Discover the 10 Best Oil Stocks for Future Investment!

Jakarta, Pintu News – The Indonesian stock market provides attractive investment opportunities, particularly within the energy sector which is dominated by oil stocks. With the ever-increasing need for energy and the vital role that the industry plays in the global economy, oil stocks offer significant profit potential.

This article will review the best oil stocks on the Indonesia Stock Exchange (IDX) that are worth considering for investors looking for diversification and stability in their portfolio.

Advantages of Investing in Oil Stocks

Oil stocks attract many investors for several reasons. First, the steady global demand for oil provides cash flow certainty for companies in this sector. Second, oil stocks are often associated with large companies that have stable finances and are able to weather economic fluctuations.

In addition, large oil companies often engage in innovation and development of new technologies that can improve efficiency and reduce operating costs. These innovations not only strengthen their market position but also add value for investors. As such, oil stocks are an attractive option for those looking for a stable yet dynamic investment.

Also Read: BONK Memecoin Surges 20%: Will the Momentum Last in January 2026?

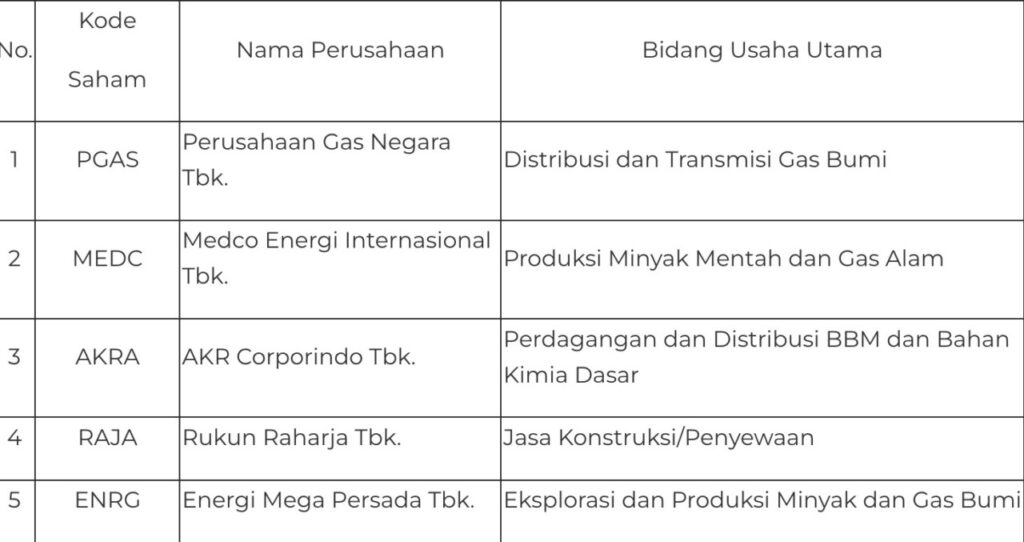

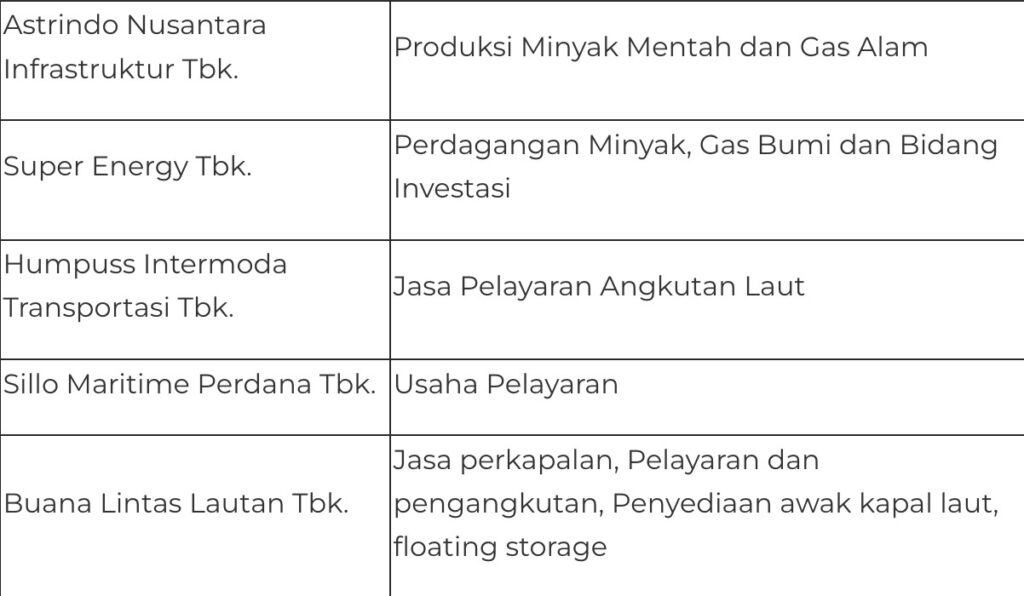

Analysis of the Best Oil Stocks on the IDX

Choosing the best oil stocks requires an in-depth understanding of market dynamics and company financial performance. Investors are advised to consider companies that not only have a solid financial track record but also a commitment to sustainability and adaptation to changing energy markets.

These companies often have large market capitalizations, indicating market confidence in their stability and long-term prospects. A large market capitalization also indicates that the company has sufficient resources for investment and expansion, an important factor in capital-intensive industries such as oil and gas.

Investment Potential and Challenges in the Oil Sector

The oil and gas sector is not free from challenges, including global oil price volatility and pressure to shift to more sustainable energy. However, it also creates opportunities for companies that can navigate these changes effectively. Companies that invest in clean technologies and sustainability strategies may be better placed to deal with changing consumer preferences and government regulations. In addition, price volatility can be capitalized on by careful investors.

Price fluctuations offer opportunities to buy at low prices and sell at high prices, a strategy that can generate significant profits if managed correctly. A solid understanding of the factors affecting global oil prices is therefore key in maximizing the profit potential of oil stock investments.

Conclusion

Investing in oil stocks offers a unique combination of stability, growth potential, and the opportunity to participate in a key sector of the global economy. With proper analysis and strategic stock selection, investors can capitalize on this opportunity to strengthen their portfolio and achieve long-term financial goals. While there are risks involved, the potential profits and stable dividends make oil stocks an attractive option for many investors.

Also Read: Ethereum (ETH) Approaching Critical Moment, Is January 2026 Time to Surge?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Brights.id. Best Oil Stocks. Accessed on January 6, 2026