7 BTC Facts Predicted to Bottom at $37,500 in 2026 – Latest Crypto Market Analysis

Jakarta, Pintu News – Recent predictions in the cryptocurrency market suggest that Bitcoin , the largest digital asset by global market capitalization, could potentially experience a deep correction in 2026 before embarking on a long-term recovery phase.

Crypto market analyst Ali Martinez expressed this view through historical charts and models that show the possibility of Bitcoin bottoming around $37,500 in the 4th quarter of 2026, based on previous bear market cycle patterns. This information is summarized from U.Today news reports and other sources that review analysts’ predictions for BTC.

1. Bottom Prediction of $37,500 by Analysts

According to Ali Martinez, a popular crypto analyst who frequently publishes technical outlooks, Bitcoin could experience a deep retracement that puts the price at around $37,500 before the next major trend reversal in late 2026. This prediction comes from the historical pattern of previous bear markets where Bitcoin experienced a retracement of between 70% to 84% of the cycle peak.

This range mimics the price drawdowns that occurred in the 2018 and 2022 Bitcoin bear markets, helping to illustrate the potential for a further downside path if the crypto market cycle follows a similar pattern in its next phase.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Historical Basis in Bear Market Cycles

The analysis shared uses quarterly data to show that significant retracements have been a consistent feature in previous Bitcoin bear market cycles. In those bear market periods, BTC prices declined sharply before eventually forming a strong macro bottom. This prediction implies that a similar pattern could reoccur if the next cycle mimics the market’s history.

The use of historical data in these kinds of predictions gives a long-term context to the volatility of the cryptocurrency market, but it’s also important to understand that past patterns don’t necessarily guarantee identical results in the future.

3. Effect of Bear Market Phase on BTC

This prediction is placed in the context that the crypto market may currently be entering a deeper bear market phase, after the price of BTC failed to sustain important levels such as $100,000 following the initial 2025 rally. The inability to defend these levels is taken by some analysts as an indication that selling pressure still exists within the market.

A bear market phase is usually characterized by consistent price declines and a period of market consolidation that can last relatively long before a bullish phase returns.

4. Current Price Movement and Market Context

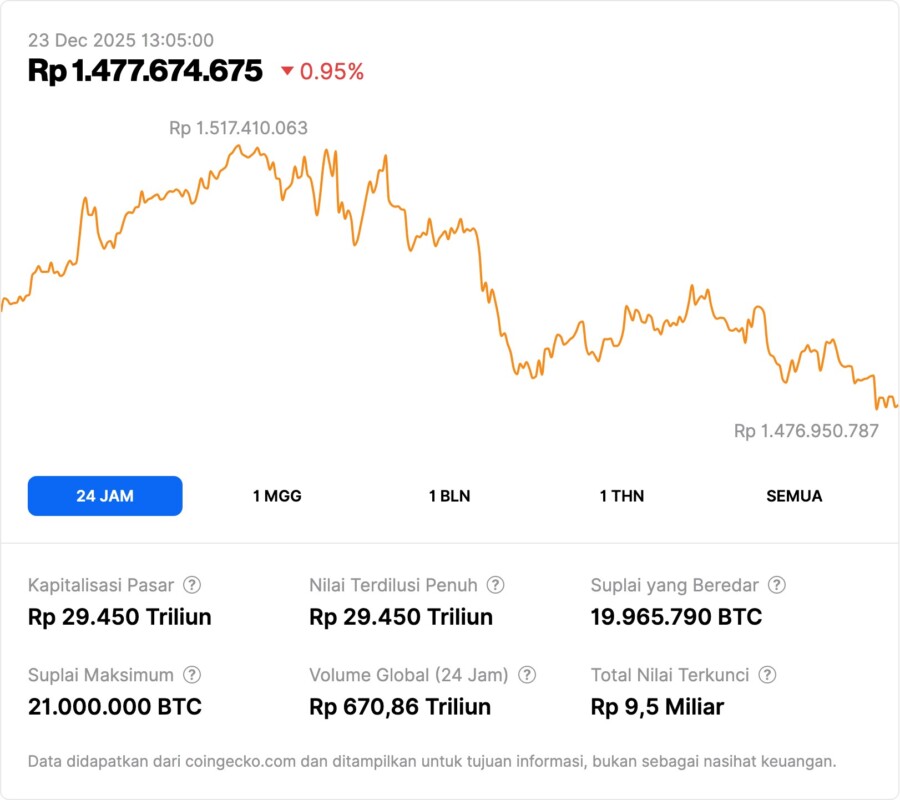

At the time of this prediction, the Bitcoin price was trading around the $90,000 level, indicating the high volatility in recent weeks in the crypto market. Bitcoin briefly tried to break above $90,000 but failed to maintain the momentum.

These actual prices give an idea of the current state of the crypto market which is more consolidative, with several periods of rebounds and corrections indicating the uncertainty of market participants’ sentiments.

5. Other Analysts’ Views on Downside Risk

In addition to predictions about a possible $37,500 bottom, other analysts also have different views on Bitcoin’s downside risks in 2026. Some analysts predict different support levels such as $75,000, while others see a higher consolidation range between $80,000 and $90,000 as the main phase in the early 2026 period.

These differing views reflect the widespread spectrum of risk among crypto market analysts, given the various methodological approaches used in price predictions.

6. Price Cycle & Investor Impact

In the cryptocurrency market, historical bottoms are often the phase where many long-term investors begin large accumulations before the next multi-year uptrend. This opinion is based on historical price cycle patterns that show significant rebounds after deep bear market periods.

However, a bottom phase is not a sure indicator that a rally is imminent, but rather a phase of market structure that can last for quite some time before bullish momentum returns.

7. Uncertainty & Market Variables

It should be noted that predictions such as these remain in the context of high market uncertainty, where external factors such as global monetary policy, capital market volatility, and regulatory changes can significantly affect the price of Bitcoin. The varying opinions of analysts reflect the extent to which these variables could alter price projections throughout 2026.

Therefore, understanding the broader context of the cryptocurrency market remains important when interpreting long-term technical predictions such as the 2026 bottom projection.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What are analysts’ predictions for the Bitcoin price in 2026?

Analyst Ali Martinez predicts Bitcoin (BTC) could drop to around $37,500 by the 4th quarter of 2026 based on the historical bear market cycle pattern.

Who are the analysts making these predictions?

This prediction was made by crypto analyst Ali Martinez and shared via a quarterly chart that shows a possible deep retracement.

Does this mean the crypto market is coming to an end?

This predicted bottom is not an indication of the end of the crypto market, but rather part of a market cycle that could be followed by a long-term rebound once the low phase of prices is reached.

How do these predictions compare to other analysts?

Other analysts have different ranges of predictions, including the possibility of Bitcoin moving between $75,000 to $90,000 by 2026, suggesting a variety of market views.

Is this price prediction a guarantee?

Such technical predictions are not guarantees and depend on many market factors including sentiment, regulation, and macroeconomic conditions.

Reference:

Caroline Amosun/U.Today. BTC Price Could Bottom at $37,500 in 2026: Analyst. Accessed December 24, 2025.