Bitwise Files S-1 for SUI ETF with the SEC – How Will SUI’s Price Respond?

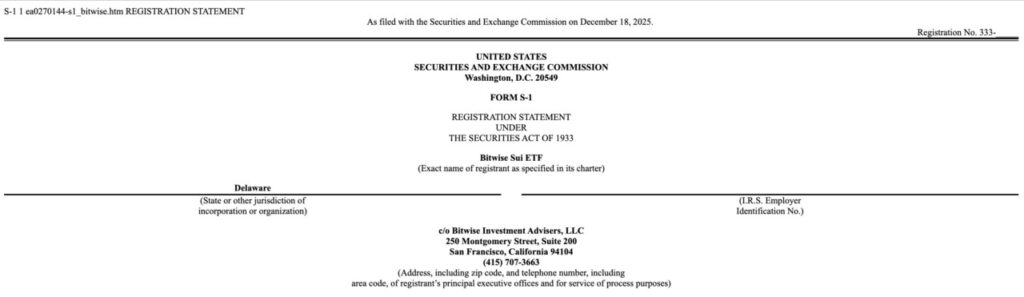

Jakarta, Pintu News – Crypto ETF issuer Bitwise is planning to add the SUI ETF to its growing list of crypto funds. The crypto asset manager has filed an S-1 with the US Securities and Exchange Commission (SEC) to offer this fund, which will provide 100% exposure to the altcoin’s spot price.

Bitwise Files with SEC to Offer SUI ETFs

A filing with the SEC shows that crypto asset manager, Bitwise, has filed a Form S-1 with the SEC to offer funds that provide exposure to SUI, the native token of the Sui network (SUI).

Read also: Canary Capital Proposes Injective ETF with Staking, Will INJ Price Recover?

Bitwise becomes the fourth asset manager to apply to offer this spot fund, joining Grayscale, 21Shares, and Canary Capital.

Grayscale filed a Form S-1 for its SUI ETF earlier this month, while 21Shares and Canary have applied to offer this fund earlier this year. SUI could be the sixth crypto asset Bitwise offers with 100% exposure, as the asset manager already offers spot ETFs for BTC, ETH, SOL, XRP, and DOGE.

Meanwhile, it is worth noting that the Bitwise crypto index fund already provides Sui exposure to institutional investors, although the fund also covers other crypto assets. According to the filing, leading crypto exchange, Coinbase, will be the custodian of this fund.

In addition, Bitwise plans to offer staking for the SUI ETF, which will generate additional tokens in the process. The asset manager will also offer in-kind creation and redemption, allowing companies to directly conduct transactions with tokens, instead of using cash.

Bitwise has yet to disclose the ticker symbol for the fund or the exchange it will be listed on.

It is worth noting that this filing comes just weeks after the SEC approved a 2x leveraged SUI ETF offered by 21Shares. 21Shares could also be the first to launch a spot SUI fund, as it has amended its filing to include important details.

Market Reaction and What’s Next

Despite the filing, SUI’s price has remained relatively flat, trading around $1.40 and still down more than 12% in the past week. However, analysts see the ETF filing as a long-term catalyst, rather than an immediate price trigger.

Read also: PUMP Prices Plunge 33% This Week, Hitting a 5-Month Low!

With Bitwise continuing to expand its crypto ETF lineup and predicting explosive growth by 2026, the competition to launch spot SUI ETFs has officially begun, and investors are watching closely.

The timing of Bitwise’s filing is significant. Under the leadership of SEC Chairman Paul Atkins, the agency has taken steps towards clearer crypto regulation, including approving a standardized ETF listing framework. These changes have helped ETFs tied to assets such as XRP , Dogecoin , and Solana move closer to market.

If this momentum continues, the spot SUI ETF may not be just a speculation in the near future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitwise Files S-1 for SUI ETF with U.S. SEC. Accessed on December 19, 2025

- Coinpedia. Bitwise Files for Spot SUI ETF With SEC. Accessed on December 19, 2025