Ethereum Holds Steady at $2,900 as Analysts Set Sights on $7,000 Target

Jakarta, Pintu News – Ethereum , the second largest crypto asset by market capitalization, has been under pressure for the past few months. After peaking at around $4,953 in August, the ETH price has now fallen by almost 40% and is trading near the $3,000 level.

The long decline is testing investors’ patience, especially with the crypto market still searching for a clear direction.

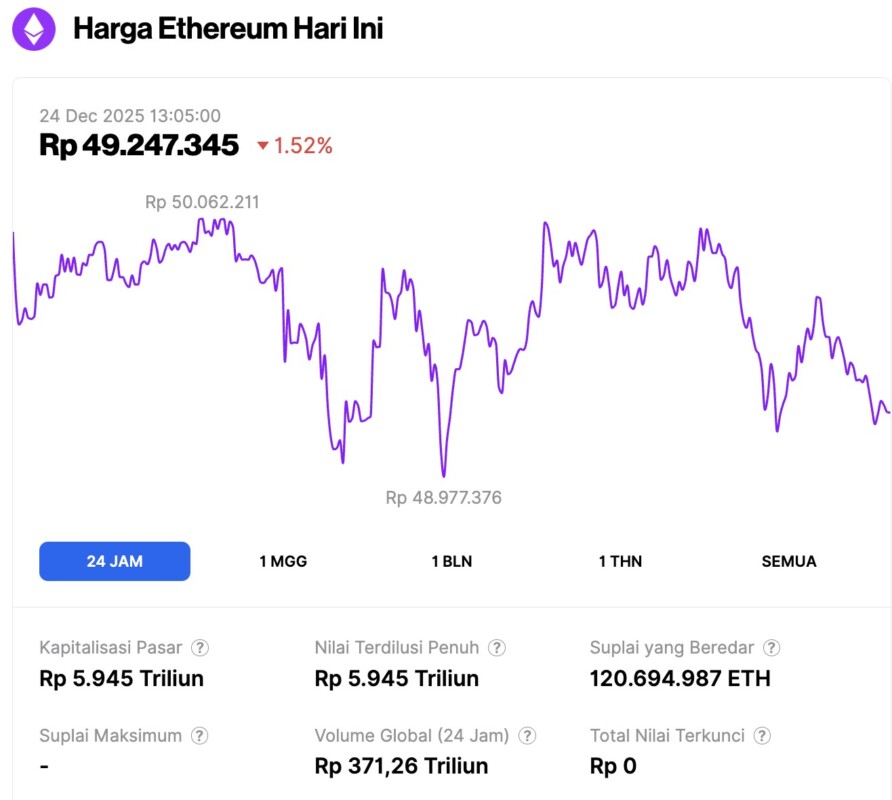

Ethereum Price Drops 1.52% in 24 Hours

As of December 24, 2025, Ethereum was trading at approximately $2,922, or about IDR 49,247,345, marking a 1.52% decline over the past 24 hours. During this period, ETH reached an intraday low of IDR 48,977,376 and a high of IDR 50,062,211.

At the time of writing, Ethereum’s market capitalization stood at around IDR 5,945 trillion, while its daily trading volume climbed 4% in the past 24 hours to IDR 371.26 trillion.

Read also: Bitcoin Price Hovering at $87,000 Level: Can BTC Reach $100K Before 2025 Ends?

ETF Outflows and Whale Selling Hit Ethereum Price

One of the main factors behind Ethereum’s price weakness is the continued selling pressure. The spot Ethereum ETF recorded seven consecutive days of outflows, signaling reduced institutional demand.

The leader of these outflows is BlackRock ETHA, which recorded a withdrawal of almost $558.1 million in just the last five days.

However, on December 22, the Ethereum ETF finally recorded an inflow of $84.6 million, after seven consecutive days of withdrawals.

On the other hand, on-chain data shows that whales have sold nearly $360 million ETH in just one week. This sustained selling pressure makes it difficult for Ethereum to rise, even as the market shows signs of a temporary recovery.

$3.8 Billion ETH Options to Expire This Week

Additionally, traders are highlighting December 26, the date on which the largest number of crypto options will expire on the Deribit exchange. Around $28.5 billion worth of options contracts will expire, including around $3.8 billion worth of Ethereum options.

According to a report by CoinPedia, Ethereum’s “max pain” level – the price at which most option positions will incur a maximum loss – is around $3,100. This means that price volatility is likely to increase ahead of that expiration date.

Read also: Vitalik Buterin Calls Prediction Markets the Antidote to Social Media, What’s the Reason?

BitMine Immersion Buys ETH Worth $88.1 Million

Although many investors are selling, not all market participants are retreating. BitMine Immersion Technologies, led by Fundstrat’s Tom Lee, recently added 29,462 ETH worth $88.1 million to its treasury.

This move comes shortly after a large $300 million buyout earlier in the week. This accumulation action suggests that some long-term players still see potential value in Ethereum at current price levels.

Analysts predict big breakout potential, target Ethereum to $7,000

Ethereum continues to struggle to return to its highs and has repeatedly failed to break through the $3,200 resistance area. This level is now a strong barrier holding back the price of ETH in the short term.

However, renowned crypto analyst and trader Michael van de Poppe sees this as a positive sign. According to him, when prices repeatedly test the same resistance level, it often indicates that selling pressure is starting to weaken.

If Ethereum finally manages to break out of this area, he expects the price to rise towards the $3,650-$3,700 zone.

This view was reinforced by analysts from Bitcoinsensus, who saw a bullish chart pattern forming on the daily timeframe. He notes that Ethereum is forming a “right-angled descending broadening wedge” pattern, a technical structure that often leads to an upward movement. Based on this pattern, he estimates an initial target of around $5,000, with a potential follow-through to $7,000 if market conditions remain favorable.

Even so, a number of other crypto analysts warn of the risk of a deeper drop if Ethereum fails to break resistance again. In a negative scenario, the chart could point to a correction to the $2,100-$2,300 area before finding fresh support.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Ethereum Price Struggles, Top Analysts Predict ETH To Rally To $5K. Accessed on December 24, 2025