XRP Overtakes BNB as ETF Demand Gains Momentum

Jakarta, Pintu News – XRP has surpassed BNB and is now the third largest cryptocurrency. This rise was driven by a new rally as well as $13.6 million in inflows into the XRP ETF. This indicates renewed confidence in the token.

What’s Driving the XRP Price Increase?

According to data from CoinMarketCap, XRP is now third in market capitalization, behind only Bitcoin (BTC) and Ethereum (ETH). This rise reflects a major shift in the dynamics of the crypto market.

Read also: Bitcoin Price Remains Stable Amid US and Venezuela Geopolitical Tensions

BNB has long held the third spot. This shift shows a renewed confidence in XRP after several years of regulatory uncertainty. Institutional interest in XRP has also increased, driven in part by the renewed XRP ETF document filed by Roundhill.

This shows that institutional adoption is starting to expand, not only to Bitcoin, but also to other altcoins such as Solana and Chainlink.

Is XRP Entering a New Bullish Phase?

According to the technical analysis shared by Steph is Crypto, XRP is breaking out of thedescending channel pattern that has held the price for the past eight months. The weekly chart shared shows the breakout occurred at $2.01. The analyst estimates that the price of XRP has the potential to go up to $2.50.

This trend is in line with institutional optimism towards XRP, which is also indicated by Standard Chartered’s 330% projected upside in their latest report.

Steph is Crypto explains that this downward trend started when XRP reached around $3.40 in July 2025. Since then, the price has continued to move down along a lower trend line.

As such, this downward trend lasted for eight months before finally breaking through an important resistance level. According to data from TradingView, the price of XRP is currently at $2, despite a slight decline in the last 24 hours.

This breakout signaled that the correction phase was over. This bullish signal is also reinforced by the price movement and increased trading volume.

ETF Inflows Strengthen Market Confidence

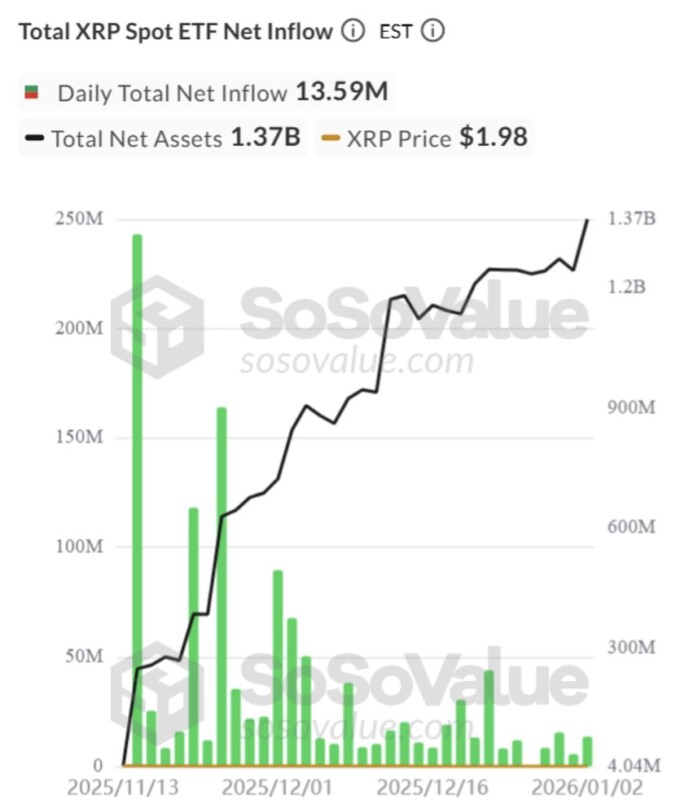

Based on data from SoSoValue, the XRP ETF recorded an inflow of nearly $14 million. Bitcoin ETFs also saw large inflows, with $471 million going into them yesterday, while Ethereum products received $174 million on the same day.

Read also: Dogecoin Climbs 3% Today as Early 2026 Reversal Signals Surface

BlackRock’s IBIT ETF recorded the highest inflow of $287 million. Meanwhile, Grayscale’s ETHE recorded the largest inflows among spot Ethereum products at $53.69 million. While inflows into XRP ETFs are still lower compared to BTC and ETH, it still indicates a healthy demand for the newer ETF category.

The growth of these ETFs reflects the increasing activity of related tokens in regulated markets. This trend is also evident from the launch of a multi-asset crypto ETF by Bitwise, which includes a range of large-cap tokens.

However, some fund issuers have started to hold back their exposure to these Ripple-related tokens. For example, ProShares’ planned leveraged XRP ETF was canceled after a review of market demand. CoinShares also halted its efforts to launch an XRP ETF despite overall fund inflows being on the rise.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ambcrypto. XRP Flips BNB, Is Massive ETF Demand Behind This Bull Run? Accessed on January 5, 2026

- Coingape. XRP Becomes Third Largest Crypto, Inflows Fuel Breakout Rally. Accessed on January 5, 2026