7 facts about the world’s oil reserves: Which Country Has the Largest “Black Treasure” on Earth?

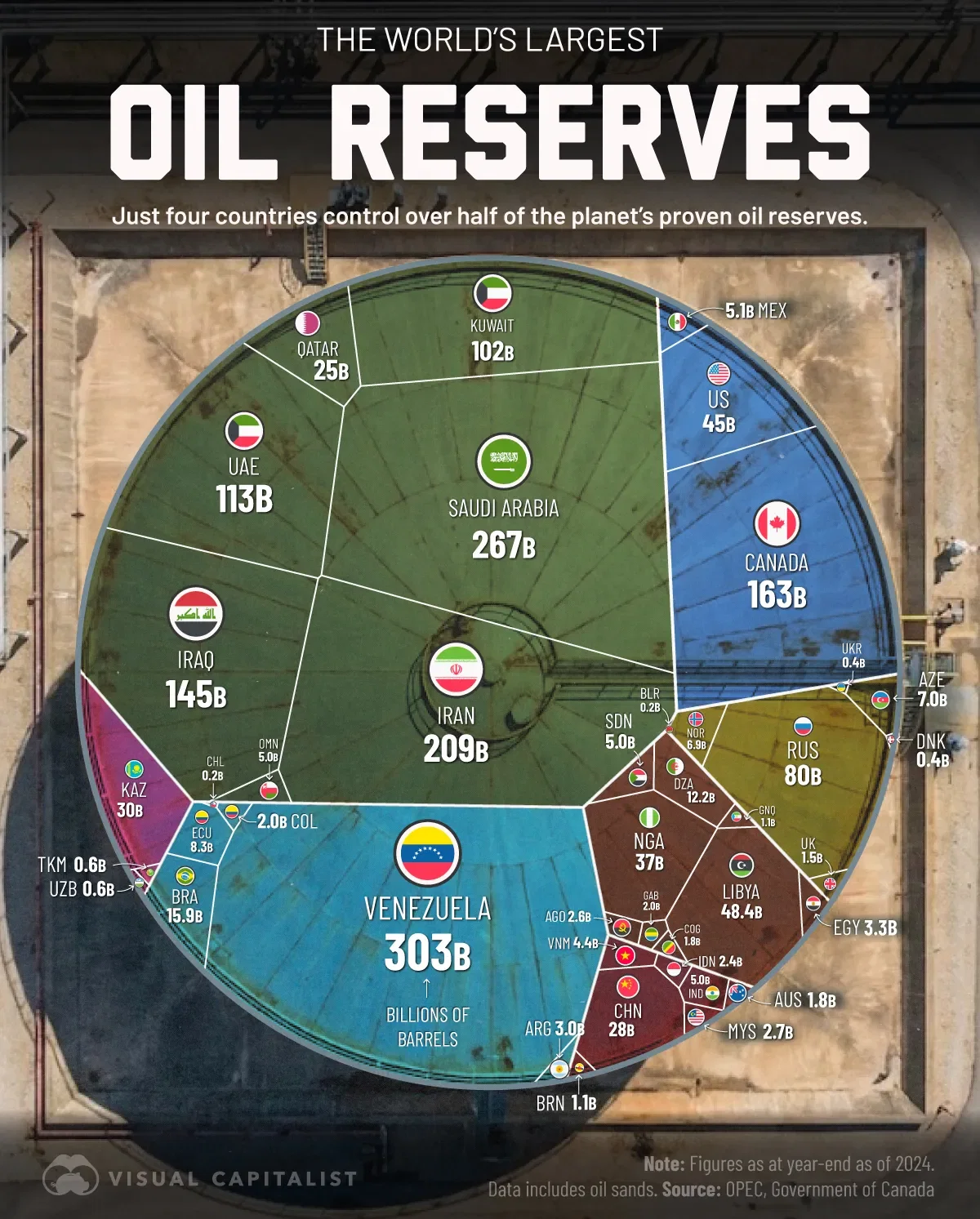

Jakarta, Pintu News – World oil reserves are one of the most important indicators in assessing renewable energy capacity and global geopolitics, reflecting the still dominant power of fossil energy resources. According to Voronoi’s latest visualization that includes data on the highest oil reserves across countries, only a handful of countries control more than half of global reserves, with Venezuela leading the list.

