XRP Struggles to Break Above $2 as Buyer Momentum Remains Weak

Jakarta, Pintu News – XRP price remains under pressure, trading below the crucial $2.00 level. Several failed attempts to climb higher have reinforced the broader downtrend, keeping buyers cautious.

With price action held back by strong resistance, momentum is weakening and market confidence remains fragile. Unless XRP is able to convincingly break back the $2.00 level, sentiment is likely to remain defensive in nature.

On-chain data shows growing pressure among XRP holders

According to data from Glassnode, the pressure on XRP holders continues to mount. About 52% of the total circulating supply is currently in profit, which means that almost half of all tokens are in a losing position.

Read also: Shiba Inu Plummets 66% and Signals Serious Problems – SHIB’s Downward Trend Continues?

This decline in profitability levels reflects the conditions at the end of 2024, when XRP failed to sustain a strong rally.

Historically, when the percentage of supply in profit approaches or falls below 50%, XRP tends to enter a long consolidation phase or even a deeper correction. While this does not necessarily signal a massive sell-off, the risk increases if the price continues to decline and token holder confidence weakens further.

Concentration of ownership is also a factor of concern for the market. Ripple Labs still controls a large portion of the XRP supply, with about 45 billion XRP held in escrow and only about 1 billion tokens actually freely circulating in the market.

Due to the highly concentrated distribution of supply in the hands of a number of large entities and exchanges, changes in the behavior of these large holders can quickly affect the direction in which the price of XRP moves.

Whale Activity Shows Caution

The data shows that wallets in the top 1% of XRP holders control around 87.6% of the total supply, slightly lower than earlier this month. While the drop is relatively small, even the slightest change on this scale can have a noticeable impact on price movements.

Instead of massive accumulation, the whales appear to be cautiously reducing exposure. This limits upside potential and reinforces the market’s flat-to-bearish structure, making a quick recovery unlikely without significant new demand.

XRP Price Analysis: Analysts See Potential Trend Reversal

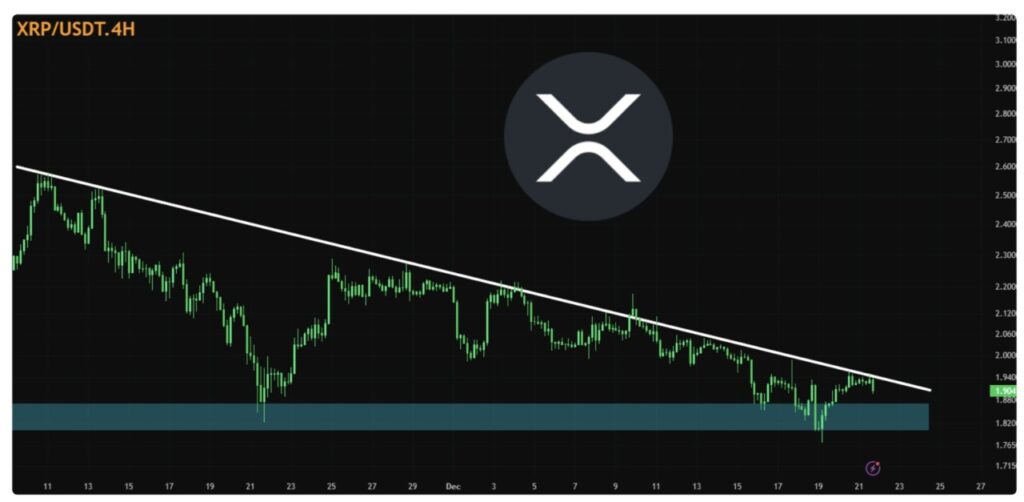

On the technical front, XRP is currently trading at around $1.92 and is still stuck below the resistance level of around $1.94. The downtrend line that has persisted for more than six weeks continues to suppress any attempts at price increases.

Read also: Wall Street Reveals Tesla Stock Price Predictions for the Next 12 Months!

In the short term, XRP is likely to remain sideways in the range of $1.85 to $1.94, barring a decisive breakout or breakdown. Despite the weak market conditions, some analysts predict a chance for a trend reversal.

Crypto analyst Arthur notes that the liquidation data shows most of the liquidity on the downside has been swept away, while there is a large liquidation cluster above the price, precisely in the range of $2.10 to $3.20. He argues that this imbalance could trigger a sharp upward movement if the market momentum picks up again.

Meanwhile, X user Niels highlighted the possibility of a double bottom pattern forming, with the RSI recovering and the price breaking back into the support area after a false breakdown.

If overall crypto market conditions improve, Niels expects XRP to potentially target the $2.30-$2.50 area.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. XRP Price Faces Strong Resistance Below $2 While Buyer Momentum Stays Weak. Accessed on December 23, 2025