts

The Dogecoin price on December 17 was briefly trading at around $0.130, reflecting continued downward pressure on the 4-hour time frame.

Read also: Bitcoin Price is Sluggish Today: BTC Still Gets Strong Support from Institutional Investors!

DOGE has not been able to break the resistance level below $0.14, after several failed recovery attempts. Dogecoin’s price structure shows an increasingly weakening pattern, confirming a long-term bearish trend.

The MACD indicator remains below its signal line, signaling a lack of further bullish impetus. The MACD histogram also shows less deep bars, indicating a consolidation phase instead of a strong reversal. The RSI is currently at an average range of 37 and has yet to enter oversold territory, signaling weak buying momentum.

On the upside, the nearest resistance level is at $0.14. If DOGE is able to break this level, the price focus could shift towards the $0.15 range.

Meanwhile, the main support is at the $0.13 level which has been tested several times. In the event of a clear breakdown below this level, the Dogecoin price could potentially drop towards the $0.12 support area.

If the bearish pressure gets stronger, there is a possibility that the price will continue to drop to the $0.115 level as the next downside target.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. DOGE Whales Add 138M Coins in 24 Hours: Will Dogecoin Price Rebound Above $0.15? Accessed on December 18, 2025