1. Venezuela: Holder of the World’s Largest Oil Reserves

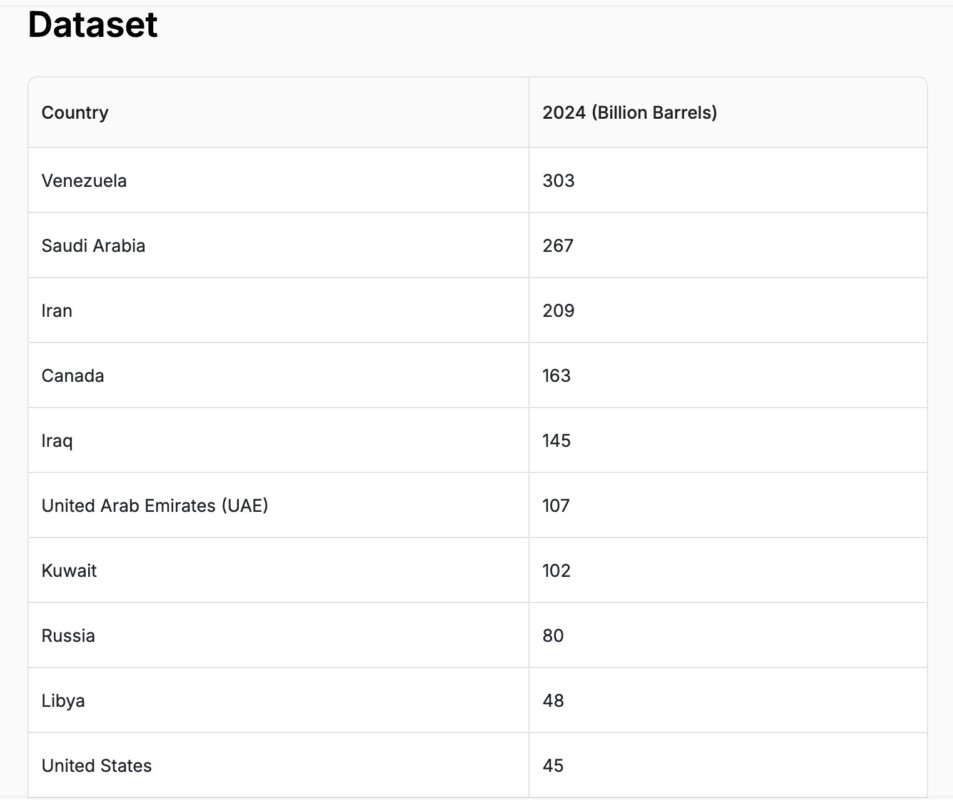

Venezuela currently holds the top spot in the world’s oil reserves with proven reserves of approximately 303 billion barrels, or about 19.4 percent of total global reserves. This data demonstrates Venezuela’s dominance in the fossil energy domain and shows its long-term strategic potential in the global oil market.

Despite the political and infrastructural challenges in Venezuela, the volume of reserves remains the largest in the world. The majority of these reserves come from heavy oil in the Orinoco Belt region, which is known to be thick and requires specialized extraction technology. This reserve analysis is taken from OPEC data visualized by Voronoi.

Venezuela’s dominance puts it ahead of other major oil producing countries such as Saudi Arabia and Iran. This is an important reference in global energy discussions, especially for countries or corporations that focus on the strategic resource of fossil energy.

Also Read: BONK Memecoin Surges 20%: Will the Momentum Last in January 2026?

2. Saudi Arabia: World’s Second Largest Oil Reserves

The country with the next largest world oil reserves is Saudi Arabia, which has proven reserves of around 267 billion barrels. This makes it one of the main pillars in global energy production and supply.

Saudi Arabia is also known to be highly efficient in crude oil production with well-established infrastructure and relatively low production costs compared to other countries. Historically, Saudi Arabia has been an important determinant in OPEC’s oil production policy. App

These reserves support Saudi Arabia’s role as a major player in the global energy market, especially in the context of medium-term supply and energy economic policies in the Middle East region.

3. Iran and Canada Next in Ranking

Next on the list of world oil reserves are Iran with about 209 billion barrels and Canada with about 171 billion barrels. This position emphasizes the important role of both countries in global energy dynamics.

Iran, as an important member of OPEC, has large reserves that support long-term production capacity, although international sanctions sometimes limit production and exports. Meanwhile, Canada’s reserves mainly come fromoil sands, which require an energy-intensive extraction process.

These two countries, along with other countries at the top of the world’s reserves, play a role in stabilizing global energy supply in various market conditions.

4. Top Five Countries Hold More than Half of Global Reserves

Data from the Voronoi visualization shows that only four or five countries together control more than 50 percent of the world’s oil reserves. This highlights the still strong global dependence on a small number of major producing countries.

In addition to Venezuela, Saudi Arabia, Iran and Canada, countries such as Iraq and the United Arab Emirates (UAE) also occupy significant positions in this list of reserves. This concentration of reserves reinforces the dominance of the Middle East and South America in fossil energy resources.

This condition also has an impact on geopolitical dynamics because these countries have great bargaining power in global energy policy.

5. World oil reserves inversely proportional to actual production

Although Venezuela has the world’s highest oil reserves, political issues and technical infrastructure have prevented its actual production from being greater. Other reports suggest that Venezuela only contributes less than 1 percent of current daily global oil production.

This means that the size of reserves does not necessarily reflect production capacity or market dominance directly. Factors such as technology, investment, and economic stability play a crucial role in monetizing such reserves.

Thus, the approach to world oil reserves should consider both aspects: the amount of reserves and the actual production capacity.

6. World Oil Reserves and OPEC

Countries with the world’s largest oil reserves such as Venezuela, Saudi Arabia, Iran and Iraq are almost all members of the Organization of Petroleum Exporting Countries (OPEC). This concentration gives them great influence in setting global production and price policies.

OPEC plays an important role in setting production quotas to stabilize global oil markets and prices. Decisions from OPEC often affect the world’s energy flows including strategic reserves and overseas exploration investments.

The involvement of these large reserve countries in OPEC is an important element in the long-term dynamics of world oil reserves.

7. Reserve Trends and the Future of Energy

Although the world’s oil reserves remain large, the global trend shows a gradual shift towards renewable energy and reduced dependence on fossil fuels. But to date, reserve data shows that fossil fuels still dominate global energy availability.

Changes in energy policy, emissions-clearing technologies and innovations in clean energy could change the role of the world’s oil reserves in the long term. Until the global energy transition is fully underway, these reserves remain a strategic asset for the world’s major economies.

Also Read: Ethereum (ETH) Approaching Critical Moment, Is January 2026 Time to Surge?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Voronoi/Visual Capitalist. All of the World’s Oil Reserves by Country, in One Visualization. Accessed January 7, 2026.